Table of Contents

hide

What Is a Short Iron Condor?

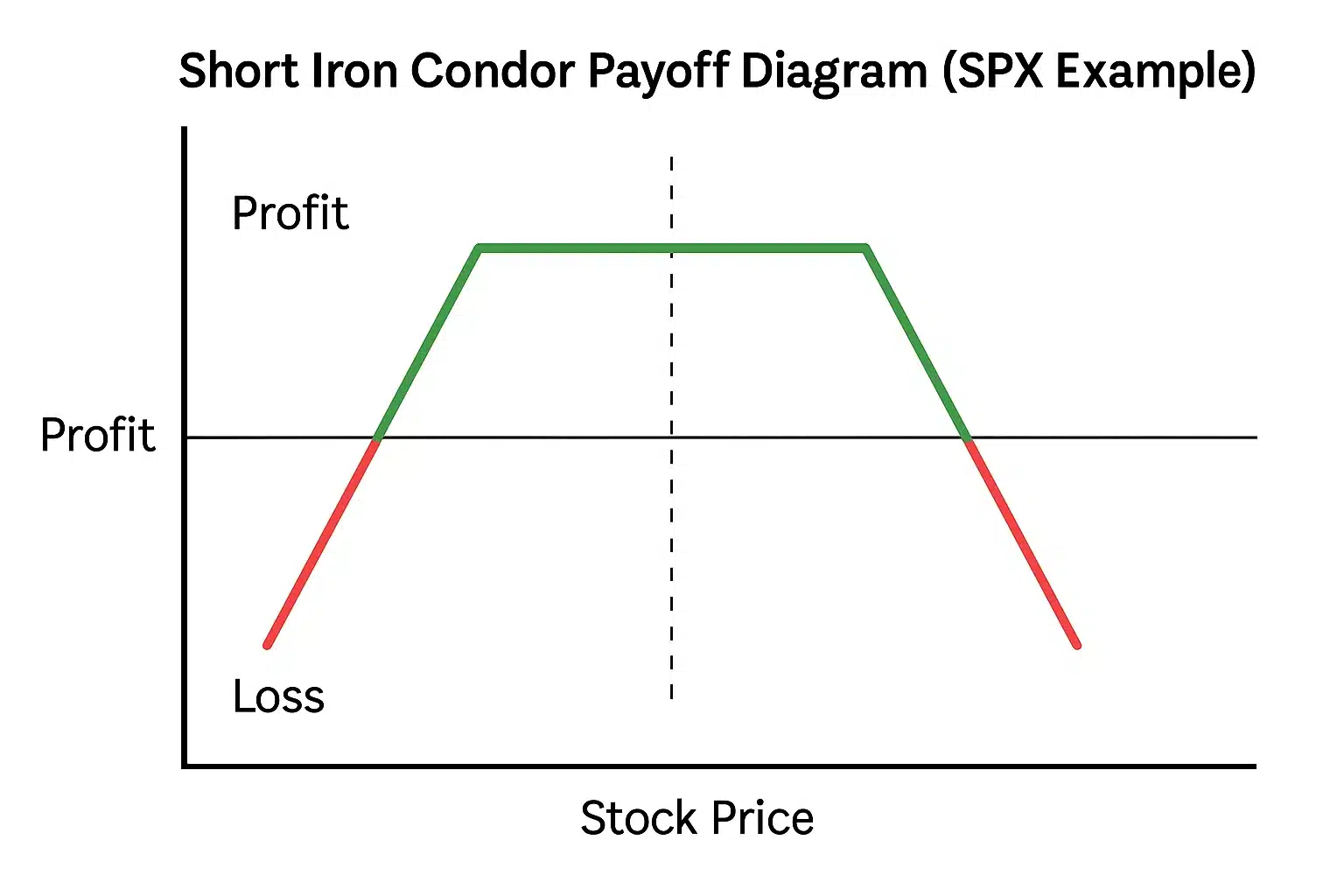

The short iron condor is a neutral, income-generating options strategy that profits when the underlying stays within a certain range. It’s a defined-risk, limited-reward trade—perfect for range-bound markets like SPX or SPY. Here’s how it works: you sell an out-of-the-money call spread and an out-of-the-money put spread at the same time. This creates a “wings-out” structure where you collect a net credit upfront and risk a capped loss if the trade breaks out beyond your range. Traders use short iron condors to bet on low volatility and time decay. As long as the stock or index stays within your selected strikes through expiration, you keep the premium. Here’s a quick breakdown:- Market Outlook: Sideways / neutral

- Max Profit: Net credit received

- Max Loss: Width between spreads – credit received

- Risk Type: Defined (no naked exposure)

If you’re new to Iron Condors, start with our main guide —

Iron Condor SPX Strategy: Profit From Low Volatility Safely.

It explains how SPX Iron Condors work, when to trade them, and how professionals manage risk.

How the Short Iron Condor Works

The short iron condor is constructed by combining two vertical spreads: a short call spread and a short put spread. All four legs have the same expiration date. The goal is to sell both spreads far enough out-of-the-money so that the underlying index stays between them until expiration. Here’s the structure step by step:- Sell 1 out-of-the-money call (e.g., SPX 5400 Call)

- Buy 1 further out-of-the-money call (e.g., SPX 5450 Call)

- Sell 1 out-of-the-money put (e.g., SPX 5300 Put)

- Buy 1 further out-of-the-money put (e.g., SPX 5250 Put)

Short Iron Condor vs Long Iron Condor

Both short iron condor and long iron condor strategies use four legs and the same strikes, but the key difference lies in your directional bet—and whether you’re collecting premium or paying it. The short iron condor is a net credit strategy that profits when the underlying stays within a range. In contrast, the long iron condor is a net debit trade that profits when the price breaks out past the wings—requiring a big move. Curious how it compares to other strategies? See our full breakdown on the Iron Condor vs Iron Butterfly strategy.| Feature | Short Iron Condor | Long Iron Condor |

|---|---|---|

| Profit Outlook | Range-bound | Breakout needed |

| Entry Type | Net credit | Net debit |

| Max Profit | Credit received | Spread width – debit paid |

| Max Loss | Spread width – credit | Premium paid |

| Best For | Low volatility environments | High volatility or event plays |

When to Use the Short Iron Condor Strategy

The short iron condor works best in specific conditions. It’s not a strategy you just fire off randomly—it’s about timing and context. Here’s when I personally use it (and when our Weekly Premium service sends signals):- Low or falling implied volatility (IV)

- Range-bound price action

- No major news or earnings events

- Short duration trades (1–2 trading days)

Risk and Reward: Short Iron Condor Payoff

With a short iron condor, your maximum profit and loss are clearly defined from the moment you place the trade.- Max Profit: Credit received

- Max Loss: Spread width – credit received

- Sell 5300 Put, Buy 5250 Put

- Sell 5400 Call, Buy 5450 Call

Get 1 High-Probability SPX Iron Condor Every Week

Weekly Premium delivers 1 SPX iron condor trade each week, fully automated for 5–10% ROI in just 2 days. Get Weekly Premium NowHow to Set Up a Short Iron Condor in Your Broker

- Choose expiration (1–3 days out)

- Select your short strikes based on expected range

- Buy protective wings 50 points away

- Enter all 4 legs as a single spread order

Common Mistakes Beginners Make

- Strikes too close together

- Holding through major events

- Going to expiration and risking assignment

- Overtrading the setup

Can You Automate the Short Iron Condor Strategy?

Yes—and you should.- Perfect execution timing

- Emotion-free trading

- Hands-off passive income