Is Automated…

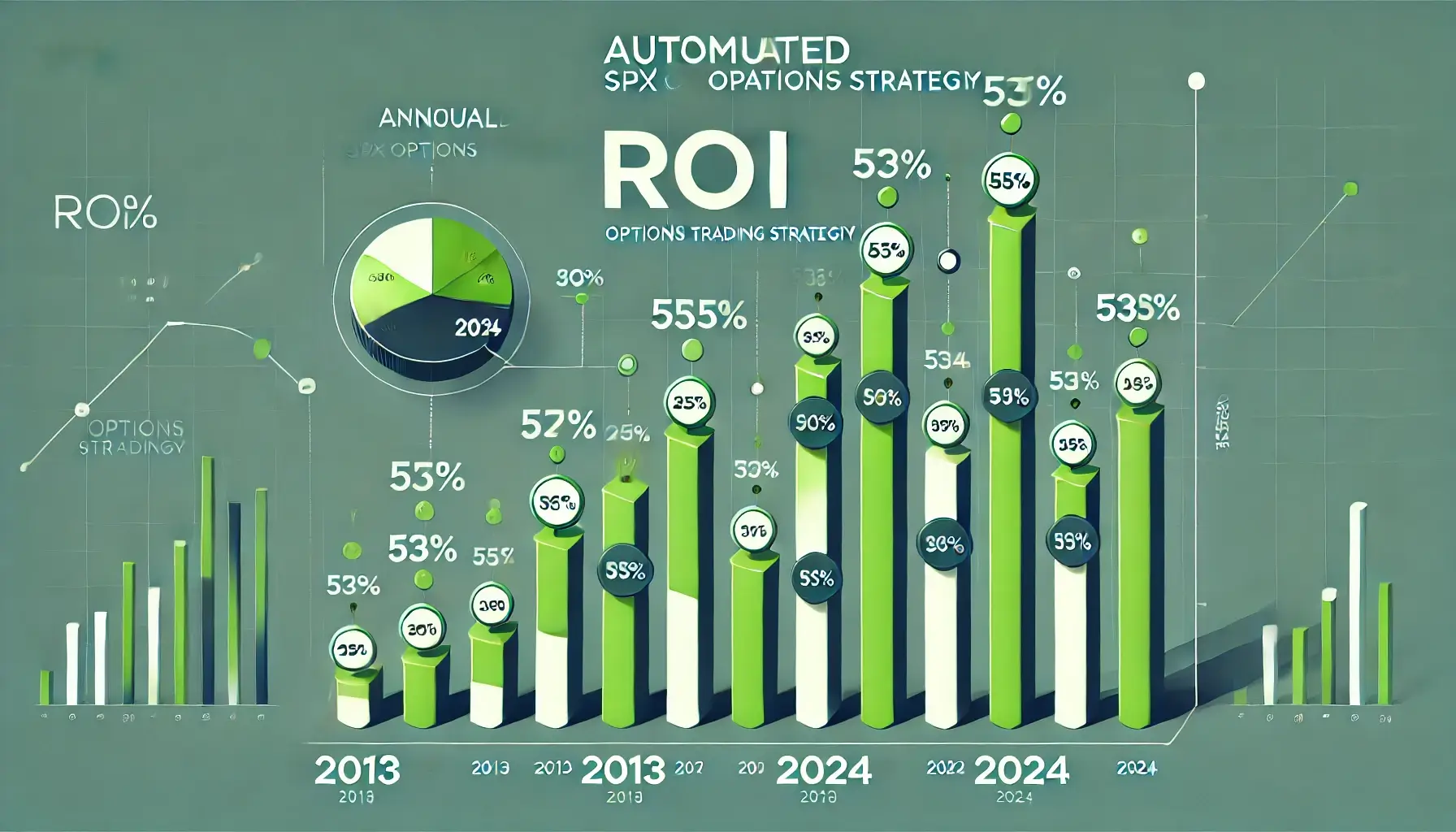

Is automated options trading profitable? Yes, automated options trading can be profitable, but success depends on strategy backtesting, risk management, and execution speed. According to industry benchmarks: Institutional Quants: Often see higher…