SPX and SPY both track the S&P 500, but when it comes to max pain, they behave very differently, and that difference matters if you trade options into expiration.

Many traders treat SPX and SPY max pain as interchangeable. In practice, they aren’t. Settlement mechanics, dealer hedging flows, and the mix of institutional versus retail participation all change how reliably price responds to max pain levels.

On SPX, those forces often create cleaner, more predictable expiration behaviour. On SPY, they introduce noise, overshoots, and late-day volatility that can distort the signal.

If you’re using max pain to guide strike placement for credit spreads or iron condors, choosing the wrong reference can lead to tighter margins and unnecessary risk.

In this article, I break down how max pain actually works on SPX versus SPY, why professionals prioritise one over the other, and how to use each correctly in real trading.

What Is Max Pain (In Plain English)?

Let’s strip away the jargon. Max pain is simply the price level where the largest combined amount of call and put open interest would expire worthless. In other words, it’s the price where option buyers feel the most “pain” and option sellers (often market makers) keep the most premium. The theory behind it is straightforward:- Market makers are usually net sellers of options.

- They hedge their risk using the underlying (SPX index or SPY ETF).

- As expiration approaches, their hedging activity can push price toward levels where they lose the least — often near max pain.

- Imagine SPX is trading around 4,580.

- The biggest combined open interest in calls and puts sits at the 4,600 strike.

- That 4,600 level is calculated as the max pain price for the day.

Quick Overview: The Core Differences Between SPX and SPY

Before we compare how reliable max pain is on SPX versus SPY, we need a clear picture of what each product actually is and how it settles. On the surface, they both track the S&P 500, but structurally they are very different instruments.SPX – Cash-Settled Index

- Underlying: The S&P 500 index (no actual shares involved).

- Settlement: Cash-settled; you never receive or deliver stock.

- Participants: Dominated by institutions, funds, and hedgers.

- Contract Size: Larger notional exposure per contract.

- Expiration Mechanics: Mix of AM-settled monthly options and PM-settled weeklies.

SPY – Share-Settled ETF

- Underlying: The SPDR S&P 500 ETF (actual shares trade).

- Settlement: Share-settled; assignment means shares delivered or received.

- Participants: Heavy retail activity plus ETF arbitrage and intraday trading.

- Contract Size: Smaller notional exposure per contract compared to SPX.

- Expiration Mechanics: All options are PM-settled at the closing price.

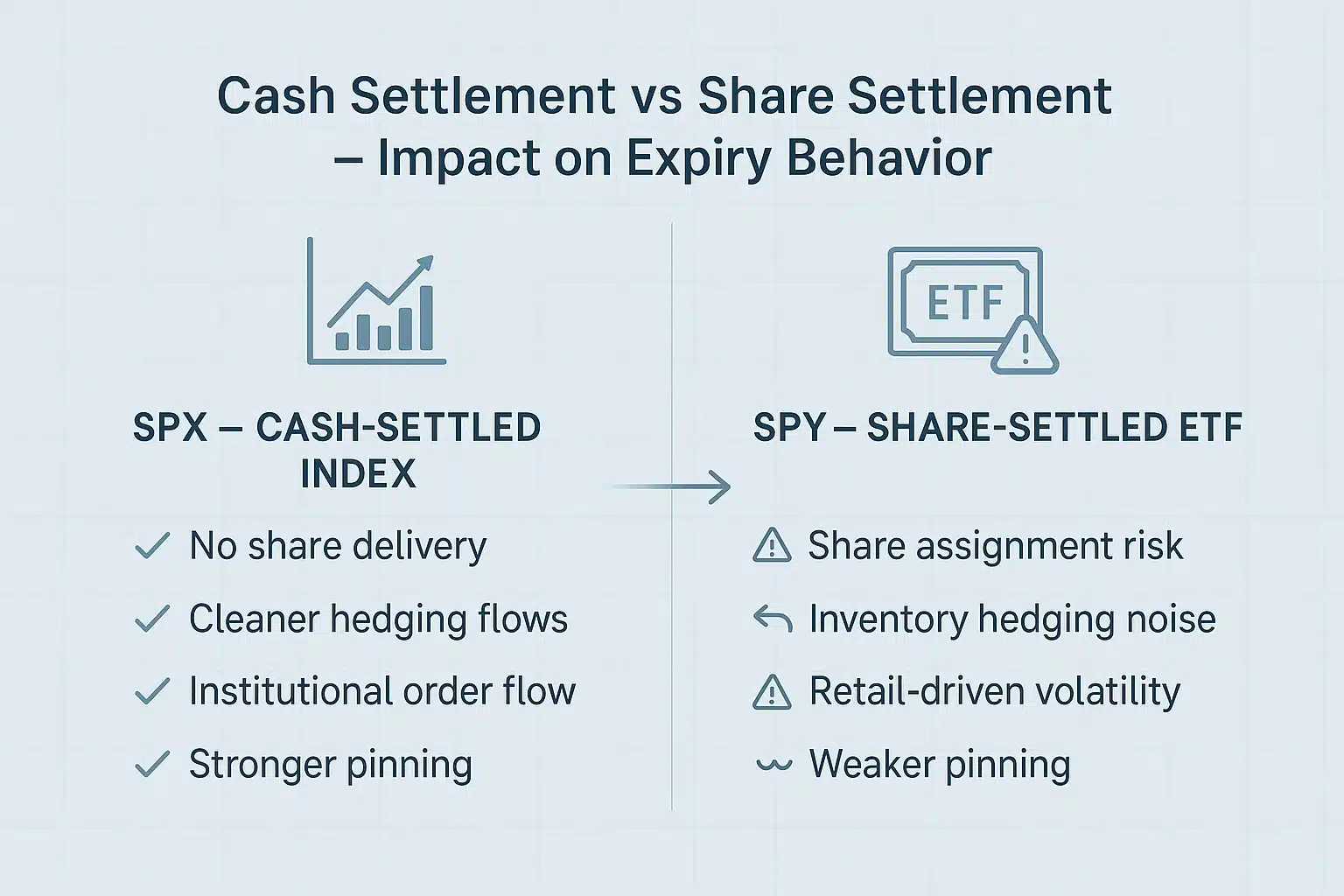

Cash Settlement vs Share Settlement — Impact on Expiry Behavior

Why Max Pain Behaves Differently on SPX

This is where the real divergence between SPX and SPY begins. Even though both track the S&P 500, their expiration mechanics produce completely different hedging flows. After watching thousands of expirations over the years — both manually and through my automated systems — I can tell you that SPX behaves far more “orderly” into expiry.1. Cash Settlement Creates Clean Expirations

SPX options settle in cash. That single feature removes the biggest source of expiration chaos: share delivery. Market makers don’t have to worry about being assigned thousands of shares on a Friday afternoon — they simply settle the cash differences. This leads to:- far less assignment-driven volatility,

- no need to unwind large share positions late in the day,

- cleaner, more predictable hedging flows,

- and stronger alignment between options open interest and index behavior.

2. Institutional Order Flow Dominates

SPX is an institutional product. Pension funds, insurance companies, volatility funds, structured-product desks — they all use SPX options as a core hedging tool. Their flows are:- large,

- methodical,

- and typically predictable.

3. AM Settlement on Monthly Expirations

SPX monthly options settle based on the opening rotation on Friday morning — not the closing print. That changes the entire rhythm of expiration:- hedging pressure peaks into Thursday’s close,

- dealers rebalance aggressively late Thursday afternoon,

- and the actual settlement price is determined by Friday’s opening auction.

Why Max Pain Behaves Differently on SPY

SPY may track the same index, but it trades nothing like SPX around expiration. The ETF structure adds layers of noise that distort max pain levels — and I see this play out consistently across my intraday flow models.1. Share Settlement Changes Dealer Behavior

SPY options are share-settled, which means assignment results in actual shares changing hands. Market makers must manage:- inventory size,

- stock borrow availability,

- ETF creation/redemption baskets,

- and the risk of ending up massively long or short after the bell.

2. Heavy Retail Flow Adds Noise

SPY is one of the most actively traded ETFs in the world — and much of that flow comes from retail traders, short-term scalpers, and intraday algorithmic strategies. When retail traders chase moves or react to headlines, their order flow can easily overpower the subtle push toward max pain. That’s why it’s common to see SPY trading several dollars away from its max pain level throughout the day, even when open interest suggests pinning should occur.3. PM Settlement Increases Late-Day Volatility

Unlike SPX, all SPY options settle at the closing price. The final minutes of the session are often dominated by:- ETF rebalancing,

- closing auction imbalances,

- end-of-day hedging and unwinding,

- and institutional equity flows unrelated to options.

Pinning Strength Comparison: SPX vs SPY

Based on every expiration dataset I’ve analyzed over the years — and the live behavior I see inside my automated credit-spread systems — the conclusion is simple: SPX pins more cleanly and more consistently than SPY. Here’s why:- SPX is cash-settled → no share-delivery distortions

- Dealer hedging is cleaner and more predictable

- Institutional flows dominate the order book

- Open interest clusters often sit on round numbers (strong psychological magnets)

- AM-settled monthly expirations reduce closing-auction volatility

Quick Example: SPX Pins, SPY Overshoots

SPX example:- Max pain: 4600

- Afternoon price: 4614

- Dealers hedge short-call exposure → selling pushes price lower

- SPX closes: 4603.7

- Max pain: 460

- Afternoon price: 463.50

- ETF flows + retail momentum push price around

- SPY closes: 462.8

How Automated Trading Handles SPX vs SPY Max Pain

When you run automated systems — especially ones built around weekly credit spreads like mine — you quickly see how differently SPX and SPY respond to max pain dynamics. The most important distinction is this: SPX max pain behaves like a structural force, while SPY max pain behaves like a sentiment zone. My automated engines treat the two products very differently because their market microstructure is nothing alike. SPX flows are slower, heavier, and institution-driven. SPY flows are more reactive and often dominated by retail and ETF arbitrage. This is also why almost all of my systematic credit-spread engines use SPX as the base product. If you want to replicate the exact filters I use (volatility regime, distance from max pain, and OI clusters), you can see the full flow in my Automated Options Trading Guide.How Automated Systems Interpret SPX

SPX is ideal for systematic trading because the flows driving it are consistent. Dealer hedging is orderly, and open interest tends to cluster tightly around round numbers — creating natural magnets during calm market conditions. For automation, this leads to clear advantages:- Cleaner hedging flows → easier modeling of expiry drift

- More predictable gamma behavior → tighter risk modeling

- Institutional order flow → less random noise

- Better alignment with max pain → stronger expiration pinning

How Automated Systems Interpret SPY

SPY is too noisy to treat max pain as a primary driver. Retail orders, ETF creation/redemption, and intraday flows distort the clean mechanics you see in SPX. Automated systems must adjust for:- Intraday volume spikes that overpower hedging flows

- Retail-driven volatility around headlines

- Share-delivery hedging that breaks pinning behavior

- PM-settlement volatility near the closing auction

When Traders Should Use SPX Max Pain

Not all max pain signals are created equal. In my experience — both manual and automated — SPX max pain is most useful when you’re trading defined-risk spread strategies into expiration, especially in calmer markets. You should lean on SPX max pain when:- You trade SPX credit spreads (bull put spreads, bear call spreads, iron condors)

- You want reliable institutional signals on expiry days

- Volatility is low and market conditions are stable

- You’re looking for a clean, predictable expiration drift

- You want to model dealer hedging flows directly

When Traders Should Use SPY Max Pain

SPY has its place — it’s just not the same place as SPX. SPY max pain is more useful for intraday context, retail-flow insight, and identifying broad pressure zones rather than exact pinning targets. SPY max pain is helpful when:- You trade SPY directly (shares or options)

- You want to identify short-term support/resistance levels

- You track retail-driven momentum or headline reactions

- You’re scalping or day trading short-term moves

- You need a “zone of interest,” not a precise expiration target

Summary Table: SPX vs SPY Max Pain

| Feature | SPX | SPY |

|---|---|---|

| Settlement | Cash | Shares |

| Who Trades It | Institutions | Retail + ETFs |

| Pinning Strength | Strong | Weak–Medium |

| Best Use Case | Credit spreads | Intraday context |

| Expiration Drift | Predictable | Noisy |

Final Verdict: SPX vs SPY Max Pain

After watching thousands of expirations over the years — and building automated strategies around both products — the conclusion is clear: SPX max pain is more reliable, more consistent, and far more actionable than SPY max pain. SPX’s cash settlement, institutional participation, round-number clustering, and predictable hedging flows all work together to create cleaner expiration behavior. When volatility is low, SPX often behaves as though it’s “magnetized” toward heavy open-interest levels. SPY, by contrast, is influenced by ETF mechanics, retail flows, and the chaotic nature of PM settlement. Max pain still matters for SPY — but mostly as a zone of interest, not a precise expiration magnet. It’s excellent for intraday context, but not for pinpointing where the market is likely to settle. If max pain is part of your trading playbook — especially for defined-risk weekly credit spreads — then SPX should be your primary guide. That’s exactly why my automated systems prioritize SPX signals: the behavior is more consistent, the hedging flows are easier to model, and the pinning effect shows up more often. If you want to see how I apply SPX max pain in live weekly trading — with fully automated SPX iron condors and credit spreads — my Weekly Premium service sends the exact trades I take each week. It’s designed for traders who want defined-risk, rules-based SPX strategies without needing to monitor the market all day.FAQs

1. Is SPX max pain more accurate than SPY max pain?

Yes — in my experience, SPX tends to pin more cleanly due to cash settlement, lower noise, and stronger institutional hedging flows. SPY behaves more like a stock with frequent intraday volatility and ETF-driven moves.2. Can SPY max pain still be useful?

Absolutely. SPY max pain can be helpful for identifying zones of interest, retail sentiment, and short-term support/resistance. It’s just rarely a precise expiration magnet.3. Does max pain always influence price movement?

No. Max pain is a guide, not a rule. Strong news, macro events, or volatility spikes can easily overpower hedging flows. Max pain tends to work best in calm or moderately quiet markets.4. Is max pain a good standalone trading strategy?

Not by itself. Max pain becomes valuable when you combine it with other factors like volatility conditions, dealer gamma levels, and liquidity flows. It’s a useful reference tool — not a complete trading system.5. Is it better to trade SPX or SPY options?

It depends on your goals, account size, and how you manage risk — but for expiration-based spread strategies, SPX is generally better for most professional and automated traders.

SPX advantages:

-

Cash-settled, so no share assignment or pin risk

-

Cleaner hedging flows means more predictable expiry behaviour

-

Stronger and more reliable max pain dynamics

-

Better for defined-risk strategies like credit spreads and iron condors

SPY advantages:

-

Smaller contract size is better for small accounts

-

Extremely liquid for intraday or directional trades

-

More flexible for trading shares and options together

If you’re trading expiry-driven credit spreads, SPX tends to offer a more consistent edge. If you’re day trading or scalping, SPY may be more suitable.

6. What are the pros and cons of SPX?

Pros (why pros prefer it):

-

Cash settlement eliminates share delivery and overnight assignment risk

-

Cleaner max pain behaviour due to institutional order flow

-

More predictable expiration drift, useful for spreads

-

Tax advantage for US traders (60/40 treatment under Section 1256)

-

Large notional exposure, so fewer contracts needed

Cons:

-

Larger contract size → higher buying-power requirement

-

Wider bid–ask spreads than SPY (though still very liquid)

-

Not ideal for very small accounts

-

Less flexible for hedging with shares

For traders running defined-risk weekly strategies, the pros outweigh the cons.

7. Is SPX or SPY more liquid?

SPY is more liquid in absolute terms, especially intraday — huge volume, tight penny spreads, and constant ETF trading flows.

But SPX has deeper institutional liquidity, especially around major strikes and near expiration. This creates:

-

more stable hedging flows,

-

cleaner gamma effects,

-

stronger pinning behaviour.

So:

-

SPY is more liquid for trading in and out during the day.

-

SPX is more liquid where it matters for credit spreads — at the strikes.

Both are highly liquid, but used for different purposes.

8. Is there pin risk on SPX?

No, not in the traditional sense.

SPX options are cash-settled, so you never wake up long or short shares after expiration. There is no risk of assignment leading to an unwanted stock position.

However, there is pricing pin risk, meaning SPX can gravitate toward heavily traded strikes near expiration, influenced by dealer hedging flows. This is useful for spread traders, not harmful.

SPY, on the other hand, does have true pin risk because options settle into actual shares.

9. Should I use max pain for credit spreads?

Yes, especially on SPX. When open interest, hedging flows, and volatility align, max pain levels can help you structure safer, more favorable credit spreads. This is a core component of how I build the automated SPX strategies inside Weekly Trend and my Weekly Premium service.Max Pain: Complete Learning Path

- Step 1: The Foundation. Max Pain Theory Explained: Understanding the core hypothesis and the ‘gravitational pull’ of option expiration.

- Step 2: Real-Time Data. The SPY Max Pain Hub: Tracking live open interest to visualize where the market makers are positioned.

- Step 3: Tactical Setup. Max Pain Strategy Guide: How to turn open interest data into a repeatable trading framework.

- Step 4: Asset Selection. SPX vs. SPY Max Pain: Determining which instrument offers the best tax and liquidity profile for pinning trades.

- Step 5: Reality Check Does Max Pain Really Work?: A critical look at the statistical success of the theory and its limitations in high-volatility markets.