Have you ever wondered how options traders make money? You’re not the only one. It’s one of the most common questions beginners have when they first explore the world of options trading. Many assume traders get rich by guessing which way the market moves — but that’s not how professionals do it.

In reality, successful options trading is built on math, patience, and smart risk management — not luck. In this guide, I’ll walk you through the key principles using simple terms and real-world examples that any beginner can understand. Let’s break it down step by step.

How Does Options Trading Work?

Before we talk about profits, let’s start with the basics — how does options trading actually work? An option is a contract that gives you the right (but not the obligation) to buy or sell a stock at a specific price before a specific date.

There are two main types of options:

- Call options – give you the right to buy.

- Put options – give you the right to sell.

Traders can either buy or sell these contracts. Buyers pay a premium upfront, hoping the stock moves in their favor. Sellers, on the other hand, collect that premium and profit if the option loses value over time. Sounds like selling insurance, right? That’s exactly how many professionals think of it.

For more on how options contracts work, see our Ultimate Guide to Options Trading Basics.

The Secret: Selling Options for Income

Most successful traders don’t gamble on big price swings. Instead, they focus on selling options for income — collecting premiums like an insurance company collects payments.

Here’s the logic:

- Every option has a time limit.

- As time passes, options lose value due to theta decay (also known as time decay).

- The seller benefits because the option they sold becomes cheaper or expires worthless.

This is how theta decay profit works. You’re not betting on where the market goes; you’re betting on time itself.

Learn more about theta decay from Investopedia.

Why Defined-Risk Strategies Win

One of the biggest misconceptions about options trading is that it’s “risky.” And that’s true — if you trade the wrong way. The real key is using defined-risk strategies where both your potential loss and gain are known before entering the trade.

Professional traders avoid “naked” options, where the potential loss can be unlimited. Instead, they use credit spreads and iron condors — structured trades where the maximum risk is capped from the start. These setups give you a clear risk-to-reward ratio and help you survive volatility swings without blowing up your account.

At Advanced AutoTrades, we only trade defined-risk spreads — never naked options — to maintain consistent, controlled performance for our subscribers.

Example 1: Credit Spreads Explained

A credit spread involves selling one option and buying another at a different strike price on the same expiration date. The premium collected from selling is higher than the premium paid for buying — resulting in a net credit received upfront.

Let’s take an example using the S&P 500 (SPX):

Imagine selling a 4400 put and buying a 4395 put in the same week. You collect a $1.00 credit per share (or $100 per contract), with a $500 max loss if the spread goes against you. That’s a 1:5 risk-to-reward ratio, but the probability of winning might be around 80–85%.

In this setup, time decay (theta) and price staying above your short strike are your friends. If SPX stays above 4400 until expiration, both options expire worthless and you keep the entire premium.

For more details, check our guide: Credit Spreads Explained.

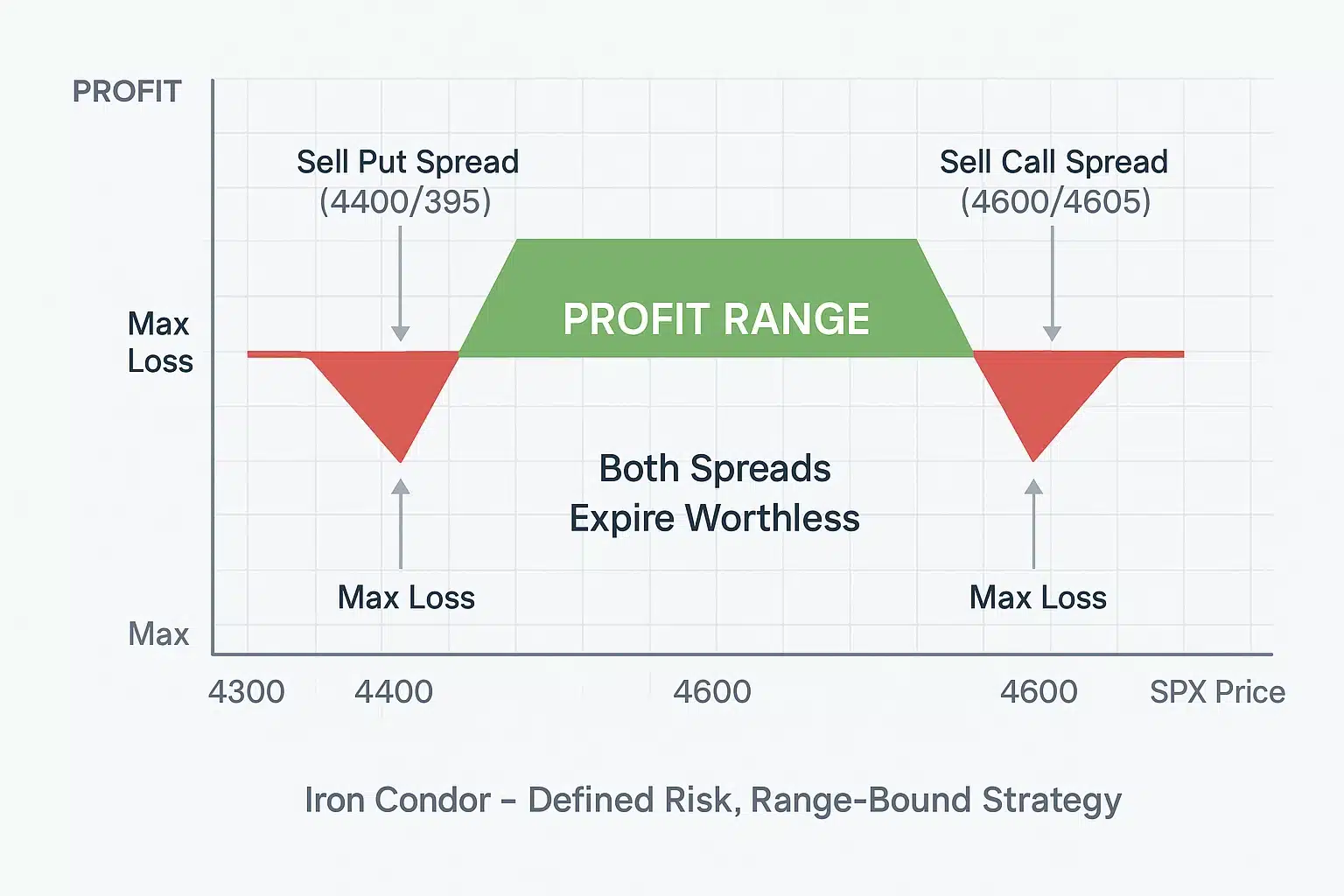

Example 2: Iron Condor — Double the Income, Defined Risk

The iron condor takes the concept of credit spreads one step further. It combines a bull put spread (below price) and a bear call spread (above price) to create a profit zone in between.

Let’s say SPX is trading at 4500. You might sell a 4400/4395 put spread and a 4600/4605 call spread, collecting $2.00 total in premium ($200 per contract). As long as the index stays between 4400 and 4600 by expiration, both spreads expire worthless — and you keep the full premium.

This strategy allows you to profit from low volatility periods where the market moves sideways — something many traders overlook. It’s why professional traders love the iron condor: it earns money even when “nothing happens.”

Understanding Time Decay (Theta)

One of the most powerful — and misunderstood — forces in options trading is time decay, also known as theta. It’s the gradual reduction in an option’s value as it approaches expiration. Think of it as the “clock” working in favor of the option seller.

Each day that passes, all else being equal, the option loses a bit of value. For traders who sell options — through credit spreads, iron condors, or covered calls — that daily erosion becomes profit if the market stays within their expected range.

This is why so many professionals prefer to sell premium instead of buying it. You don’t need to predict direction — you simply need the market not to move too far, too fast. And that’s where consistent profits often come from.

For a deeper look at how theta impacts your strategy, see our guide on Risk Management in Options Trading.

Consistency Beats Prediction

The biggest edge in trading isn’t guessing the next market move — it’s managing risk consistently. Even the most advanced models and signals won’t be right 100% of the time. What separates professionals from amateurs is their ability to control losses and let probabilities do the work.

That’s where automation can make all the difference. Automated trading removes emotion, executes trades with precision, and maintains discipline even when markets turn volatile. It allows traders to follow their strategy without hesitation or overreaction.

At Advanced AutoTrades, our systems use rule-based logic to execute defined-risk spreads automatically on SPX — with pre-programmed allocation, entry, and exit rules. That means every trade is executed with institutional-level discipline, not emotion.

Final Thoughts

Options trading can absolutely be profitable — when done the right way. It’s not about chasing the next hot stock or trying to predict every market swing. It’s about understanding probabilities, controlling risk, and staying consistent.

By using defined-risk strategies like credit spreads and iron condors, traders can collect premium with confidence, knowing their downside is capped. And with automation, the process becomes even more reliable.

Ready to see how it works in real time? Automate SPX credit spreads with our Weekly Trend Signals — where every trade is executed automatically with strict risk control and data-driven precision.

Frequently Asked Questions

Can options trading really make money?

Yes, options trading can be profitable when using defined-risk strategies such as credit spreads or iron condors. The key is consistency, risk control, and understanding probabilities — not chasing big wins.

What are the most common ways traders make money with options?

Most professional traders make money by selling premium — collecting income from time decay as options lose value before expiration. Common examples include bull put spreads, bear call spreads, and iron condors.

Is buying options profitable for beginners?

Buying options can work in specific short-term setups, but most beginners lose money because of time decay and poor timing. Selling options with defined risk generally offers a higher probability of consistent profits.

What’s the safest strategy for new options traders?

Defined-risk strategies like credit spreads are safer because both your potential profit and loss are known in advance. They’re also easier to automate and manage compared to naked options.

Can options trading be automated?

Yes. Platforms like Advanced AutoTrades execute credit spreads and iron condors automatically with built-in risk management, removing emotional decision-making and improving consistency.