When I first started trading options decades ago, I quickly realized that the market doesn’t always play nice. Prices move, volatility shifts, and sometimes even the best setups get tested. That’s where iron condor adjustments come in.

Managing these trades isn’t about guessing direction; it’s about staying calm, defining your risk, and adapting when the market throws a curveball. In this guide, I’ll show you how to adjust an Iron Condor, manage it like a professional, and know when to sit tight. Read my Iron Condor SPX Strategy guide if you’d like to start from the basics before diving into adjustments.

Why Iron Condor Adjustments Matter

Every trader dreams of those quiet, sideways markets where Condors glide smoothly to profit. But in real life? Markets trend, break ranges, and volatility pops. Adjustments are your safety net.

Here’s why adjustments matter:

- Risk control: They help you avoid hitting max loss when the price tests one side.

- Time management: Rolling gives your trade more time to work instead of closing early.

- Profit preservation: A small move can turn winners into losers near expiration.

Think of adjustments like course corrections for a pilot; you don’t wait for turbulence to crash the plane — you steady it before trouble hits.

Common Adjustment Strategies (Rolling, Converting, Reducing Width)

Let’s talk about the real tools in a trader’s toolkit. These are the iron condor management moves I use most often:

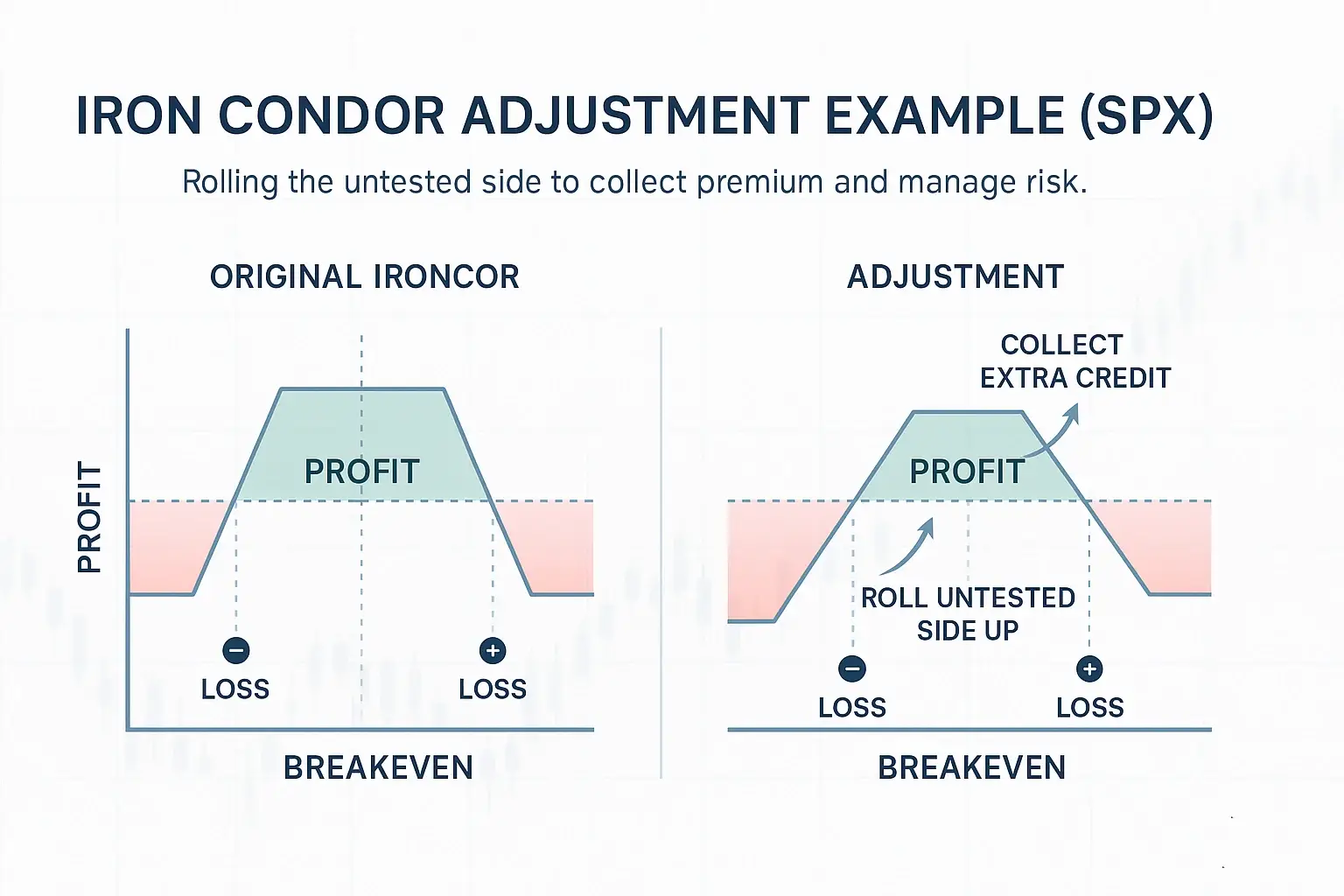

1. Rolling the Untested Side for Credit

When the price starts to lean toward one wing, I roll the untested side closer to collect more premium.

Example: If SPX rises and your call spread gets tested, roll the put spread upward. You collect more credit, reducing overall risk. But be careful — don’t over-roll and narrow your profit zone too much.

2. Rolling Out in Time

Sometimes, price hits a wing, but the story isn’t over. Instead of closing for a loss, I’ll roll the Iron Condor out to a later expiration.

- Close the current trade.

- Reopen the same strikes further out in time.

This move buys more time for the market to cool off and lets theta (time decay) work for you.

3. Converting to an Iron Fly or Butterfly

When your short strikes get tested hard, one option is to repair the position by turning it into an Iron Butterfly.

- Move the untested side closer until both short strikes meet at the same level.

- This centers your trade around the current price, creating a tighter range but higher reward potential.

It’s like trading offense instead of defense — you realign your Condor for the new reality.

4. Reducing Width or Taking Partial Profits

If one side performs well, take profits there. Close the winning side and keep the tested spread open with reduced size. That locks in gains while freeing up capital. These strategies aren’t about heroics; they’re about survival and consistency.

| Adjustment Type | Goal | Example |

|---|---|---|

| Roll Untested Side | Collect more credit | Roll puts up 50 points |

| Roll Out in Time | Buy more duration | Move 2D → 5D expiration |

| Convert to Iron Fly | Re-center trade | Bring short legs together |

| Take Partial Profit | Reduce exposure | Close winning side early |

When to Adjust: Timing and Indicators

The timing of adjustments can make or break your trade. Here’s what I look for before making a move:

- Price touches your short strike: that’s the first red flag.

- Delta of the short leg > 25: risk is rising — time to react.

- Volatility spikes: premiums expand fast; better to adjust early.

And here’s what not to do:

- Don’t adjust out of panic.

- Don’t adjust within 1–2 days of expiration; gamma risk goes wild and the smallest move can ruin your day.

Remember, not adjusting is also a decision. Sometimes the smartest move is to let the numbers play out.

Example: SPX Iron Condor Adjustment Step-by-Step

Let’s walk through a real example.

Setup:

- Underlying: SPX @ 5050

- Expiration: 3 days (3 DTE)

- Volatility: Mild (VIX ~16)

You sell:

- Sell 5140 Call @ $6.00

- Buy 5150 Call @ $5.00

- Sell 4910 Put @ $6.50

- Buy 4900 Put @ $5.50

Credit received: $2.00 (i.e., $200 total).

Mid-week: SPX jumps to 5090. The short call is getting tested.

What I do:

- Roll the put side up 50 points (to 5000/4990).

- Collect an extra $1.00 credit.

- Total credit becomes $3.00 ($300), which cushions risk and shifts the profit zone upward.

Result: You’ve bought yourself breathing room without panicking. (Tip: a quick before/after payoff diagram makes this crystal clear.)

Manual vs Automated Adjustments

In my early years, I spent hours watching every tick. Today, automation changes the game.

Manual management means:

- You monitor charts, deltas, and volatility by hand.

- You decide when to roll or close positions.

- Great for learning — but stressful under pressure.

Automated iron condor management does the heavy lifting:

- Algorithms track delta, theta, and volatility in real time.

- When price hits preset thresholds, rolls are executed automatically.

- Execution stays fast and emotion-free — the way it should be.

Learn the basics and context by following our trading with our Weekly Premium SPX signals.

Managing Risk and Avoiding Over-Adjustment

Here’s the truth — too many adjustments can do more harm than good. The goal isn’t to “save” every trade; it’s to protect capital and stay in the game for the long run.

A few key rules I live by:

- Close trades before expiration to dodge gamma spikes.

- Use defined-risk spreads — that’s the real beauty of the Iron Condor.

- Avoid revenge trading. Don’t open another setup immediately after a loss.

Good iron condor risk management means knowing when to stop tinkering. Sometimes, the best repair is a clean exit. If you’re unsure about specific option terms, here’s a great Investopedia overview on Iron Condors.

Final Thoughts

It’s not about predicting what will happen — it’s about being flexible enough to adjust when the market changes. If you follow a plan, roll the untested side, extend in time, and manage risk, you’ll keep your account alive and your confidence strong.

Discipline will always beat luck — whether you’re trading SPX, QQQ, or RUT. Successful traders understand it’s about consistency, not chasing single wins. Be patient, trust your math, and let probability do the work.

When you’re ready to take this process to the next level, automation can help. Automate your Iron Condor adjustments with our Weekly Premium SPX Signals — defined-risk, no guesswork, and emotion-free execution.

Quick Recap

- Adjust only when risk metrics or price movement justify it.

- Keep your Condor defined-risk and close before expiration week.

- Track every adjustment — data beats emotion.

- Consider automation to remove execution stress.

Iron Condor Adjustment FAQs

When should I adjust an Iron Condor position?

I usually adjust when price touches or slightly breaches my short strike — that’s the first sign the trade is being challenged. Other early signals include the short leg’s delta rising above 25 or a sudden spike in volatility. The key is to react calmly, not emotionally.

What is rolling the untested side of an Iron Condor?

Rolling the untested side means moving the profitable side closer to the current price to collect more premium and reduce risk. For example, if SPX rallies, I roll the put spread upward. This adds credit and recenters the trade’s profit zone — just don’t over-roll and squeeze your range too tightly.

Is it better to adjust or close a losing Iron Condor?

That depends on your risk plan. If the position still has time and volatility stabilizes, a smart adjustment may make sense. But if you’re within a few days of expiration or the short strike is deep in the money, closing the trade often preserves more capital than fighting to repair it.

Can Iron Condor adjustments be automated?

Yes. Automated Iron Condor management systems, like the ones we use at Advanced AutoTrades, can monitor delta, volatility, and time decay in real time. When conditions hit predefined thresholds, adjustments execute instantly — no hesitation, no emotion.

How can I limit losses when managing an Iron Condor?

Take profits early and close before expiration to avoid gamma spikes. Using defined-risk spreads ensures that even in the worst-case scenario, you know exactly how much you can lose.