professionals don’t wait for max loss.

They adjust early, systematically, and without emotion. In fact, the difference between a losing retail trader and a consistently profitable trader usually comes down to one skill:

knowing how and when to adjust a bull put spread that’s going against you.

In this guide, I’ll walk you through the exact adjustment techniques professionals use, the triggers that matter, and how I manage losing trades inside my own SPX strategy,

Monthly Trend.

If you’re not yet fully comfortable with the basic structure of the strategy, you may want to quickly review my core guide first:

What Are Bull Put Spreads and How I Trade Them?

Once that foundation is clear, this adjustment playbook will make a lot more sense.

Master the Bull Put Spread: Complete Learning Path

- Step 1: The Foundation: What are Bull Put Spreads? Understanding the core mechanics and risk-defined profile.

- Step 2: Strategy Selection SPX vs. SPY: Which is better for your account?: The tax and liquidity breakdown.

- Step 3: Tactical Execution Strike Selection Masterclass: How to find the sweet spot using Delta and Support.

- Step 4: Defensive Management The Pro Adjustment Guide: How to fix a trade when the market turns against you.

- Step 5: Advanced Setup Advanced SPX Setup & Examples: Real-world application and institutional workflows.

First Step: Identify the Type of Trouble

Most traders react emotionally when their bull put spread starts losing. Pros don’t. Before adjusting, they diagnose the type of problem — because the correct adjustment depends entirely on the market behavior.

1.1 Slow Drift Toward Strike

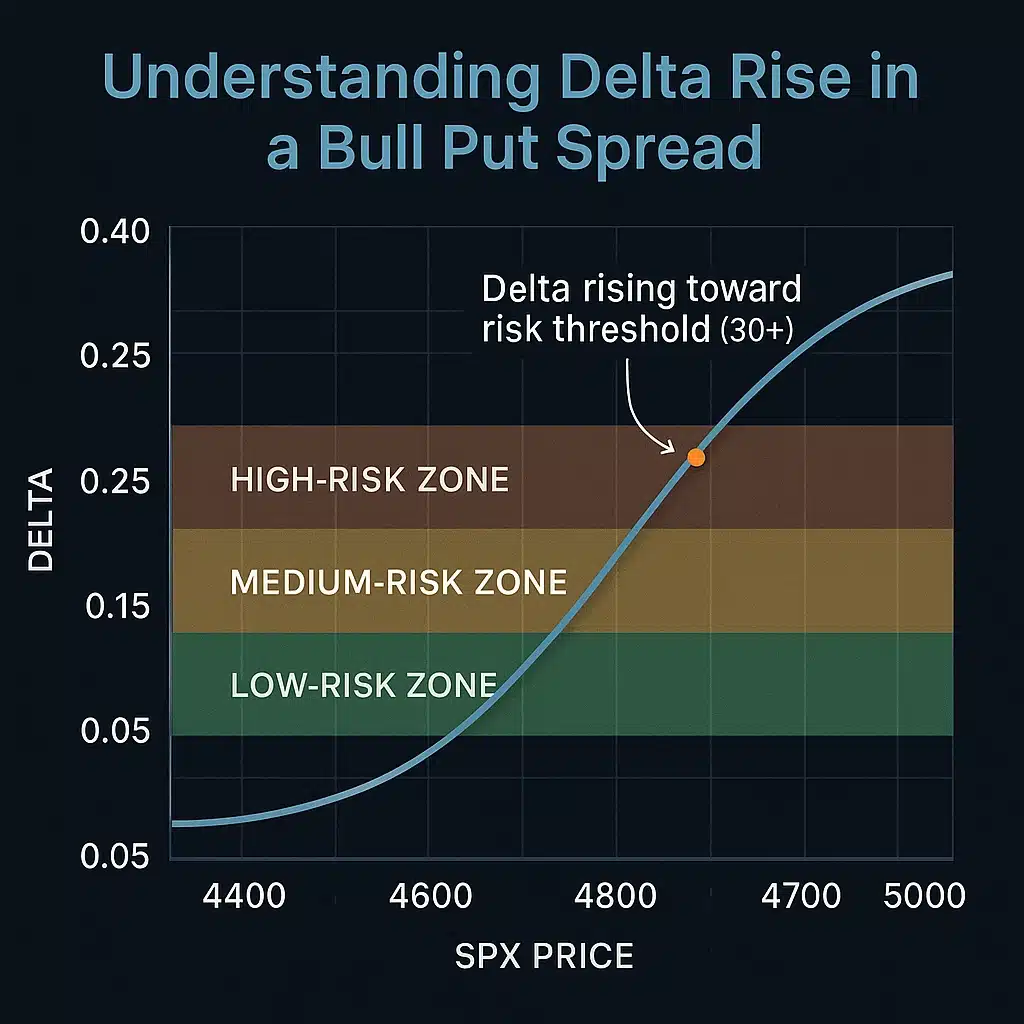

- Delta rises gradually

- Market still stable

- No volatility spike

Best adjustments: roll early, roll down, or add time.

1.2 Sharp Drop (Volatility Spike)

- IV expands rapidly

- Bid/ask spreads widen

- The trade becomes unstable quickly

Best adjustments: reduce size, close, or reposition far OTM.

1.3 Strike Breach (Short Put ATM or ITM)

- Delta climbs quickly

- Short put behaves like a long stock position (high gamma exposure)

Best adjustments: roll ITM → far OTM, or close if time is short.

Adjustment #1 — Roll the Spread Out in Time

Rolling is the most common professional adjustment. It gives the trade more time to recover while letting you shift your short strike farther out-of-the-money (OTM).

Why pros roll early:

Professionals don’t wait until delta explodes. Rolling when delta is only beginning to rise — typically in the 25–35 delta range — keeps the adjustment inexpensive and preserves flexibility.

Early adjustments also prevent emotional spiral decisions later, when losses are larger and choices are limited. By acting early, pros avoid the trap of “hoping” the market bounces. Hope is not a risk-management tool, and rolling early replaces hope with a structured, proactive plan.

If you want to see how I choose my original strikes before any adjustment is needed, I walk through the full process in this guide:

How Pros Select Bull Put Spread Strikes for Monthly Income.

When to roll out:

- Delta reaches 25–35

- Price moves against you, but trend isn’t broken

- There is still significant time value left

Why rolling works:

- Extends duration → more theta decay

- Allows shifting short strike further OTM

- Often provides additional credit

SPX Example:

Let’s say you sold the 4850/4800 spread with 5 DTE and SPX drops toward 4875. You roll the entire spread out to 21 DTE and reposition to 4750/4700 for a credit.

Now your trade has more time, lower delta, and better distance from the price.

Adjustment #2 — Roll the Strikes Down

This is ideal when the market pulls back slowly but hasn’t triggered panic. You stay in the same expiration but move your strikes to a safer level.

When pros roll down:

- 7–20 DTE remaining

- Price nearing short strike

- Trend intact; selling pressure mild

Why it’s effective:

- Immediately reduces risk

- Lowers net delta

- Keeps expiration close → faster theta benefit

Example:

Original: 4900/4850

Rolled Down To: 4800/4750

Adjustment #3 — Reduce Position Size

This is one of the simplest but most underrated adjustments in trading. Retail traders try to “repair” trades. Professionals focus on protecting capital.

How to reduce size:

- Close 50–75% of the position

- Reopen a much smaller spread further OTM

- Or close everything and re-enter half size later

Why it works:

- Reduces stress and emotional pressure

- Reduces margin usage

- Protects account equity during volatile periods

The psychology of reducing size:

Most traders resist cutting size because it feels like “giving up.” But pros know that reducing exposure preserves mental capital just as much as financial capital.

Smaller size leads to clearer thinking, better decision-making, and reduced panic. It’s much easier to adjust rationally when you’re not overloaded with risk. Reducing size is not weakness — it’s emotional discipline.

Adjustment #4 — Convert to an Iron Condor

When the market is drifting lower but still range-bound, adding a call credit spread above the price can neutralize delta and bring in more credit.

When this works well:

- IV is high

- Market remains inside a range

- You want to reduce downside bias

Important: Only use this in controlled markets, not during fast selloffs.

If you want a deeper dive into this structure, I break down how I use it on SPX in my iron condor guide:

SPX Iron Condor Strategy for Weekly Income.

Adjustment #5 — Rolling ITM Spreads (Pro Technique)

Rolling an ITM bull put spread is advanced but extremely powerful when done correctly.

When pros roll ITM:

- You want to avoid assignment

- Market is stabilizing after a drop

- You still want to stay in the trade

Golden Rules of Rolling ITM:

- Always roll to far OTM, never to another ITM strike

- Increase duration

- Improve strike distance

What I NEVER do when adjusting:

I never roll ITM → ITM. This increases gamma risk, compresses breathing room, and turns the adjustment into a hope trade. A valid adjustment must reduce risk — never increase it. This rule alone has saved me from dozens of catastrophic trades over the years.

Example:

ITM spread: 4850/4800

Roll → 4700/4650 with more time.

When NOT to Adjust

Sometimes the smartest decision is simply to close the trade. Professionals close early when:

- Less than 3 DTE remain

- Major technical support has broken

- IV is exploding higher

- The spread is deeply ITM

- An adjustment would increase risk instead of reducing it

Quick Adjustment Framework (Pro Checklist)

- Strike breached? → Roll ITM or close

- Delta rising fast (25–35)? → Roll early

- IV high? → Reduce size or roll down

- Support holding? → Roll out or down

- Time too short? → Close immediately

This is the exact framework I’ve refined during years of SPX trading.

Final Thoughts

Successful bull put spread trading isn’t about avoiding losses — it’s about managing losing trades like a professional. With clear rules, early action, and proper sizing, you can turn a potentially large loss into a controlled, manageable outcome.

If you’re still deciding whether to use SPX or SPY for this kind of strategy, I compare both in detail here:

SPX vs SPY for Credit Spreads.

For a full overview of how I set up my base trades before any adjustment, you can revisit the core explainer:

What Are Bull Put Spreads and How I Trade Them?

If you want to follow the exact SPX bull put spread trading I use myself, you can join the Monthly Trend program here:

Frequently Asked Questions About Bull Put Spread Adjustments

1. When should I adjust a bull put spread that is losing?

I start looking at adjustments when the short put delta climbs into the 25–35 range, or when price moves close to my short strike earlier than expected. If the market is drifting slowly, I roll down or roll out in time. If the move is violent with a volatility spike, I often reduce size or close instead of adjusting.

2. What is the best adjustment for a bull put spread in SPX?

The most common professional move is to roll the entire spread out in time and further OTM. It gives the index more room and lets theta work in your favor again. For a refresher on basic setup mechanics, see my core bull put spread guide.

3. Should I roll a bull put spread or just close it?

If there are only a few days to expiration, or if key support has clearly broken, I prefer to close the spread and move on. Rolling makes more sense when there is still time left and you can meaningfully improve your risk profile.

4. How do professionals roll a losing bull put spread?

Pros roll either down and out (lower strikes, later expiration) or down in the same expiration. They avoid rolling ITM → ITM because that increases risk instead of reducing it. For examples of safer strike positioning before things go wrong, see my strike-selection guide.

5. Can I turn a losing bull put spread into an iron condor?

Yes. Adding a bear call spread above price creates an iron condor that brings in additional premium and neutralizes delta. This works best when volatility is high but price action is orderly. I cover iron condor construction in more detail here:

SPX Iron Condor Strategy.

6. How do you handle adjustments in Monthly Trend?

I start with small position size (around 5% of account). If a trade moves against us, I roll out and down, reduce size, or close entirely. The objective is always the same: protect capital first. You can see how this looks in practice inside the

Monthly Trend SPX bull put spread program.

Want everything done for you?

Join the Monthly Trend program — one trade per month, fully rules-based and managed using the same adjustment logic in this guide.