Why Automated Options Trading Matters in 2026

Ever missed a trade because you were stuck at work?

That was the story I kept hearing from retail traders for years. It’s frustrating when you spot the setup, do the research, and then miss the execution because life gets in the way.

That’s exactly why I built Advanced AutoTrades to give everyday investors access to the same kind of automation and precision that institutions have relied on for decades.

Automated options trading is what happens when you stop babysitting every chart and let rules and software do the heavy lifting. If you’ve ever missed a perfect SPX or SPY setup because you were in a meeting, commuting, or just away from your screen, this guide is for you.

In the next few minutes, you’ll see exactly how automated options trading works in practice: which strategies (credit spreads, bull put spreads, iron condors) are realistic to automate, what kind of returns and drawdowns you should expect, and which brokers actually support bots.

We’ll also look at where automation fails, from 0DTE scalping bots to over-optimised systems, so you know what to avoid.

Whether you’re new to options or ready to scale an existing strategy, this is your practical roadmap to building a safer, rules-based automated options trading setup in 2025.

🎧 Listen: Automated Options Trading — The 2026 Ultimate Guide

In this episode, we discuss how retail traders can use automation, AI, and defined-risk spreads

to trade like institutions. Stream directly below or find it on Spotify and Apple Podcasts.

From Institutional Trading to Retail Automation

I started my career trading options at an institutional level, learning from industry veterans in an environment where hedge‑fund‑style strategies, robust automation, and tight risk controls are non‑negotiable.

But here’s the problem: that level of sophistication wasn’t available to the average trader for years.

In recent years, that changed. With:

- Broker APIs are opening up,

- More retail traders are interested in options trading, and

- Automation technology is becoming more accessible,

I saw an opportunity to:

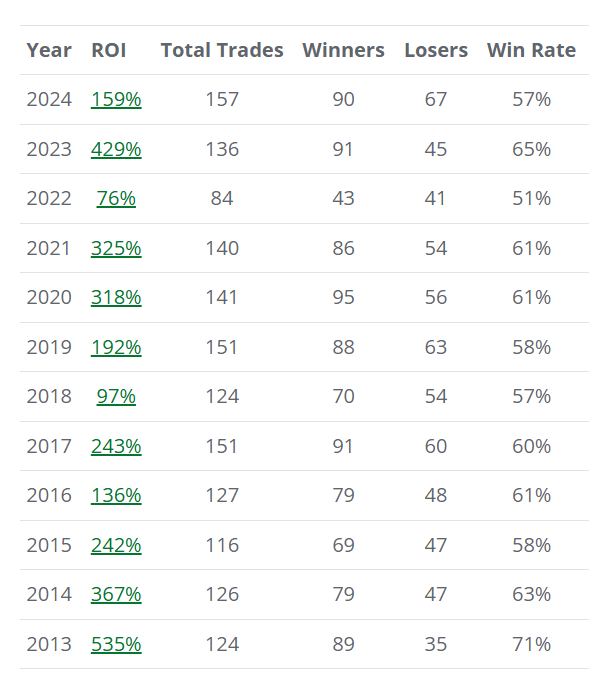

- Combine a proven automation trading system (running since 2009)

- With time‑tested institutional strategies (used since 1983, democratized in the 2000s)

- And optimize them for retail traders who want consistency without complexity

That’s how our automated options trading services came to life — and why we’re helping 500+ traders today.

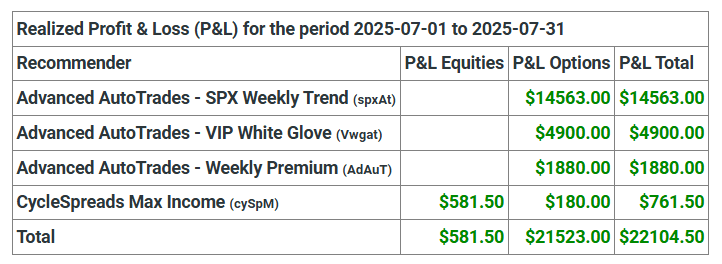

Based on live‑tracked performance on our website, our subscribers typically achieve 50–200% annualized returns, depending on their risk appetite and allocation.

What automated options trading means (and how it works)

In simple terms, automated options trading uses software to execute predefined options strategies like credit spreads, bull put spreads, or iron condors, without manual clicks.

Instead of watching charts all day, you set your rules, connect to your broker, and let automation handle the execution consistently and without emotional bias.

Automated options trading is the use of software or trading bots to execute options strategies automatically according to predefined rules. It removes manual execution and emotional bias, allowing traders to achieve consistency and precision similar to institutional systems.

Why We’ve Reached the Tipping Point

The landscape has shifted.

Since the 2008 crisis and COVID, retail investors have realized that institutions do not act in their best interest.

At the same time, advancing technology is disrupting the financial industry and lowering barriers to entry, making hedge‑fund‑level automation accessible to anyone willing to use the right tools:

- AI‑driven filters are improving signal generation and risk scoring

- Broker APIs from platforms like Interactive Brokers and Tradier, enabling low‑latency execution

- Automation platforms simplifying compliance and execution for retail traders

For retail traders, this means you can execute trades and pursue returns like professionals, using risk‑defined strategies and automation that enforces discipline, without spending years in training or watching markets 24/7.

Who This Guide Is For

This guide will show you how to use institutional‑grade automation to trade smarter, safer, and more profitably in 2025.

- Beginners: Want an easy, structured method to start trading options and pursue consistent returns.

- Risk‑Averse Planners: Doctors, executives, and professionals seeking steady, defined‑risk income strategies.

- Tech‑Savvy Traders: Ready to leverage automation technology for a competitive edge without building systems from scratch.

Want to trade like the pros without the hassle?

Our Monthly Trend service delivers fully automated SPX bull put spreads with institutional‑grade execution, so you can focus on your life while your strategies run. See how it works →

How Automated Options Trading Works (Step-by-Step)

Automated options trading sounds complex, but when you break it down, it’s a straightforward, repeatable process. Here’s how it works in practice — and how we’ve refined it over years of trading and automation experience.

Step 1: Select a Strategy

Before any bot is switched on, you need a clear trading plan.

- Start with your goals: Are you aiming for steady income with low drawdowns (like our Monthly Trend strategy) or higher returns with more frequent trades (like our Weekly Trend or Weekly Premium strategy)?

- Balance risk and reward: Aiming for a 50% annual return? Expect about a 10% drawdown. Looking for 100%+? Be prepared to weather 20–30% drawdowns.

- We use data, not guesswork: We select strategies based on years of backtesting and live trading results, not gut feelings.

Pro Tip: Avoid “curve-fitted” strategies that only look good on paper. Simpler, well-tested strategies tend to perform better across different market conditions.

Read more: Pros & Cons of Automated Trading Bots →

Step 2: Choose a Broker

Automation doesn’t work in isolation. It needs a brokerage account that supports automated execution.

We currently support:

- Interactive Brokers — Best for accounts above $100K and SPX trading.

- Tradier — A cost-effective choice for smaller accounts (below $25K) and SPY trading.

- Global AutoTrading — Adds automation capabilities to an Interactive Brokers or Tradier account (U.S. clients only). Learn how to link Global AutoTrading →

- AutoShares — Ideal for international clients and beginners with a simple 10-minute setup. Automation execution is already included. See our AutoShares beginner guide →

Learn more about choosing the right broker in our section: Costs & Fees: What You Need to Know.

We’re also working on broader integrations via SignalStack. If you want to automate through another broker, contact our support team, and we can help you connect.

Step 3: Execute via Bots

Once your broker and automation are set up, the heavy lifting begins:

- Our bots execute trades in your account in seconds, with no manual clicks, and no emotional second-guessing.

- Orders are sent as limit orders, not market orders. This means tight fills without slippage.

- Liquidity matters: We only automate strategies on highly liquid instruments (like SPX and SPY), ensuring smooth entries and exits for all clients.

Step 4: Monitor & Adjust

- Automation isn’t “set it and forget it.”

- We continuously monitor trades and performance, adjusting when market conditions demand it.

- You get complete transparency about every trade setup — no black-box systems, no surprises.

This is the same proven process we’ve used since 2009 to bring institutional-grade trading to retail investors.

Bottom line:

Automated options trading combines data-driven strategies, brokerage integration, and precise execution to help you trade like a pro, without being glued to your screen.

Key takeaway: How automated options trading works

- You choose a rules-based options strategy that fits your risk profile.

- You connect a compatible broker so trades can be placed automatically.

- The system sends limit orders, sizes positions, and manages exits for you.

The benefits of automated options trading for retail traders

If you’ve ever missed a perfect trade setup because you were at work, busy with family, or simply away from the screen, you’re not alone.

Here’s why automated options trading can change the way you approach the markets:

1. Trade Without Emotion and Stay Consistent

Most retail traders lose not because their strategy fails but because emotions take over. Fear, greed, and hesitation kill consistency.

Automated trading removes that emotional rollercoaster. Trades are placed exactly as planned, with no second-guessing, no chasing.

“I finally stopped overtrading when I automated my spreads. It executes even when I can’t.” — Reddit user

2. Proven Technology Since 2009

This isn’t a shiny new idea. Our automation technology has been running since 2009, refined through bull markets, bear markets, and everything in between.

You get the stability of an institutional-grade execution system built to survive market volatility, not a beta product or a risky experiment.

3. Access Institutional-Grade Strategies Without Years of Training

Learning to trade like a pro can take years. With automation, you don’t have to start from scratch.

You can access advanced options strategies, the same kind used by professional desks, without sitting through endless courses or writing complex algorithms.

“It feels like I’m trading with the tools hedge funds use — without quitting my day job.” — Retail trader testimonial

4. Learn by Doing, Not Just Watching

Watching tutorials won’t teach you how markets really move. Active, automated trading lets you see strategies play out in real time, helping you understand mechanics like credit spreads, expirations, and adjustments far faster than theory alone.

5. Focus on Safer, Defined-Risk Strategies

We don’t gamble with naked options. Those may work, until they don’t.

Our focus is on defined-risk spreads:

- Credit spreads for consistent premium income

- Iron condors for balanced, range-bound plays

- Bull put spreads for lower-volatility growth

These strategies give you known risk at entry, with no surprises, no account-blowing disasters.

6. Automation Works for Smaller Accounts Too

Think automation is just for six-figure portfolios? Think again.

Our services execute SPX and SPY spreads with precision, designed for accounts starting from $1,000. This makes professional-style trading accessible, even if you’re starting small.

Read Article: How to Trade Automatically (Even If You’re a Beginner)

See how Weekly Premium delivers fully automated SPX Iron Condors every week → Learn More

Key takeaway: Why automated options trading helps retail traders

- Removes emotional decisions like chasing trades or panic selling.

- Keeps position sizing and risk consistent from trade to trade.

- Lets you follow a professional strategy without watching markets all day.

Automated Options Trading Strategies That Work in 2026

When it comes to automated options trading, not all strategies are created equal. Some lend themselves perfectly to automation, while others are either too volatile or too dependent on ultra-fast execution to be practical for retail traders. Let’s break down what works, why it works, and what to avoid.

1. Credit Spreads (3–7 DTE)

Best for: Active traders who want up to 5 trades per week with low risk per trade.

Our Weekly Trend service automates credit spreads with 3–7 days to expiration (DTE). These trades are structured for high liquidity and executed with limit orders in the first 15 minutes of the trading session. This ensures every trader gets the same entry without slippage, regardless of account size.

Quick Stats:

- Trades per week: Up to 5

- Risk-to-reward: 1:1

- Win rate: ~60% historically

- Annual returns: Up to 200% (with active compounding)

- Risk per trade: 1–5%

These are short-term, high-frequency setups ideal for retail traders who want consistent engagement without being glued to the screen.

2. Bull Put Spreads (~30 DTE)

Best for: Risk-averse traders or larger accounts looking for stable monthly growth.

Our Monthly Trend service focuses on bull put spreads with around 30 days to expiration (DTE). These trades are less volatile and offer deep liquidity, making them suitable for accounts up to $5 million.

Quick Stats:

- Trades per month: 1

- Risk-to-reward: 1:2

- Win rate: ~55% historically

- Annual returns: 50–100%

- Risk per trade: 1–10%

This is an excellent set-and-forget strategy for traders who prefer a lower-stress, higher-probability approach with meaningful returns.

3. Iron Condors (Weekly)

Best for: Traders who want diversified income strategies with a high win rate.

Our Weekly Premium service automates iron condors — one high-probability trade per week with limited adjustments (at most one if needed). This strategy sits at the edge of what’s possible for retail automation today.

Quick Stats:

- Trades per week: 1

- Win rate: 85%+ historically

- Annual returns: ~80%

- Account size: Best for accounts under $50,000 (to minimize slippage)

Why this matters: Iron condors provide balanced exposure and are a go-to strategy for steady weekly income, but they require careful execution and adjustment rules — exactly where our trading desk and automation can help you.

4. Why 0DTE Options & Scalping Bots Don’t Work for Retail

Reddit users say it best:

“Scalping 0DTE with bots sounds great… until you get filled on the wrong side of the spread three times in a row.”

Zero-day-to-expiration (0DTE) options are brokerage favorites because they drive commissions, but for most retail traders, they’re a disaster waiting to happen:

- Insufficient liquidity for clean automated entries

- Ultra-tight timing — requires HFT-level infrastructure

- Huge slippage that can wipe out the edge instantly

The bottom line: 0DTE options may be trendy, but they’re unsuitable for retail automation or trading.

5. What About Forex & Futures?

Forex:

Short-term forex trading is dominated by high-frequency computers with near-zero commissions. For retail traders, forex trading only makes sense for long-term, fundamentally driven strategies.

Futures:

While you can automate futures, the product is limited as you’re only trading up or down. Funded accounts can seem attractive, but there’s a catch: some providers shut down accounts arbitrarily if you win too often.

Key Takeaway:

Automated trading works best when strategies are:

- Defined-risk (you know your max loss at entry)

- Liquid (no execution headaches)

- Probability-based (no emotional decision-making)

That’s why our Weekly Trend, Monthly Trend, and Weekly Premium services are tailored for real-world retail traders — balancing performance, consistency, and capital protection for the type of trader you are.

Why Options Trading Is Not Dangerous

When it comes to trading, not all markets are created equal. After decades in institutional trading, I can confidently say this: options — when used correctly — provide significant advantages that stocks, futures, forex, and crypto simply can’t match.

Let’s break down why.

1. More Ways to Be Right

With stocks, you’re either right or wrong. If the price goes up, you win; if it goes down, you lose.

Options selling changes the game.

Using defined‑risk strategies like credit spreads and iron condors, we don’t need to predict exactly where the market will go. Instead, we only need to predict where the market is unlikely to go.

That means we trade probabilities, not directions. We’re not gambling on a single outcome, we’re selling options to other traders and positioning ourselves to profit when their predictions are wrong.

This is how institutions trade, by focusing on probabilities rather than making risky directional bets.

2. Built‑In Risk Control

The fear of options usually comes from hearing about traders who blow up accounts with naked positions.

That’s not what we do.

- No naked options.

- No unlimited risk.

- Only defined‑risk strategies with clearly limited gains and losses.

This means you always know the worst‑case scenario before you even enter a position. Our trades carry only a few percent risk per trade.

This is why our risk‑averse clients, from doctors to retirees, trust our strategies.

3. Data‑Driven Strategies on the S&P 500

We don’t trade random tickers. We trade the S&P 500, a market index that has existed since 1957.

Why?

- Decades of data: We’ve studied how this index behaves through bull markets, bear markets, and everything in between.

- Predictable structures: The S&P 500 has a unique, exploitable structure that has remained unchanged for over 60 years.

- Unmatched liquidity: Trading SPX (cash-settled index options) and SPY (the ETF equivalent) gives us deep, highly liquid markets. That means tight spreads, faster fills, and less slippage — critical for automated strategies.

Read more about why the S&P 500 goes up over time here.

4. No Need to Spend Years Learning Complex Jargon

Calls. Puts. Iron condors. Credit spreads.

Most people see that and walk away.

That’s where automation changes everything. You don’t need to spend years studying options theory to profit.

We’ve built systems that:

- Handle the complex execution for you.

- Place trades automatically based on institutional‑grade rules.

- Remove emotional decision‑making from the equation.

Bottom Line:

Options selling on the S&P 500 with defined‑risk strategies gives you a superior balance of opportunity, consistency, and control.

We’re not predicting the future — we’re leveraging probabilities backed by decades of market data. And with automation, you can access these advantages without the steep learning curve that keeps most people out.

Is Automated Options Trading Profitable? (The Data Says Yes—But Here’s the Catch)

The short answer: Yes, automated options trading can be highly profitable – but only if you understand the risks, strategy type, and your personal tolerance for drawdowns.

Let’s break it down.

Why Automation Often Outperforms Manual Trading

As someone who spent decades on institutional trading desks, I can tell you this with confidence:

Emotions are the silent killer of profitable trading.

Automated trading removes:

- Fear and greed-based decisions – No panic-selling after a bad headline.

- Execution delays – Trades fire within seconds at predefined prices.

- Inconsistent sizing – Bots stick to allocation rules, and there are no “revenge trades.”

In short, automation gives you disciplined, repeatable execution, something even seasoned traders struggle to maintain manually.

Returns vs. Drawdowns: The Trade-Off You Can’t Ignore

Here’s a truth most “gurus” won’t tell you:

Higher returns always come with higher drawdowns.

- If you want 200%+ annual returns, you must be comfortable with 40% drawdowns.

- If you target 100% returns, expect 20% drawdowns.

- If you aim for 50% returns, your drawdowns can stay closer to 10%.

It’s about matching your risk appetite to your growth expectations.

Ask Yourself These Questions Before You Start

- What’s my max pain?

Can I stomach a 20%–40% drawdown without pulling the plug? - What’s my goal?

Do I want a steady income (Monthly Trend or Weekly Premium) or higher growth potential (Weekly Trend)? - Am I patient enough to let the system work?

Automation isn’t magic — you need to give it time.

How Account Size, Commissions, and Frequency Impact Results

- Account size: Larger accounts benefit more from scaling and tighter spreads (especially on SPX).

- Commissions: Overtrading kills profits. That’s why we focus on low-frequency, high-probability trades — fewer trades, better fills.

- Execution speed: Working with brokers like Interactive Brokers or Tradier ensures clean fills with minimal to no slippage.

What Realistic Returns Look Like

| Target Return | Expected Drawdown | Who This Fits |

|---|---|---|

| 50% annually | ~10% | Conservative traders |

| 100% annually | ~20% | Moderate risk takers |

| 200% annually | ~40% | Aggressive traders |

These numbers are illustrative based on typical strategy behavior and industry data. Your actual results will depend on account size and risk allocation.

Pro Tip: The most successful traders aren’t the ones chasing the highest returns — they’re the ones who stay in the game long enough to let compounding work for them.

Curious what realistic returns look like?

You can find detailed trade logs on our Weekly Trend service page.

Platforms & Tools for Automated Options Trading

Choosing the right automated trading platform is the make-or-break decision for anyone automating options trading. Over the years, I’ve tested everything from DIY Python bots to turnkey broker integrations. The truth? There’s no one-size-fits-all solution. Your account size, experience level, and strategy preferences all shape which platform will serve you best.

Below, I’ll break down the top platforms I recommend to my clients — and explain who each one is best suited for.

Interactive Brokers + Global AutoTrading

Best for: Accounts $100K+ trading SPX spreads and complex strategies.

- Low commissions for bigger accounts and no assignment fees.

- Institutional-level execution speed (crucial for avoiding slippage).

- Global AutoTrading integrates seamlessly, turning your strategies or signal services into hands-free trades.

- Highly regulated, with strict compliance standards under major U.S. and international financial authorities — an added layer of security for larger accounts.

Pros:

- Extremely fast execution on high-liquidity instruments (like SPX).

- Robust API access for advanced automation.

- Internationally recognized broker with top-tier compliance standards.

Cons:

- Not beginner-friendly — the platform has a steep learning curve.

- Customer service can be slow and inconsistent.

Tradier + Global AutoTrading

Best for: Accounts under $50K, especially SPY trading and basic automated strategies.

- Zero commission for SPY trading with a monthly subscription (can save frequent traders big money).

- Fast integration with Global AutoTrading.

- Simple enough for intermediate traders without the complexity of IBKR.

Pros:

- Cost-effective for high-frequency or smaller-account traders.

- Integrates directly with GAT for fully automated trade execution.

- Responsive customer service and simpler onboarding than Interactive Brokers.

Cons:

- Limited advanced order types compared to Interactive Brokers.

- Higher commissions for SPX strategies than Interactive Brokers.

AutoShares (Best for Beginners)

Best for: Risk-averse beginners using our Monthly Trend service with only one trade per month (SPX bull put spreads).

- Quick setup (often under 10 minutes).

- No technical skills or coding required.

- Great for low-frequency trading accounts where simplicity matters more than advanced tools.

Pros:

- Beginner-friendly interface and onboarding.

- Automation is fully integrated — no need to manage signals or configure external tools.

- Accepts international clients, making it accessible for traders outside the U.S.

Cons:

- Less control over advanced order customization.

- Primarily geared toward low-frequency trading.

No-Code vs. Coding Your Own Bots

You don’t have to be a programmer to automate your trades — but if you are, your options expand.

- No-code platforms (like Option Alpha or drag-and-drop interfaces on GAT) are perfect for those who want pre-built workflows.

- Coding your own (with Python, QuantConnect, or IBKR’s API) gives ultimate control but requires deep technical knowledge — and hours of backtesting to avoid costly mistakes.

Pro insight: Most retail traders overestimate the benefits of coding from scratch. Unless you have institutional-level infrastructure, no-code solutions often provide better value with a fraction of the complexity.

Comparison: IBKR vs. Tradier vs. AutoShares

| Feature | Interactive Brokers | Tradier | AutoShares |

|---|---|---|---|

| Best For | $100K+ SPX strategies | <$100K SPX+SPY strategies | Beginners / Monthly Trend service |

| Commission | $0.10-0.65/contract | $0.10-0.35/index contract + $10–35 monthly subscription; $0.00 for SPY | $0.65/contract + $4.95 auto trade fee |

| Execution Speed | Ultra-fast | Fast | Fast |

| Ease of Use | Complex (steep curve) | Moderate | Very simple |

| Integration | Global AutoTrading, API | Global AutoTrading | Direct auto-execution |

| Customization | Advanced | Intermediate | Limited |

How to Choose the Best Automated Options Trading Platform

- If you’re an absolute beginner: Start with AutoShares for a stress-free and 15-minute setup.

- If you want to make many trades in a small-to-mid account: Tradier offers a commission subscription rate to reduce commission costs.

- If you’re experienced and managing a larger account: Interactive Brokers offers the regulation and execution speed you need for institutional-level trading.

Still unsure? I’ve broken down these platforms even further in our guide to the best automated trading brokers.

Pro tip: Don’t choose a platform based on cost alone. Execution speed and volume, strategy compatibility, and ease of use will make a bigger difference to your bottom line than saving a few cents on commissions.

AI and algorithmic options trading in 2026: what works and what doesn’t

Artificial intelligence (AI) has made its way into nearly every corner of financial markets, and options trading is no exception. But let’s get real for a moment: can AI actually trade options profitably?

The answer: Yes — but only when used as a tool, not a replacement for strategy or human judgment.

Where AI Is Improving Automation

AI isn’t magic, but it does make certain parts of trading faster, smarter, and more efficient.

- Signal Generation: AI can scan thousands of market data points (price movements, implied volatility shifts, sentiment indicators) in seconds, identifying trade setups much faster than a human.

- Risk Management: Machine learning models can analyze historical performance to optimize position sizing and detect unusual volatility spikes, helping us tighten stop-loss levels or exit trades early.

- Pattern Recognition: AI shines at finding subtle correlations between market events and price moves, giving traders an extra layer of insight when refining strategies.

Where AI Falls Short

AI isn’t a crystal ball — and this is where most traders get burned.

- Market Noise: Markets are messy. AI can confuse short-term randomness for meaningful patterns, leading to overfitting and poor real-world performance.

- Overfitting: A common mistake with AI trading bots is training them to perform perfectly on past data. They “look brilliant” in backtests but collapse when markets change.

- No Human Context: AI can’t interpret the bigger picture (geopolitics, unexpected news events, or sudden changes in market psychology).

In short: AI gives us speed and scale — but it doesn’t replace experience.

How We Use AI at AdvancedAutoTrades

This is where we stand apart from other services that sell black-box AI bots. At AdvancedAutoTrades, AI supports our rules-based strategies — it doesn’t drive them.

- We use AI as a supporter, not a decision-maker.

- Our strategies are built on decades of institutional trading experience, dating back to the 1990s options frameworks and refined for modern automation.

- Every trade is rules-based and overseen by humans — AI simply helps execute those rules sharper.

Mini Case Study: AI as a Risk Filter

Here’s a real example from our trading desk:

- In late 2024, AI flagged an unusual options skew on SPX following a Fed announcement.

- Historically, similar conditions led to increased downside risk within three days.

- Our system didn’t automatically reverse the trade. Instead, the AI filter triggered a manual review.

- After confirming the pattern matched our risk criteria, we reduced position sizing by 20% for that week — a move that helped us avoid a drawdown when SPX dipped sharply.

That’s the difference: AI flagged the data. Our rules and oversight made the decision.

Bottom Line: AI Is a Tool, Not a Trader

If you’re considering using AI in options trading, here’s the reality: you get out what you put in. AI is powerful when used to execute or analyze a proven strategy. It fails when you hand it the keys and hope it drives itself.

At AdvancedAutoTrades, we blend human judgment, rule-based systems, and AI support to help retail traders achieve institutional-level execution with transparency and discipline.

Want to see how I use AI in practice? Read my deep dive: ChatGPT Day Trading: How I Use AI to Trade Smarter

Backtesting & Risk Management: Don’t Skip This Step

If there’s one thing I’ve learned in my thirty years of trading professionally and building automated systems, it’s this: a strategy that isn’t appropriately tested will fail.

Backtesting and risk management aren’t the flashy parts of options trading — but they’re where real success is built. Whether you’re a seasoned trader or just starting with automation, this step separates professionals from gamblers.

Why You Must Backtest or Forward Test Every Strategy

Before putting real money on the line, you need proof that your system works — not just in bull markets but also through chop, volatility spikes, and macro shocks.

I recommend using the ThinkorSwim OnDemand feature to manually review past trades. Look at how your entries and exits would have behaved under different conditions — don’t cherry-pick just the wins.

Want to confirm live performance? Forward-test with 1 contract for a few months. This is one of the best ways to validate a published strategy before scaling. If it holds up, then you can increase size with confidence.

Read more: How to Backtest Your Auto Trading Strategy →

Avoiding the Over-Optimization Trap

We see it all the time: traders try to tweak their bots to perfection, until they’ve essentially programmed hindsight. The result? A system that has only worked in the past.

The simpler the strategy, the longer it will survive.

At Advanced AutoTrades, our credit spread and iron condor strategies have held up for over a decade across every market cycle — not because they’re complex, but because they’re robust.

If you’re coding or building your own strategy:

- Avoid filters that rely on rare signals

- Don’t optimize for just one market condition

- Test through bear markets, sideways periods, and volatility spikes

How Much Should You Risk Per Trade?

Risking too much per trade is how accounts blow up. We recommend the following:

| Trade Frequency | Suggested Risk per Trade |

|---|---|

| Once per month (e.g., Monthly Trend) | Up to 10% of the account |

| Daily trades (e.g., Weekly Trend) | 1 – 5% per position |

Remember: automation doesn’t eliminate risk — it just manages it better. The key is knowing how much you will lose on any trade before the position is placed.

Always Use Defined-Risk Strategies

We don’t trade naked options. We never will. Naked trades may work for a while… until they don’t. One unexpected move and the drawdown could wipe out months of gains.

Instead, we stick to defined-risk spreads like:

- Bull Put Spreads (used in Monthly Trend)

- Iron Condors (used in Weekly Premium)

- At-the-money Credit Spreads (used in Weekly Trend)

These strategies tell us our max loss at entry, every time. That’s why they’re the backbone of our auto trading service.

Explore our Risk Management Guide →

DIY Backtesting Checklist

If you’re testing your own automated strategy, use this checklist to keep things realistic:

- Backtest at least 12–24 months of data

- Include bull, bear, and sideways markets

- Test both entry and exit timing

- Check slippage on spreads, not just fills

- Include commissions and fees in your results

- Validate with forward testing using 1 contract

- Review your max drawdown vs. risk appetite

Backtesting isn’t about finding perfection. It’s about finding something that’s repeatable and will keep you in the game when others panic.

Ready to Trade with Confidence?

Our Monthly Trend service is built with risk first. We only risk 5% of capital per month using defined-risk bull put spreads — strategies that have performed well since 2013 through rate hikes, crashes, and bull runs.

→ See how Monthly Trend protects capital and delivers consistent returns →

Is Automated Options Trading Legal & Safe?

Spoiler: Yes — if you’re using the right brokers, following the rules, and not trying to be smart and game the system.

Is Automated Trading Legal in the U.S.?

Yes, automated options trading is 100% legal in the United States — as long as you follow the rules established by regulatory bodies like the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC).

Here’s what matters:

- You’re using registered brokers that allow automated execution.

- You’re not deploying high-frequency trading algorithms without proper oversight.

- Your strategy isn’t designed to manipulate markets or front-run orders (which is illegal).

Want details straight from the source?

Broker Requirements: Not All Platforms Allow Bots

If your broker doesn’t support API access, you can’t legally automate through them. Period.

The good news? Some brokers do encourage it:

- Interactive Brokers – full API access, ideal for SPX and large accounts.

- Tradier – API-enabled and perfect for small-to-medium retail accounts.

- AutoShares – beginner-friendly access via a quick 15-minute setup.

These brokers partner with automation platforms (like Global AutoTrading) that manage the backend so you don’t need to code anything — and they operate within all U.S. regulatory requirements.

Explore our integration guides here:

Is It Safe to Trade Options with a Bot?

Yes — if you’re using defined-risk strategies and proper risk management.

In fact, automation is often safer than manual trading. Why?

- No emotional decisions → Bots follow pre-set rules, not gut feelings.

- Fewer mistakes → No fat-finger entries or forgotten exit orders.

- More consistency → Same entry logic, every time.

At Advanced AutoTrades, all strategies are built using:

- Defined-risk trades (e.g., bull put spreads, iron condors)

- Strict allocation rules (low percent per position, depending on the service)

- Institutional-level execution with complete transparency

If you’re worried about rogue bots or losing control, don’t be. Our systems don’t “think” for themselves. They execute our rule-based strategies with human oversight.

Final Word: Legal? Yes. Safe? Safer Than You Think.

If you use a compliant broker, stay within risk limits, and trade defined-risk spreads, you’re on solid ground.

Automated trading isn’t a loophole or a backdoor — it’s the evolution of smarter retail investing.

Costs & Fees: What You Need to Know

Understanding the full cost structure is critical to long-term success in automated options trading. Many beginners focus solely on commissions, but hidden costs can impact performance just as much as trading strategy.

Let’s discuss what you’ll pay, what to expect, and how we can help you avoid costly mistakes.

Broker Commissions for Options Spreads

Every trade involves two legs: one to sell and one to buy. Depending on your broker, commissions are charged per contract, per leg—which adds up fast if you’re trading frequently.

Here’s how the most popular brokers in our automation ecosystem stack up:

Fee Comparison Table (Per Trade Cycle)

| Platform | Base Commission Structure | Monthly Platform Fee | Automation Fee (Global AutoTrading) | Best For |

|---|---|---|---|---|

| Interactive Brokers | $0.15-0.65/contract, no assignment fee | $0 | $70/mo for one newsletter, $35/mo per additional | Advanced traders with $100K+ SPX accounts |

| Tradier | $0.00-$0.35/contract, $5-9 assignment fee | $10-35/mo (subscription fee) | $70/mo for one newsletter, $35/mo per additional | Cost-conscious traders using SPY spreads |

| AutoShares | $0.65/contract | $0 | $4.95 per autotrade transaction | Beginners needing turnkey automation |

| Global AutoTrading | N/A | N/A | $70/mo for one newsletter, $35/mo per additional | Works with IBKR and Tradier |

TIP: Tradier is often the most cost-efficient if trading small and SPY. If you’re scaling up with SPX spreads, IBKR provides the best execution and margin efficiency.

Don’t Overlook Hidden Costs

Beyond the listed fees, there are three hidden cost categories every options trader should understand:

- Slippage

The difference between the expected price and the executed price. Poorly timed entries or lack of liquidity (especially with 0DTE or after hours) can eat into returns.

How we help: Our systems use limit orders on highly traded instruments SPY and SPX to minimize slippage across all accounts. - Margin Requirements

Credit spreads and bull put spreads, as seen in our Weekly Trend and Monthly Trend services, can be traded in a cash account. However, iron condors, like those in our Weekly Premium service, require a margin account. - Assignment Risk

If you’re trading short options near expiration, you risk being assigned—especially on SPY, which settles in stock.

How we help: SPX is cash-settled (no shares change hands).

For SPY, we close trades before assignment becomes possible, removing unexpected exposure.

You never wake up to an unwanted stock position.

Our Promise: Full Transparency

We’ve automated over a decade of defined-risk strategies, and part of what makes our service unique is realistic cost forecasting. Every trade you follow with us is:

- Designed to limit slippage and avoid assignment

- Compatible with multiple brokers at different budget levels

Cost Efficiency Isn’t Just About Cheap Commissions

The goal isn’t to find the cheapest broker—it’s to find the right fit for your account size, goals, and risk profile. Saving a few cents per contract doesn’t matter if you incur slippage when entering trades or if your automation fails due to poor integration.

What to Know About Costs

- Tradier is best for small accounts & SPY spreads

- IBKR is ideal for large SPX traders focused on performance

- AutoShares is beginner-friendly with a quick 15-minute setup

- Global AutoTrading enables automation across IBKR and Tradier

Common Mistakes & How to Avoid Them

Even with the best automation tools, some traders still fall into avoidable traps: from overconfident traders blowing up accounts after a hot streak, to others blindly following untested strategies.

If you’re serious about building a long-term edge with automation, you need to know what not to do — and how to sidestep these mistakes before they cost you.

1. Overconfidence & Over-Allocating After a Few Wins

The Mistake:

Traders hit a few wins, then double their risk per trade. Before long, one bad week wipes out a month’s worth of gains — or worse.

What to Do Instead:

- Set a fixed allocation per trade (e.g., 1%–5% of capital).

- Expect losing streaks. They’re baked into the system.

- Use drawdown-based position sizing, not emotion-based.

Pro Tip: Our automated services are built around fixed, defined-risk sizing. You’ll never be exposed to “all-in” risk scenarios.

2. Automating Naked Options (Don’t Even Think About It)

The Mistake:

Running naked puts or calls on automation? That’s asking for disaster. It only takes one black swan event to erase your account — and then some.

Why We Avoid It:

- Unlimited risk is unacceptable in automation.

- No human override in real time = no way to defend bad trades.

- Margin calls can trigger forced liquidations — without warning.

What to Use Instead:

- Stick with defined-risk spreads: credit spreads, bull put spreads, and iron condors.

- These limit max losses and are far better suited for automation.

Read more: Common Mistakes in Automated Options Trading →

3. Relying on Untested Strategies

The Mistake:

Follow intransparent strategies from websites or forums and plug them into a bot without historical testing.

Why It Fails:

- You don’t know the win rate, max drawdown, or profit curve.

- One bad market cycle can break an unvetted system.

How to Avoid It:

- Always backtest first.

- Forward test with one contract for 30–60 days.

- Confirm results match what’s advertised — especially if you’re using paid signal services.

Use our guide: How to Backtest Auto Trading Strategies →

4. Failing to Monitor Bot Performance

The Mistake:

Setting up automation and walking away without tracking results or reviewing trades.

Why It’s Risky:

- You may miss early warning signs (e.g., slippage, missed entries).

- Bots are only as good as the market conditions they were designed for.

Smart Monitoring Tips:

- Review each trade weekly.

- Keep a performance journal or dashboard.

- Adjust if volatility shifts or win rate dips below historical averages.

5. Ignoring Risk-to-Reward Psychology

The Mistake:

Focusing only on win rate or returns, while ignoring risk-to-reward ratios and drawdown comfort.

What I Recommend:

Ask yourself:

- Am I comfortable with a 10% drawdown to earn a 50% annual return?

- Would I stick with the system during 3–4 losing trades in a row?

Answering honestly before you automate will help you stay calm during inevitable downturns — instead of pulling the plug too early and giving your money away.

Real Mistakes from Real Traders (Reddit Insights)

Here are the top real-world mistakes we see retail traders confess online:

- “I thought the bot would print money. I didn’t realize I still needed to monitor it.”

- “I automated a naked put strategy and woke up to a -75% loss.”

- “I followed a signal service without testing it myself. It looked good in screenshots, but didn’t match my fill prices.”

- “I increased size after a few wins and gave it all back in one trade.”

- “I tried scalping 0DTE with a bot… let’s just say I’m not doing that again.”

Takeaway

Automated options trading works when done right — but it still requires discipline. Stick to defined-risk strategies. Size trades based on risk, not emotions. Test before you trust. And above all, remember: you’re still the pilot, even if the bot is flying the plane.

Learn more in our deep dive: Common Mistakes in Automated Options Trading →

Traders Ask, We Answer (Community Q&A)

We’ve been asked just about every question under the sun about automated options trading. Here are some of the most common ones — answered straight, no fluff.

1. Can options trading be automated?

Yes, options trading can be fully automated using software that sends predefined strategies (like credit spreads, iron condors, or bull put spreads) directly to your broker. Automation handles entries, exits, sizing, and timing without manual clicks. The key requirement is using a broker that supports automation (e.g., Interactive Brokers, Tradier, AutoShares) and a rules-based strategy suited for retail automation.

2. Is automated trading a good idea?

Automated trading is a good idea for traders who want consistency, defined risk, and freedom from emotional decision-making. Automation excels at executing repeatable strategies, sticking to allocation rules, and avoiding human errors. It’s not a magic money machine — you still need a proven strategy and realistic expectations — but for many retail traders, automation improves discipline and long-term performance.

3. Is there a bot for options trading?

Yes. There are several options-trading bots for all skill levels:

Beginner-friendly bots: Option Alpha, AutoShares, Global AutoTrading integrations

Advanced API bots: Interactive Brokers, Tradier, QuantConnect

Signal-driven bots: Services that automate trades from newsletters like Advanced AutoTrades

Bots can automate spreads, iron condors, and defined-risk setups — but avoid bots that attempt scalping or 0DTE high-frequency trading, as retail accounts lack the infrastructure to support them safely.

4. Can you automate options trading with ThinkorSwim?

Yes, but with limitations. ThinkorSwim is excellent for backtesting and strategy testing, but it doesn’t support full hands-off execution without using an API or third-party tools.

For simple, plug-and-play automation, brokers like Interactive Brokers or Tradier paired with Global AutoTrading work far better.

5. What’s the cheapest platform for options trading bots?

Tradier is one of the most affordable platforms for automated options trading, especially for small accounts, with low commissions and fast execution. If you want a beginner-friendly setup, AutoShares offers a quick 10-minute onboarding for fully automated trading, with no coding or complex configurations required.

6. Is automated trading profitable for beginners?

It can be, if done right. Beginners typically succeed with defined-risk strategies like credit spreads or bull put spreads. Start with small positions, monitor your results closely, and grow your account gradually. Automated services like Weekly Trend and Monthly Trend are designed to make this process easier.

7. Can AI replace a human trader?

Not yet. AI can scan markets, generate signals, and calculate risk, but it only works with the data and rules it’s given. Human oversight is still crucial for adapting to unexpected events, changing market conditions, and avoiding overfitting — things AI alone cannot handle.

8. Which broker allows bots for options trading?

Interactive Brokers and Tradier are the most popular choices for automated options trading because they provide easy API access. AutoShares is another strong option if you prefer a ready-made, 10-minute setup for automation without coding or technical requirements.

9. Are 0DTE options good for automated trading?

Not for most retail traders. Zero-day-to-expiration options are highly volatile, move too fast, and require institutional-level speed to manage effectively. They also expose traders to heavy slippage. Safer automated strategies include credit spreads or iron condors with 3–30 days to expiration.

10. What’s the biggest mistake people make with automated options trading?

Overconfidence and over-allocating after early wins. Always size positions for the worst-case scenario, not the best. Automated trading still requires monitoring, understanding drawdowns, and sticking to your chosen strategy. Over-leveraging and skipping risk management are the quickest ways to get burned.

11. Can I make a living from automated options trading?

It’s possible, but it takes time and discipline. Most traders start by using automation to supplement their income rather than replace it. Build your account gradually, reinvest profits, and view automation as a scaling tool, not a shortcut to bypass learning the fundamentals.

12. How much capital do I need to start automated options trading?

You can start small. With brokers like Tradier or AutoShares, accounts as low as $5,000–$10,000 can access defined-risk automated strategies. For more advanced SPX trading through Interactive Brokers, having at least $50,000–$100,000 is recommended for flexibility and smoother execution.

13. Can you automate trading on Robinhood or Webull?

No, not effectively. Robinhood and Webull do not support API access for automated options trading. If you want full automation, you’ll need brokers like Interactive Brokers, Tradier, or AutoShares that work with third-party platforms such as Global AutoTrading.

14. What are the best strategies to automate?

Defined-risk strategies work best. Credit spreads, bull put spreads, and iron condors are ideal for automation because they have clear entry/exit rules and manageable risk. High-frequency strategies or naked options are too risky for most retail traders using automation.

How to Start: Beginner-Friendly Setup

Getting started with automated options trading can feel overwhelming — especially if you’re new to broker integrations, credit spreads, or trading bots. The good news? You don’t need to code. You don’t need to be glued to your screen. And you don’t need $100,000 to begin.

As someone who’s built automated systems for institutional desks and adapted them for retail traders, I’ve seen what works — and what trips beginners up. Let’s break down how to get started, based on your account size, risk profile, and comfort level.

Choose the Right Service for Your Account Size

Not every strategy fits every trader. Here’s how to pick the right signal service based on your capital and goals:

Monthly Trend

- Best for: Beginners, retirement accounts, and conservative investors

- Strategy: Monthly SPX bull put spreads with ~30 days to expiration

- Risk level: Low

- Account size: Ideal for accounts from $2,500 to $5,000,000

- Why it works: These defined-risk trades are slower-moving, low-maintenance, and great for learning while earning.

Weekly Trend

- Best for: Hands-on traders with some experience

- Strategy: Daily SPY or SPX credit spreads with 3–7DTE

- Risk level: Low to Medium

- Account size: Works well for accounts $1,000 and up

- Why it works: You get frequent trades, tighter timeframes, and minimal slippage using limit orders placed early in the day.

Weekly Premium

- Best for: Manual traders and traders seeking weekly income with managed risk

- Strategy: Weekly SPX Iron Condors, 1 position per week

- Risk level: Medium to High

- Account size: Recommended for accounts $1,000 to $50,000

- Why it works: This is our most aggressive strategy. One trade per week, max one adjustment — optimized for simplicity with edge.

Step-by-Step Onboarding

Whether you’re starting with $1K or $250K, the onboarding process is fast and beginner-friendly. Here’s how to connect your broker and automate your first trade.

For Accounts Above $100,000 (SPX Traders):

- Use: Interactive Brokers + Global AutoTrading

- Offers cost-effective access to SPX options, with no SPX assignment fee.

- Reliable execution and deep liquidity

- Connects directly to our automation platform

- How to link IBKR → Setup guide here

For Smaller Accounts (SPY Traders):

- Use: Tradier + Global AutoTrading

- Cost-effective, but SPX assignment fee.

- Ideal for SPY spreads

- Easy to fund and manage

- How to connect Tradier → Follow this guide

For Complete Beginners:

- Use: AutoShares + Monthly Trend

- Best for low-frequency traders

- One platform quick onboarding (no need to link platform)

- Simple setup process. We walk you through it

- Start here → AutoShares Setup Guide

Quick-Start Checklist for Beginners

Here’s your no-nonsense setup roadmap. You’ll go from zero to your first automated trade in under 30 minutes.

| Step | Action | Link |

|---|---|---|

| 1 | Open a broker account (AutoShares, Tradier, or IBKR) | Get started |

| 2 | Connect IBKR or Tradier to Global AutoTrading | Link here |

| 3 | Subscribe to your preferred signal service (Monthly, Weekly Trend, or Premium) | — |

| 4 | Choose your risk level and allocation | 1%–5% per trade recommended |

| 5 | Receive your first trade — auto-executed, monitored, and managed | — |

No Coding. No Guesswork. Just Execution.

Our system is built for people who want professional-grade execution without the complexity of institutional systems. We’ve taken everything that worked in hedge fund automation and wrapped it into a solution beginners can launch in under an hour.

Start Your First Trade Today

Automated Options Trading in 2026 & Beyond

We’re living through a seismic shift in how options trading is executed — and it’s only just beginning. As someone who’s traded through both pre- and post-automation eras,

I’ve never seen more retail traders empowered by technology than I do right now. But the next chapter? It’s even more disruptive and potentially more rewarding, if you know where to look.

Hybrid AI + Rules-Based Trading Is Here to Stay

We’ve seen the convergence of AI-powered tools with structured, rules-based systems, which will change the way both retail and professional traders automate.

What’s working best isn’t fully autonomous “black-box” AI bots, but human-designed systems enhanced by AI filters.

For example:

- AI-assisted entry timing for credit spreads

- Historical data scans to reduce false positives in signal generation

- Risk scoring that adjusts allocation dynamically based on market conditions

At Advanced AutoTrades, we’ve tested everything from pure neural nets to rule-only frameworks. The best performance has come from what we call “supervised automation” — where clear, time-tested strategies (like bull put spreads or iron condors) are paired with AI-enhanced filters to remove noise, not replace traders.

The bottom line: AI is a tool, not a trader. Traders who use it wisely will outperform those who blindly follow AI signals without context.

More Broker Integrations Are Leveling the Playing Field

Until recently, options automation was mostly limited to U.S. residents through Global AutoTrading, AutoShares, and a few niche API-accessible platforms. But that’s changing rapidly:

- Signal Stack, TradersPost, and Capitalise now connect to many U.S. and international brokerages

- AutoShares continues to simplify the onboarding process for newer investors and international clients

- Several EU and Asia-based brokers are entering the automation space via Open APIs

We expect to see fully automated strategies available to non-U.S. clients within the next 6–12 months. That would be a game-changer for anyone outside the U.S. who has felt excluded from advanced options execution tools.

The Crypto Crossover: Caution Required

Crypto platforms are also rushing to catch up. Exchanges like Deribit and OKX are now offering options APIs and basic bot automation for BTC and ETH contracts.

While this might seem exciting — and it is — it comes with massive risks:

- Low liquidity outside top-tier tokens

- Extreme volatility makes standard options strategies unstable

- Regulatory risk is still a moving target

We’ve seen this story before: early platforms make big promises, draw in retail capital, and only the infrastructure builders walk away with consistent profits. Unless you’re building the engine, you’re the fuel.

That’s why we currently do not automate crypto options at AAT and likely won’t until we see clearer protections and tighter spreads.

What to Expect Next (and How to Stay Ahead)

Here’s what I believe the next three years will bring for retail traders:

- Increased access to institutional-grade execution tools (without needing a Bloomberg terminal)

- More white-labeled automation services — where strategies like ours run behind brokerage platforms

- Real-time portfolio optimization powered by AI

- Robo-risk managers that help traders adjust their allocations automatically based on performance

But with all this innovation comes one critical truth:

More technology doesn’t reduce risk. It just changes how you need to manage it.

Stay focused on defined-risk strategies. Stick with systems that have transparent rules, a verified track record, and human oversight. That’s what separates consistent long-term traders from those who chase hype.

Key Takeaway

2025 marked the expansion phase of retail trading automation, but not all opportunities are created equal.

If you’re serious about using these tools for consistent results, start with proven systems, pair them with smart technology, and always prioritize risk management.

Final Thoughts: Should You Automate Your Options Trading?

If you’ve made it this far, one thing is clear – you’re serious about growing your account with more structure, less stress, and fewer emotional decisions.

When Automation Makes Sense

Automating your options trading makes the most sense when:

- You don’t have time to monitor markets all day.

- You want to remove emotions from the equation.

- You value consistency over adrenaline.

- You’re already following a repeatable system – or want to start.

In short, if you’re tired of chasing trades or second-guessing yourself, automation might be your best ally.

When It Doesn’t Make Sense

On the flip side, automation might not be for you if:

- You’re still experimenting with different strategies and have no clear plan.

- You enjoy discretionary trading and manual adjustments.

- You’re looking for fast profits from speculative plays like 0DTE scalping or naked options (not recommended for most traders anyway).

Automation isn’t a silver bullet. It’s a tool – a powerful one – when paired with a well-defined, risk-controlled strategy.

Why We Focus on Defined-Risk Automation for Retail Traders

Most retail traders fail not because they’re unskilled, but because they take undefined, unmonitored risks. That’s why we only automate defined-risk strategies like:

- Bull put spreads

- Credit spreads

- Iron condors

These aren’t “get-rich-quick” tactics. They’re built for capital preservation, consistent income, and long-term compounding.

Since 2009, we’ve refined our automation system with one goal in mind:

Help real traders like you trade like institutions — but without the overhead, jargon, or complexity.

We’re not selling a theory. We run this every day – in real accounts, with real trades, and real returns.

Final Word: The Power of Hands-Off Discipline

If you’ve ever hesitated to place a trade…

If you’ve ever closed a position too early or held on too long…

If you’ve felt like trading was another job on top of your job…

Then automation isn’t just a luxury.

It’s a way to avoid your worst trading habits while keeping full control of your capital.

Ready to Automate?

Let us help you start where most retail traders never do – with a proven system.

Start with Monthly Trend – our lowest-stress, highest-trust strategy:

- One trade per month

- Defined-risk bull put spreads

- SPX execution with institutional-grade precision

- Backed by over a decade of performance data

Join here and start trading smarter — automatically.

Automated Options Trading: Complete Learning Path

- Step 1: The Foundation. The Ultimate Guide to Automated Options Trading: Understanding how algorithms remove emotion and why professional traders use automated systems.

- Step 2: The Basics. Is It Possible to Automate Options Trading?: Breaking down the technology that allows retail traders to execute complex strategies automatically.

- Step 3: Platform Selection. Best Platforms for Automated Options Trading: A review of the software and brokerages required to run institutional-grade signals.

- Step 4: Tactical Setup. How to Trade Automatically: A step-by-step framework for connecting your account and activating your first automated strategy.

- Step 5: Reality & Risk. Is Automated Trading Risky?: A transparent look at the risks of algorithmic trading and how to implement proper safety controls.

- Step 6: Data & Profitability. Is Automated Options Trading Profitable?: Examining the performance data and why “zero-emotion” execution leads to more consistent returns.

- Step 7: Reference Guide. Glossary of Automated Options Trading Terms: A quick-reference library for the technical jargon used in the automated space.