Weekly Income from a High-Probability SPX Iron Condor — Built for Consistency

Weekly Income from a High-Probability SPX Iron Condor

Get one high-probability SPX iron condor each week, backed by a proven, rules-based system and real performance — no stress, no screens, no noise.

Get one high-probability SPX iron condor each week, backed by real performance.

104.50% Avg Annual Return · 4-Year Live Track Record · Target 5–10% Weekly ROI

Trade Weekly Income

Like Institutions Do

Follow the same high-probability iron condor logic institutions use — simplified for everyday traders.

One Powerful Trade a Week

One trade a week — no charts, no monitoring, no overthinking.

Grow and Protect

Target 5–10% weekly returns with disciplined, risk-managed setups built for consistency.

Why This Strategy Works

Iron Condor Strategy Methodology

Weekly Premium focuses on probability and time decay, not market prediction. Entries typically begin on Wednesday, after most news is released and the SPX has completed much of its weekly range.

Trades use a combination of fundamental and technical analysis along with SPX options pricing. Depending on conditions, we either enter a full iron condor (collecting about $2.00 in premium) or start with a single out-of-the-money spread (about $1.00) and add the second leg if conditions remain favorable. Strikes are selected to balance distance from price with meaningful premium collection.

At entry, the strategy targets an approximate 4:1 risk-to-reward ratio and has historically delivered a win rate above 90%, achieved by not holding trades to expiration. Positions are actively managed and typically closed once a 5% weekly return on allocated capital is reached, while more experienced traders may hold longer to pursue higher returns with added risk.

Risk management is conservative and proactive. We do not roll trades to later expirations or roll up or down strikes. If a trade moves against us, we may close the entire position early for a controlled loss or reduce exposure by closing one side first. Losses are addressed early, not deferred.

Because SPX options decay rapidly near expiration, trades often reach their objective in no more than one trading day.

How It Works

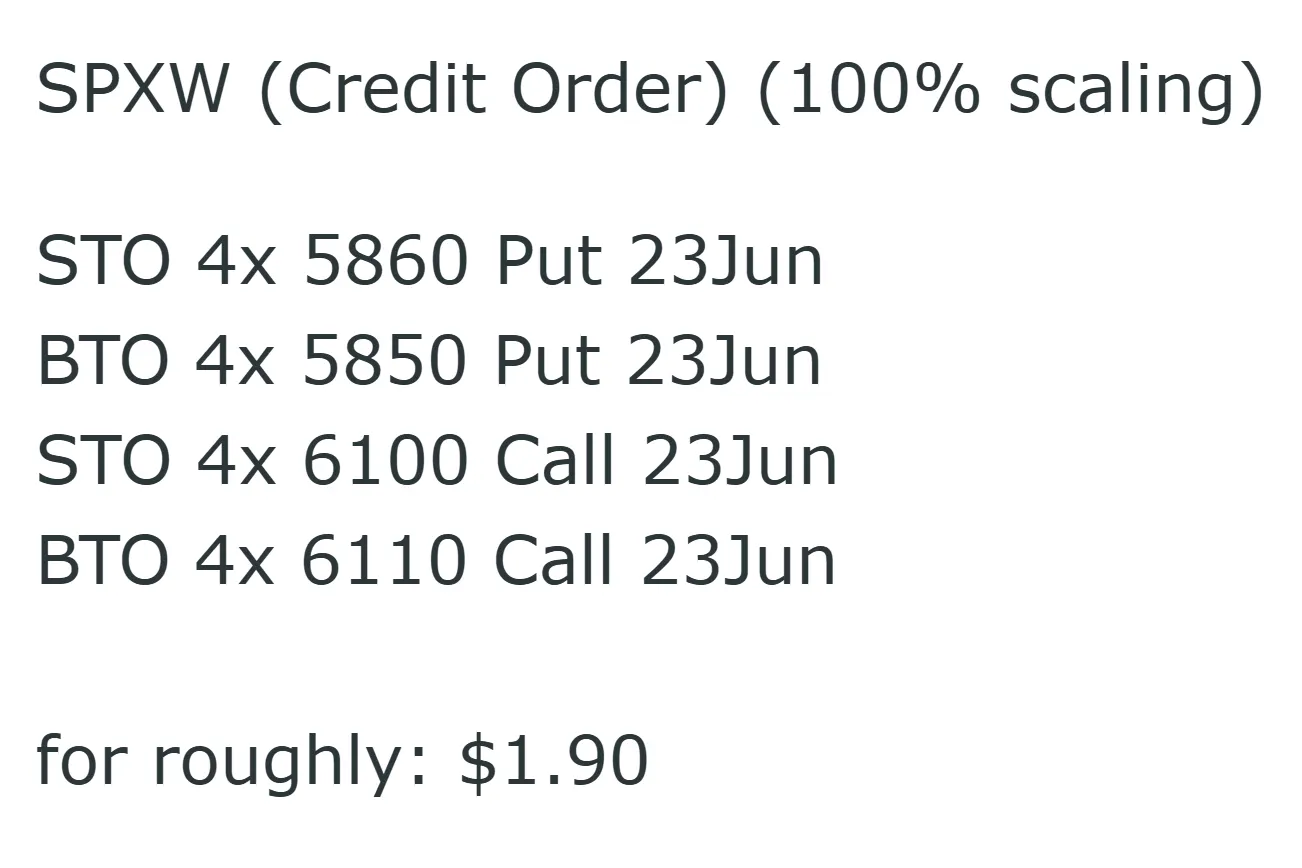

This is the entry a credit order: You receive a $1.90 premium when you open the position.

We send these emails to all subscribers. Manual traders can place these orders themselves and auto traders to Global AutoTrading / AutoShares will mirror these orders automatically.

STO- Sell to open / BTO- Buy to open are the entry actions. Puts and calls are combined to form an iron condor.

23Jun is the expiration. 4x means 4 contracts for a $5k account.

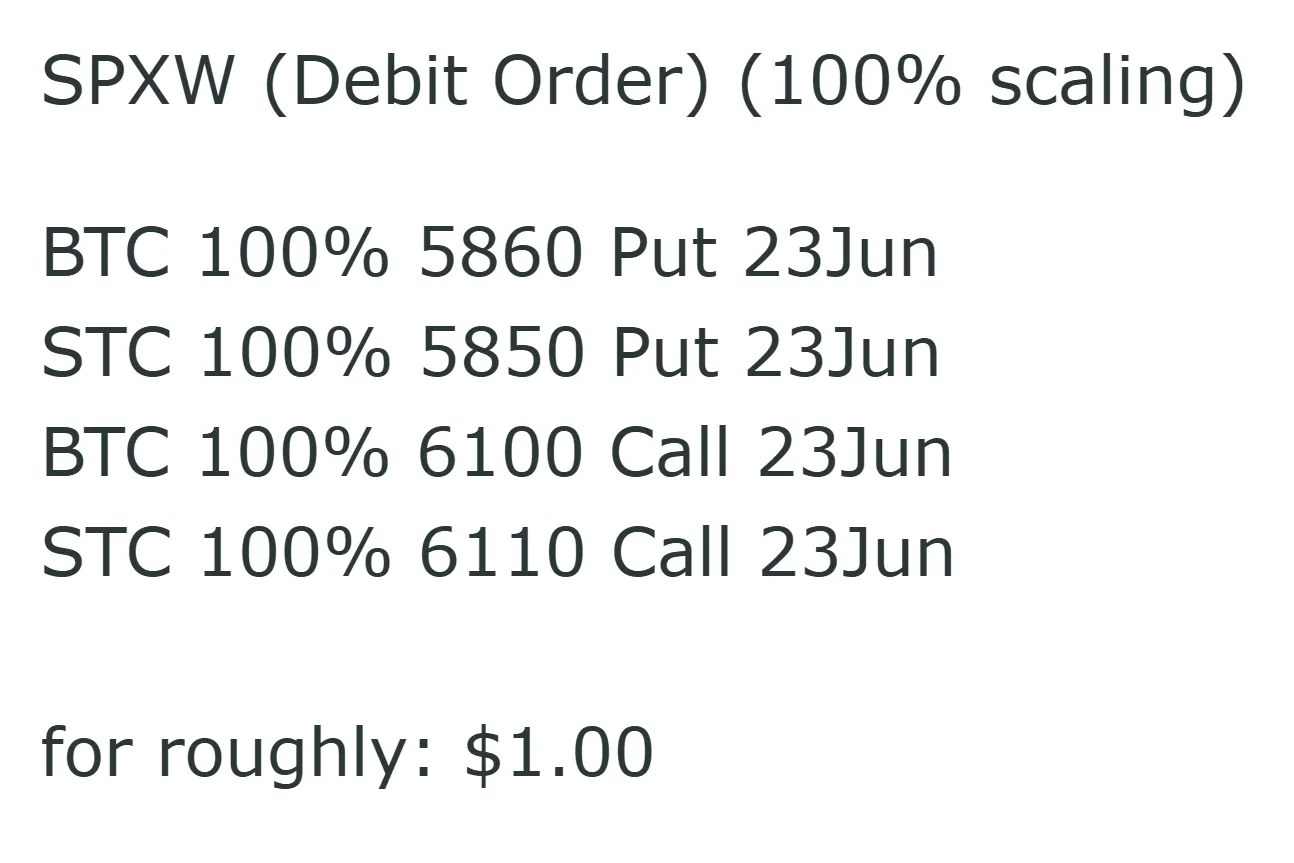

This is the exit a debit order: You pay $1.00 when you close the position.

BTC- Buy to close / STC- Sell to close indicate we’re exiting. 100% means we closed the entire position size, not a partial close.

We collected $1.90 in premium and closed the position for $1.00, keeping $0.90 per contract.

With 4 contracts, the net profit was $360 ($0.90 × 4 × $100), which corresponds to a 7.20% weekly return on a $5k account.

Weekly Premium Performance Overview

These numbers reflect live trades from our auto trader clients, showing the performance of an account that started with a $10,000 investment.

View 2022 Weekly Premium Performance Here

View 2023 Weekly Premium Performance Here

View 2024 Weekly Premium Performance Here

What you get with Weekly Premium

- Trade alerts via email

Entry alerts and exits for SPX at any time during market hours. One high-probability trade per week

A position is typically opened starting from Wednesday.Defined-risk iron condor strategy

Every trade uses a fixed 4:1 risk-to-reward, defined upfront at entry.Clear position sizing guidance

Allocation recommendations so you can choose an allocation based on your comfort level.Institutional, probability-driven execution

Trades follow a systematic process designed for SPX weekly options that combines fundamental factors, technical analysis, and options mechanics.Optional automation support

If you choose to automate, we help you set it up so trades follow the same rules, entries, and exits shown in our 4-year live track record.

What you get with Weekly Premium

- Trade alerts via email

Entry alerts and exits for SPX at any time during market hours. One high-probability trade per week

A position is typically opened starting from Wednesday.Defined-risk iron condor strategy

Every trade uses a fixed 4:1 risk-to-reward, defined upfront at entry.Clear position sizing guidance

Allocation recommendations so you can choose an allocation based on your comfort level.Institutional, probability-driven execution

Trades follow a systematic process designed for SPX weekly options that combines fundamental factors, technical analysis, and options mechanics.Optional automation support

If you choose to automate, we help you set it up so trades follow the same rules, entries, and exits shown in our 4-year live track record.

- Trade alerts via email

Weekly Premium Signals

- Email trade alerts for SPX

- 1 High-Probability Trade per Week

- Trade Duration: 1–2 Days

- Allocation guidance included

$149

/month

🔒 Signals via email. Automation optional. You stay in control.

Cancel anytime. No questions asked.

Who Weekly Premium Is For

This iron condor strategy is designed for time-constrained professionals and weekly income-oriented investors who want controlled market participation — with minimal time commitment.

- Time-Constrained Professionals

Designed for investors who value predictable entry and exit signals, and repeatable execution — without watching markets all day.

- Weekly Income Traders

For weekly income-oriented investors who prioritize weekly return potential, accept calculated risks, and want asymmetric upside.

- Active Manual Traders

Ideal if you already trade options but want a systematic framework to reduce overtrading and second-guessing.

What Our Clients Are Saying

The most compelling evidence about our iron condor strategy is derived from traders like yourself who are achieving real results.

“They enter high probability spreads and iron condors with a defined risk and exit quickly when things go the wrong way. This is the best peace of mind you can have as an investor and trader.”

— Harry R.

Verified subscriber · Using Weekly Premium for 5 months

“This strategy fits perfectly alongside my other positions. It generates steady weekly income without dominating my time.”

— Kelton H.

Verified subscriber · Using Weekly Premium for 8+ months

“The automation was a big reason I joined. I get the same fills shown in the track record, and it’s been hands-off.”

— Jareth T.

Verified subscriber · Using Weekly Trend for 11 months

“This feels much more institutional than how I used to trade. Defined risk, clear exits, and a calm approach to weekly income.”

— Steve J.

Verified subscriber · Using Weekly Trend for 1+ years

“The entries are well-timed and the exits are clear. I appreciate that losses are managed early and not rolled endlessly.”

— Kenneth D.

Verified subscriber · Using Weekly Premium for 8 months

Build an All-Weather Options Portfolio

Why rely on one strategy when you can diversify? The All-Weather Portfolio blends two proven approaches to deliver steady income and strong growth.

What It Includes:

- Weekly Trend or Monthly Trend (Directional Spreads) – Capture directional SPX movement with risk-managed trades designed for compounding growth.

- Weekly Premium (Neutral Iron Condor Strategy) – Generate steady weekly income by harvesting time decay in calm and volatile markets.

Together, these strategies are designed increase opportunity and to reduce drawdowns, allowing capital to work whether markets are trending, consolidating, or rotating.

30-Second Quiz "What Trader Type Are You?"

Struggling to Choose the Right Strategy? Take this Quiz.

This quick quiz shows you the best trading approach for your personality, time availability, and risk tolerance — and what you should avoid.

- Tailored to You – Whether you're brand new or a seasoned trader, this quiz filters out the noise and points you to the trading style that fits your life.

- Instant Results – No fluff. In under a minute, you’ll get your trader type and strategy recommendation that actually make sense.

- Smarter Trading Starts Here – Don’t waste months on the wrong strategy. Let this quiz give you the right strategy.

Start the quiz now and get your results instantly.

🔒 100% free. Takes less than a minute. Taken by over 500 traders.

FAQs

Everything you need to know about our Weekly Premium iron condor strategy before getting started.

Are these auto-trading results?

Yes, we publish entry and exit prices directly from our auto-trading partners. However, please note that actual results can differ because of market conditions and execution timing.

What should be my allocation?

Select your allocation based on unit size with Global AutoTrading or, alternatively, by dollar amount with AutoShares.

Next, make sure your allocation aligns with your investment goals and overall risk tolerance. You can view the unit size table here.

Keep in mind, we may utilize 100% of your allocated capital during any trade cycle. Therefore, choose your allocation wisely and confidently.

How is profit/loss (P/L) of an iron condor calculated?

Profit and loss depend on your account size, trade allocation, and the premium you collect from iron condors. In other words, these factors work together to shape your results.

For example, if you have a $10,000 account (2 unit sizes), you will enter 8 SPX contracts with a profit target of $0.60 per contract. This approach keeps risk defined and manageable.

Specifically, the calculation looks like this: $0.60 × 8 contracts × 100 multiplier = $480 profit. As a result, you achieve a 4.8% return on your account size, clearly showcasing the potential for consistent gains.

How much of my capital is used in each trade?

The allocation is structured for each trade with capital efficiency and risk control in mind. Here’s how it works step by step:

~60% of your buying power goes directly to opening the trade.

Meanwhile, the actual maximum risk is around 30% because of the defined-risk structure of an iron condor. Each iron condor has two legs (spreads). So when one leg moves against you, the other typically gains value, which helps offset the loss. This built-in balance keeps potential losses contained.

Additionally, the remaining ~40% of your allocation stays available for early exits or trade adjustments, giving us flexibility to manage risk proactively.

In practice, we often keep drawdowns under 10% by actively managing trades before they ever reach their maximum risk.

Why do you trade SPX weekly options?

We trade SPX weekly options over stock options because they offer higher premium collection, which means greater profit potential in less time. Additionally, shorter expirations of just 2–3 days create faster trade cycles and improve risk management. Plus, deep liquidity ensures you can execute trades easily with minimal slippage.

With this approach, our strategy leverages option pricing, risk graphs, and technical analysis to pinpoint the most optimal entry and exit points.

Can I trade this strategy manually?

Yes, you can absolutely trade this iron condor strategy manually using our trade signals.

First, manual traders benefit from clear entry and exit signals for SPX weekly options. In addition, you’ll receive strategic position adjustments designed to target a 5% weekly ROI. With more experience, you can also choose to hold positions longer and aim for an even higher return of 7.5–10% per week.

Ultimately, this systematic approach helps you avoid overtrading and make confident, rational decisions instead of emotional ones.