Credit spreads are one of the most powerful strategies in options trading—especially if you’re looking for consistent returns without taking outsized risk. I’ve used them for decades, both on the trading floor and in my current auto-trading service, and they continue to be a core part of how I trade SPX weekly options.

In this guide, I’ll break down credit spreads in plain English: how they work, when to use them, how to calculate the numbers, and—most importantly—how to manage the risk. I’ll also walk you through a real SPX example I use regularly in my Weekly Trend service.

What Is a Credit Spread in Options Trading?

A credit spread is an options strategy where you sell one option and buy another with the same expiration date but a different strike price. Because the option you sell is worth more than the one you buy, you receive a net credit when entering the trade.

- Bull Put Spread – a bullish strategy using puts

- Bear Call Spread – a bearish strategy using calls

A credit spread is an options trading strategy where you sell one option and buy another with the same expiration date but a different strike price, receiving a net credit upfront. It’s a defined-risk approach that profits from time decay and stable or mildly directional market movement.

How Does a Credit Spread Work?

When you open a credit spread, you’re taking in premium upfront and hoping the price stays on the favorable side of your short strike. If it does, both options expire worthless—and you keep the full credit.

- Defined risk: You know your worst-case scenario upfront.

- Time decay advantage: Theta works in your favor.

- Flexibility: You can be bullish or bearish depending on the setup.

Think of it like running an insurance business. You collect premiums, and if no claim is made (the stock stays above or below your chosen strike), you keep the money.

Credit Spread Strategy: When and How to Use It

Here’s one of my favorite setups. We run a version of this almost every week on SPX in our Weekly Trend strategy:

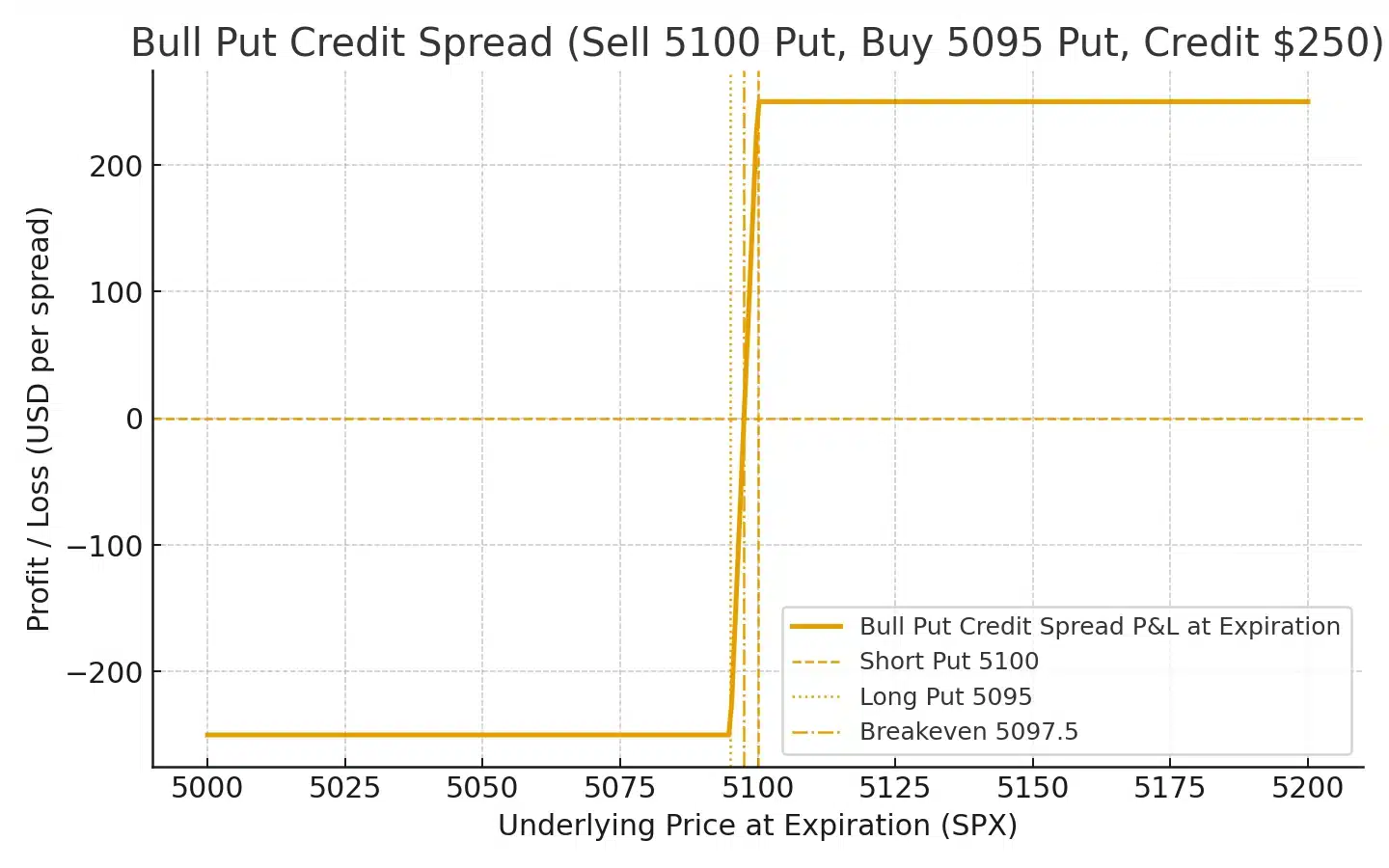

Real Example: SPX Bull Put Spread with 1:1 Risk-to-Reward

- Underlying: SPX (S&P 500 Index)

- Outlook: Slightly bullish or neutral

- Strategy: Bull Put Spread

- Strike Width: $5

- Expiration: 7 DTE

- Trade Setup: Sell 5100 Put, Buy 5095 Put

- Net Credit: $2.50

Trade Stats:

- Max Profit: $2.50 (if SPX stays above 5100)

- Max Loss: $2.50 (if SPX falls below 5095)

- Breakeven Point: 5097.50

- Risk-Reward: 1:1

SPX has an upward drift over time, and when using proper timing (e.g., avoiding earnings weeks and trading after Fed events), this setup has historically yielded a 60% win rate.

We’ve backtested this strategy over 13 years of SPX data. With just 2.5% capital at risk per trade, the strategy can average around 100% annualized return, with a max drawdown of only ~20%. At 5% risk per trade, returns can exceed 200% per year. This powers the Weekly Trend service.

Credit Spread Formula: How to Calculate Profit, Loss, and Breakeven

- Net Credit = Premium received – Premium paid

- Max Profit = Net Credit

- Max Loss = Spread Width – Net Credit

- Breakeven = Short Strike – Net Credit (for puts)

When to Use a Credit Spread

I typically deploy put credit spreads:

- During earnings season, when there’s a bullish bias

- At large events (FOMC, CPI) that suggest upside

- When technicals show a bottom or strong support level

How to Manage Risk and Adjust a Credit Spread Position

Common Risks:

- Assignment risk (especially near expiration)

- Gap risk (overnight moves through strike)

- Margin pressure (when over-allocated)

How I Manage It:

Assignment: Trade on SPX (cash-settled, no assignment). For SPY, attach a $0.02 target order at entry and close all positions 2 hours before expiration.

- Gap risk & margin pressure: Risk only 2.5% or 5% per trade with a 1:1 risk/reward ratio. This limits drawdown and avoids leverage stress.

In Weekly Trend, these rules are built into our automated system.

Credit Spread vs Debit Spread

| Feature | Credit Spread | Debit Spread |

|---|---|---|

| Entry Cost | Receive premium | Pay premium |

| Time Decay | Helps | Hurts |

| Max Profit | Net credit | Spread width – debit |

| Market Bias | Neutral-to-directional | Directional |

| Risk/Reward | 1:1 or better win rate | Higher reward potential |

Common Questions About Credit Spreads

Can I lose more than my initial credit?

Yes, but only up to the defined spread width minus the credit. Losses are capped.

Is a credit spread bullish or bearish?

Bull put spreads are bullish; bear call spreads are bearish.

Should I hold until expiration or close early?

For SPX, you can hold to expiration. For SPY, close at your $0.02 target or 2 hours before expiration. In Weekly Trend, this is handled automatically.

Can beginners trade credit spreads?

Yes. With automation and small sizing, it’s an ideal strategy for learning defined-risk income trading.

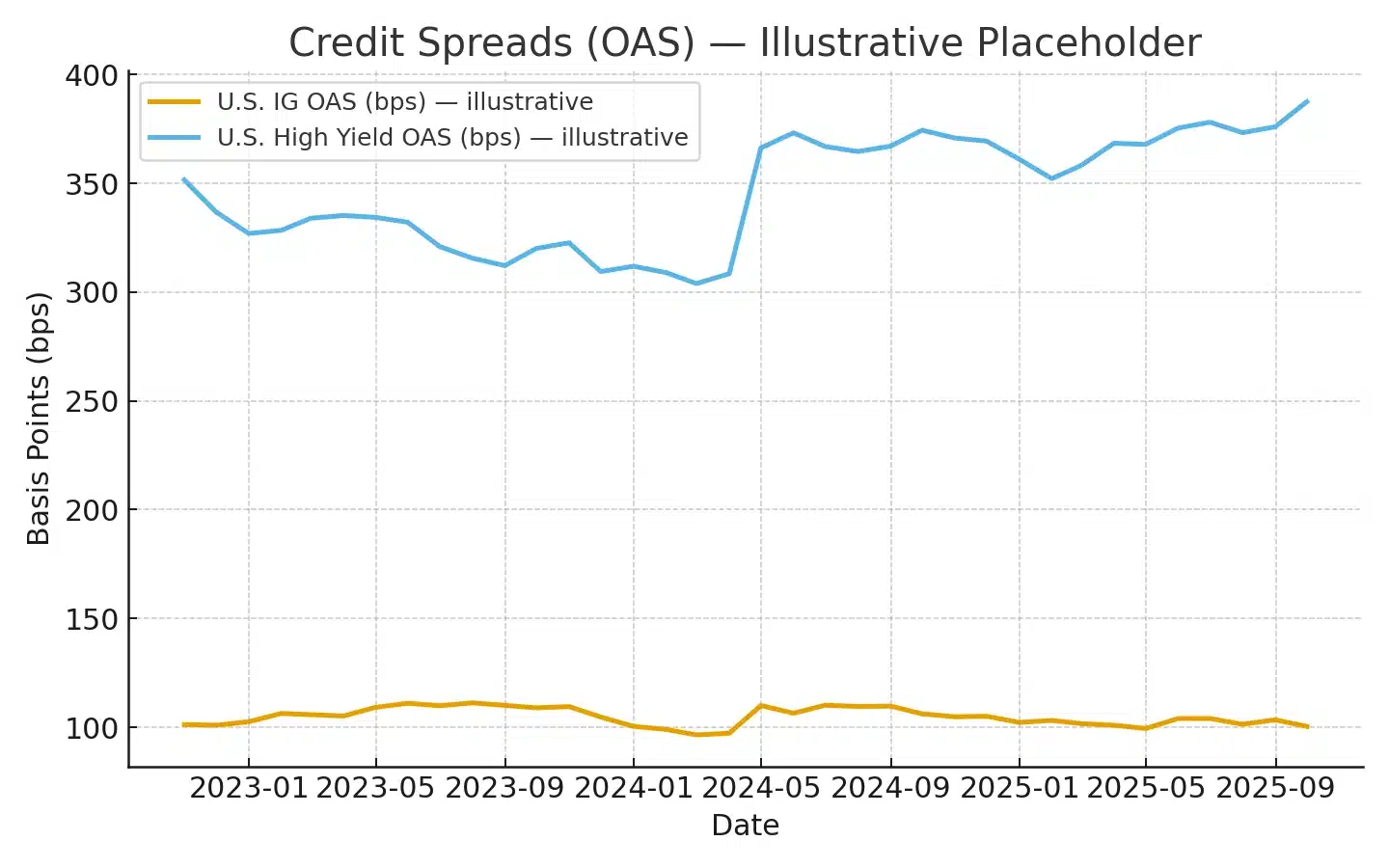

Bond Credit Spreads (Yield Spreads): What They Are & Why They Matter

Outside of options, “credit spread” also refers to the yield difference between a risk-free government bond (e.g., a U.S. Treasury) and a riskier bond of the same maturity (e.g., a corporate bond). This spread is a real-time barometer of default risk and overall market sentiment.

Quick Definition

Bond credit spread (a.k.a. yield spread) = the extra yield investors demand to hold a risky bond instead of a comparable-maturity Treasury.

Formula

Credit Spread = Corporate Bond Yield − Treasury Yield (in %, or basis points)

Example (10-Year Bonds)

| Instrument | Yield |

|---|---|

| U.S. Treasury (10Y) | 4.00% |

| Corporate Bond (10Y) | 6.00% |

| Credit Spread | 2.00% (200 bps) |

Investors are demanding an additional 200 bps to hold the corporate bond over Treasurys to compensate for default and liquidity risk.

How to Read Bond Credit Spreads

- Widening spreads → Rising perceived credit risk, tighter financial conditions, risk-off sentiment.

- Narrowing spreads → Improving credit outlook, easier conditions, risk-on sentiment.

Rule of thumb by rating: Investment-grade spreads (e.g., AAA) are typically smaller than lower-rated (e.g., BBB, high-yield) spreads. During stress events (GFC, pandemic), even high-quality spreads can spike.

What to Track

- Investment-Grade OAS (option-adjusted spread)

- High-Yield OAS

- Sector spreads (e.g., financials vs. industrials)

Why Options Traders Should Care

Credit cycles influence volatility, liquidity, and directional risk. Wider bond spreads often coincide with elevated equity volatility—an environment where defined-risk credit spreads in options (bull put / bear call) can be sized conservatively while targeting attractive premiums.

Next up: Bull Put Spreads · Iron Condors · Automated Credit Spread Signals

Bond Credit Spread: Quick FAQ

Is a bigger credit spread always bad?

No. Bigger spreads indicate higher perceived risk, but they can also reflect normal risk-off periods. Persistent, fast widening—especially in high-yield—usually signals stress.

What’s a “normal” spread?

It varies by rating and cycle. Investment-grade often sits near low hundreds of basis points, while high-yield is structurally wider. During crises, both can spike materially.

Do I use bond spreads to time options trades?

Use them as a context gauge. Widening regimes imply higher volatility and fatter options premiums; narrow regimes suggest calmer conditions and smaller credits.

Best Tools to Trade Credit Spreads

- Platforms: Thinkorswim, Tastytrade, Interactive Brokers

- Tools: OptionStrat, POP calculators, trade probability models

- Automation: Advanced AutoTrades integrates with IB and Tradier to auto-execute Weekly Trend signals

Conclusion

Credit spreads offer what most strategies can’t: a balance of risk, reward, and statistical edge. Whether you want weekly cash flow or structured compounding, credit spreads provide a professional framework.

Ready to automate high-probability SPX trades with a 60% win rate and only ~20% historical drawdown?

Explore our Weekly Trend service—built for long-term growth with institutional logic.

Prefer slower-paced setups? Check out our Monthly Trend strategy.

Credit Spread — Frequently Asked Questions

What is a credit spread in options?

A credit spread is a defined-risk options strategy where you sell one option and buy another with the same expiration but a different strike, collecting a net credit at entry. You profit if price stays on the favorable side of your short strike and time decay works in your favor.

How do I calculate max profit, max loss, and breakeven?

Max Profit = Net Credit

Max Loss = Strike Width − Net Credit

Breakeven (bull put) = Short Put Strike − Net Credit

Breakeven (bear call) = Short Call Strike + Net Credit

Is a credit spread bullish or bearish?

Bull put spreads are bullish to neutral. Bear call spreads are bearish to neutral.

Can I be assigned on a credit spread strategy?

Yes. American-style options can be assigned at any time. Using cash-settled index options (e.g., SPX) and closing before expiration reduces assignment events.

Should I hold a credit spread to expiration?

Many traders close early after capturing most of the credit or before major events to limit gap/assignment risk. Holding to expiry maximizes potential credit but increases tail risk near your strikes.

How are credit spreads taxed?

Tax treatment depends on jurisdiction and product (e.g., U.S. index options may get Section 1256 treatment). Consult a qualified tax professional.

What is a bond credit spread (yield spread)?

In fixed income, it’s the yield difference between a risky bond (e.g., corporate) and a government bond of the same maturity. It compensates investors for default and liquidity risk.

What does it mean when bond credit spreads widen or narrow?

Widening = higher perceived credit risk / risk-off conditions. Narrowing = improving credit outlook / risk-on conditions.

What’s a “normal” bond credit spread?

It varies by rating and cycle. Investment-grade spreads are typically far smaller than high-yield spreads; both can spike during recessions or market stress.

Do bond credit spreads affect options strategies?

Yes. Credit conditions influence volatility and liquidity. Wider bond spreads often coincide with higher equity volatility and richer option premiums—useful context for sizing and selecting credit spreads.