A credit spread strategy is one of the most reliable ways to trade options with defined risk, consistent probabilities, and steady income potential. Instead of trying to predict big market moves, credit spreads let you profit when the market simply behaves as expected — staying flat, drifting slightly higher, or fading off resistance.

That’s why professional traders rely on bull put spreads and bear call spreads as their foundation for short-premium trading on SPX and SPY.

With the right strike placement and disciplined exits, a credit spread strategy gives you clear risk, clear reward, and a 60–85% probability of success.

In this guide, I’ll break down exactly how the strategy works, when to use it, how to select strikes, and how to manage risk like a pro, with real examples pulled from the same logic I use in my automated systems.

Are Credit Spreads a Good Strategy?

Yes — credit spreads are one of the most consistently profitable options strategies when used correctly. They benefit from time decay, allow traders to sell premium far from current price, and keep risk strictly defined. This makes them especially effective in neutral or mildly trending markets where price isn’t expected to move aggressively.

The key advantage is probability: you can structure spreads with a 60–85% chance of expiring worthless while still maintaining controlled risk and mechanical exits.

What Is the Credit Spread Strategy? (Quick Refresher)

A credit spread is an options position where you sell one option and simultaneously buy another option on the same underlying and expiration, at a different strike. The sale brings in more premium than the purchase, so you collect a net credit. Your max profit is that credit; your max loss is the strike width minus the credit.What Are Common Credit Spread Strategies?

Bull Put Spread (Mildly Bullish)

- Sell higher-strike put; buy lower-strike put (same expiry).

- Profit if price stays above the short strike or time/vol decay helps.

- Common on SPX/SPY when trend is up or range holds.

Bear Call Spread (Mildly Bearish)

- Sell lower-strike call; buy higher-strike call (same expiry).

- Profit if price stays below the short strike or rallies fade.

- Useful in weak or choppy tape when rallies keep failing.

When to Use Credit Spreads

I deploy the credit spread strategy when probabilities and pricing tilt in my favor—typically during neutral to mildly directional markets with supportive volatility. Here’s the practical checklist I use before selling a bull put or bear call on SPX:1) Market Context (Price Action First)

- Mildly bullish / range-holding: consider a bull put spread beneath recent support.

- Mildly bearish / fading rallies: consider a bear call spread above resistance.

- Avoid placing new spreads directly into binary catalysts (FOMC, CPI) unless that is part of your plan.

2) Implied Volatility (Get Paid for Risk)

- Prefer elevated but not extreme IV. Higher IV generally pays better credits and more distance from price.

- When IV is very low, I either move further out (time) or skip the trade—thin credits aren’t worth the tail risk.

3) Liquidity & Execution

- Stick to liquid underlyings and expirations (tight bid-ask, active series). SPX and SPY are ideal.

- Use limit orders and avoid chasing fills; slippage quietly taxes your edge.

Bull Put vs Bear Call Use-Cases

| Market condition | Best spread | Why |

|---|---|---|

| Range-bound | Either | Sell outside support/resistance |

| Mildly bullish | Bull put spread | Price expected to stay above support |

| Mildly bearish | Bear call spread | Price expected to stay below resistance |

| High IV | Both | Higher premiums + more strike distance |

| Pre-catalyst | Avoid spreads | Harder to model risk |

How to Set Up a Credit Spread & Pick Strikes (Step-by-Step)

My process is simple and repeatable. The goal is to sell premium where price is unlikely to go, collect a solid credit, and keep risk capped. Here’s the checklist I use on SPX/SPY every week:1) Choose the Spread Type

- Bull Put Spread for mildly bullish or range-bound markets (sell put closer to price; buy a further OTM put).

- Bear Call Spread for mildly bearish or mean-reverting rallies (sell call closer to price; buy a further OTM call).

2) Time to Expiration (DTE)

- I prefer 30–45 DTE for smoother theta and easier management.

- For faster turnover, 21–30 DTE is fine if liquidity is excellent.

3) Strike Distance & Probability

- Anchor short strikes near ~0.05–0.10 delta (or use your preferred POP threshold).

- Place them beyond obvious support/resistance zones on the daily chart.

4) Credit, Width & Risk/Reward

- Target a credit that gives you at least 1:2 risk/reward (max loss ≈ 2× max profit or better).

- Remember: Max Profit = Net Credit; Max Loss = Width − Credit.

5) Exit & Risk Rules

- Take profits around 50–60% of max profit; close 3–5 DTE to avoid gamma/assignment risk.

- Size each trade at ~1–5% of account risk; keep a buying-power buffer for volatility spikes.

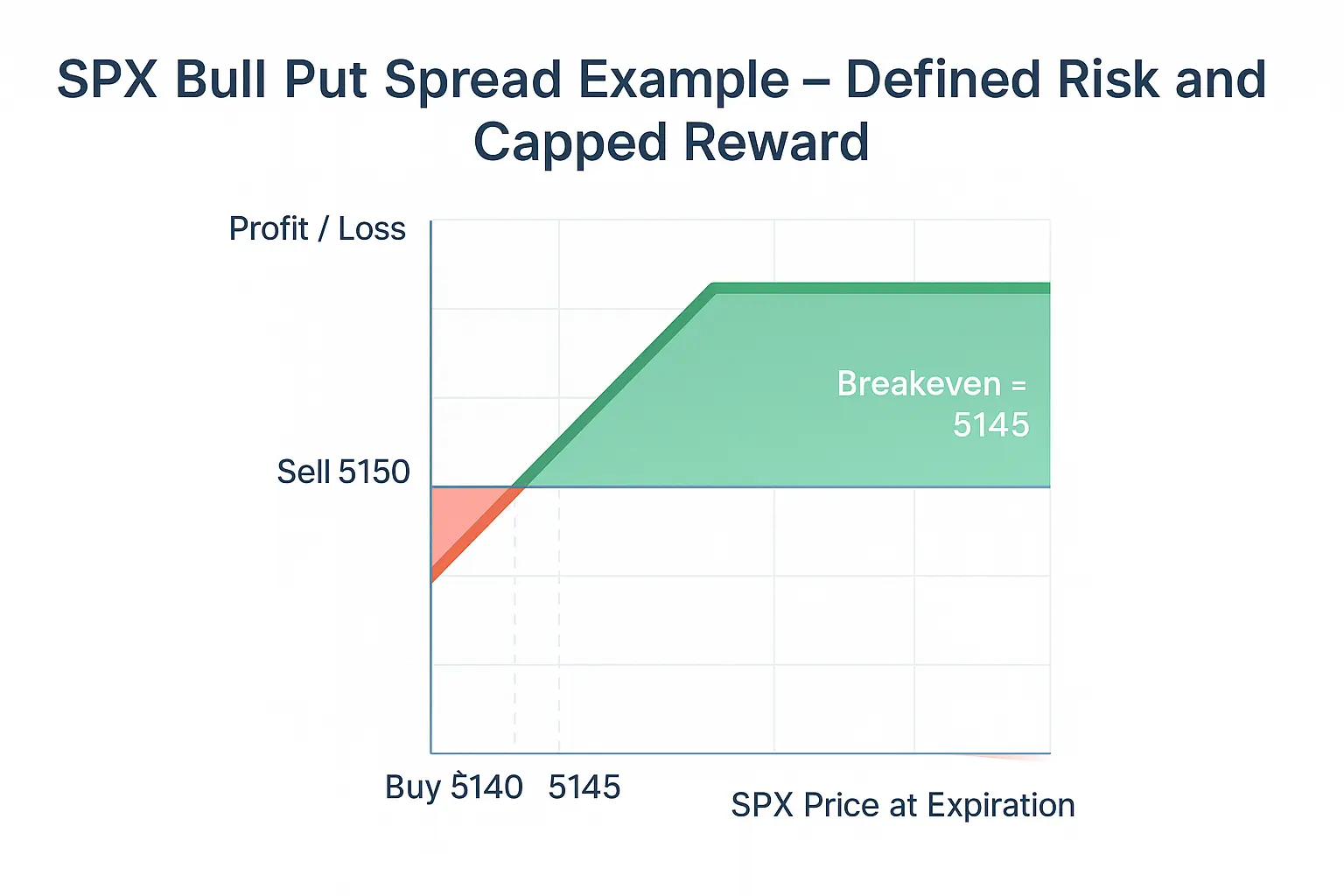

Example #1: SPX Bull Put Spread (Mildly Bullish)

This is my base case when price is trending up or holding a range above support.Setup

- Underlying: SPX

- Assume Price: 5100

- Expiry: ~35 DTE

- Strikes: Sell 5150 put / Buy 5140 put (width = 10)

- Credit Received: 5.00

Math

- Max Profit: 5.00

- Max Loss: 10 − 5.00 = 5.00

- Breakeven: Short strike − credit = 5145

- Risk/Reward: 5.00 : 5.00 ≈ 1 : 1

Why This Works

- Short strike sits below recent support and below the 20–50 DMA cluster.

- Elevated IV improves credit and distance.

- Defined risk; easy to automate exits at 50–60% of max profit.

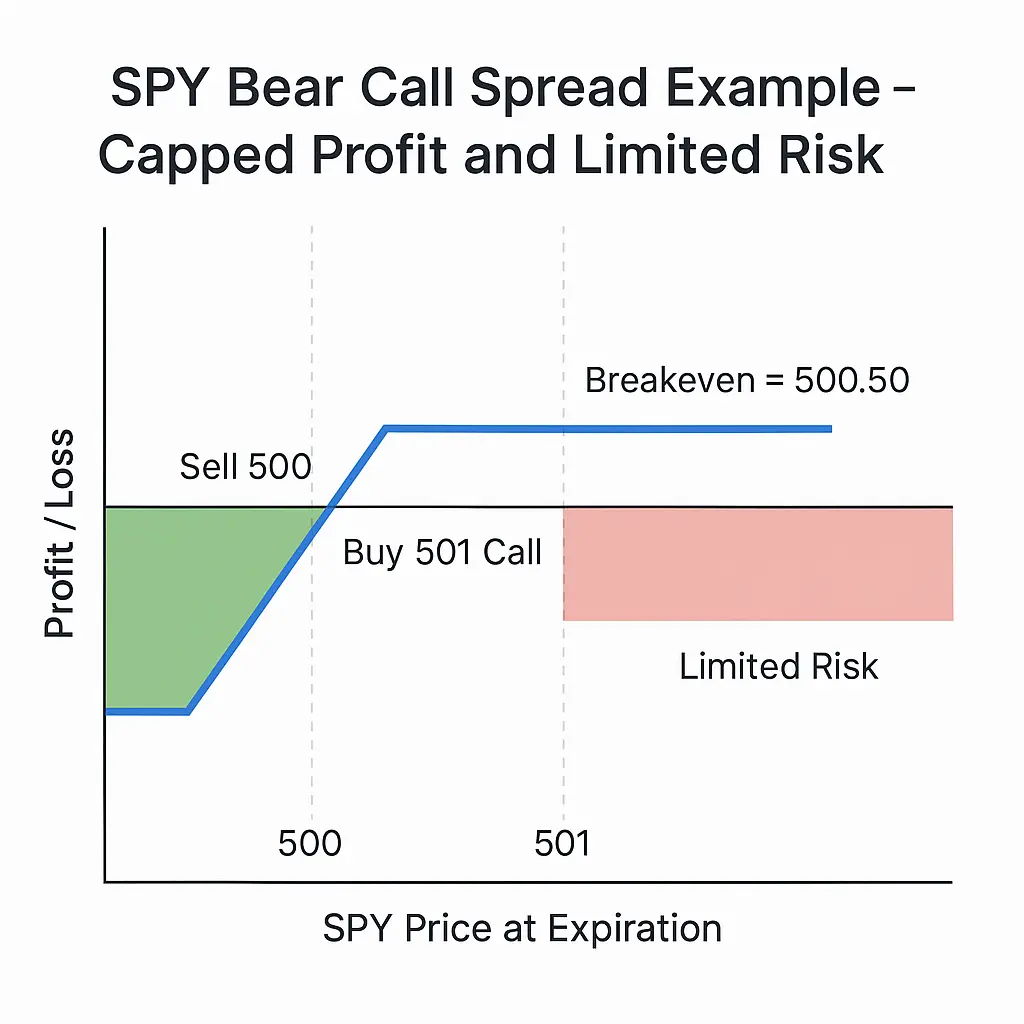

Example #2: SPY Bear Call Spread (Mildly Bearish)

I like this when rallies look tired and keep failing under a known resistance level.Setup

- Underlying: SPY

- Assume Price: 505.00

- Expiry: ~30 DTE

- Strikes: Sell 500 call / Buy 501 call (width = 1)

- Credit Received: 0.50

Math

- Max Profit: 0.50

- Max Loss: 1 − 0.50 = 0.50

- Breakeven: Short strike + credit = 515.50

- Risk/Reward: 0.50 : 0.50 ≈ 1 : 1

Why This Works

- Short call is set above resistance with rallies failing to break/hold.

- Neutral-to-bearish tape + reasonable IV supports quicker decay.

- Defined risk with straightforward exits and assignment awareness (SPY is American-style).

Risk Management & Credit Spread Probability of Profit

Successful traders don’t predict — they prepare. The edge in credit spreads isn’t in calling market tops or bottoms; it’s in managing position size and timing exits with discipline.My Risk Rules

- Risk 1–5% of account per trade. This ensures that even consecutive losers can’t destroy capital.

- Close early at 50–60% of max profit. Don’t get greedy — you reduce gamma and event risk.

- Avoid selling cheap premiums. If IV is low and credits are tiny, skip the trade.

- Monitor your short strike. If price crosses it, adjust or exit — fast. Hope is not a strategy.

What Is the Best Strategy for Put Credit Spreads?

The best approach for put credit spreads is to sell a bull put spread below a strong support zone, ideally at a delta between 0.05–0.15. This places your short strike in an area the market is unlikely to test while still delivering a solid credit.

Professional traders prefer:

-

30–45 DTE for smoother decay

-

Exiting at 50–60% max profit

-

Avoiding weeks with major macro events

-

Defined width (so risk is capped regardless of volatility spikes)

In SPX/SPY, this setup consistently outperforms because liquidity ensures tight fills and predictable behaviour.

Credit Spread vs. Debit Spread

Traders often confuse credit spreads with debit spreads. Both are defined-risk option structures, but their objectives — and their cash flows — are opposite.| Feature | Credit Spread | Debit Spread |

|---|---|---|

| Cash Flow | Receive premium | Pay premium |

| Goal | Earn from time decay | Profit from directional move |

| Ideal Market | Neutral to slow | Trending strongly |

| Risk | Limited to width − credit | Limited to premium paid |

Defined-Risk Options Trading: Why It Works

Defined-risk trading is the foundation of longevity. Every time I sell a spread, I know my exact dollar risk and my maximum reward before the order fills. That allows me to scale consistently, manage stress, and avoid catastrophic drawdowns. Here’s what makes defined-risk spreads so powerful:- Predictable outcomes: You know both your cap and your floor.

- Consistency: Frequent small wins compound steadily over time.

- Emotional control: Pre-defined exits eliminate panic decisions.

“You don’t need to predict the market; you just need to define your risk and let time work for you.”Want to automate this discipline? Learn how our system executes SPX and SPY credit spreads with rule-based precision: Credit Spread Signals – Advanced AutoTrades.

Automation and Execution (Advanced AutoTrades)

Even the best trading plan fails if execution is sloppy or emotional. That’s why automation has become a major edge for retail traders. I’ve seen it firsthand—many traders lose not because the strategy is bad, but because they hesitate, overtrade, or ignore exit rules. Automated systems like those used by Advanced AutoTrades execute SPX and SPY credit spreads with precise rules: correct strike distance, defined risk, and mechanical exits. Automation doesn’t trade more—it trades better.- Removes hesitation and emotional bias.

- Executes with consistent position sizing and stop rules.

- Improves fill quality by acting faster during liquidity windows.

- Lets you focus on strategy selection instead of order entry.

FAQs About Credit Spread Strategies

1. What is the safest credit spread strategy?

High-probability spreads placed far from the current price—typically around the 60–80% probability-of-profit level—are the safest. These are usually bull put or bear call spreads structured well beyond short-term volatility ranges.2. How far out should I go when selling a credit spread?

Most traders choose expirations between 7–30 days. Shorter trades decay faster but allow less time for adjustments; longer trades decay slower but are easier to manage.3. What delta should I sell for a high-probability credit spread?

I usually target a delta of 0.05–0.25. That gives roughly a 60–85% chance the option will expire worthless while still offering reasonable credit.4. Do I need to hold a credit spread to expiration?

No. I typically close after capturing 50–60% of the available credit. Exiting early reduces gamma risk and prevents assignment surprises, especially on SPY or QQQ.5. Can beginners trade credit spreads safely?

Yes, as long as they understand the math and stick to small position sizes. Defined-risk spreads limit losses and provide frequent, steady income—making them ideal for beginners learning disciplined trading.Wrapping It Up: Trade Smarter, Not Harder

At its core, the credit spread strategy is about trading probabilities, not predictions. You sell one option, buy another for protection, and let time decay and discipline do the heavy lifting. In bullish markets, use a bull put spread; in bearish setups, use a bear call spread. Either way, your risk is defined, your reward is clear, and your process becomes repeatable. When you’re ready to see how I apply these setups every week—fully automated and broker-executed—explore: Credit Spread Signals – Advanced AutoTrades.Credit Spreads: The Complete Learning Path

- Step 1: The Foundation Credit Spreads Explained: The core mechanics and how credit spreads generate income.

- Step 2: How It Works Mechanics of a Credit Spread: Understanding premium collection, margin, and the math of the trade.

- Step 3: Strategy Selection Credit vs. Debit Spreads: Which strategy fits your market outlook?

- Step 4: Tactical Setup Bull Put Credit Spread Guide: A step-by-step framework for placing your first high-probability trade.

- Step 5: Risk & Risk Management The Risks of Credit Spreads: How to identify Max Pain and protect your capital from market shocks.

- Step 6: Real-World Application Examples & Strategy: Case studies and advanced strategy rules for consistent returns.