Credit spreads are one of the few options strategies that allow traders to generate steady income without predicting big market moves. Instead of guessing direction, credit spread traders rely on probability, time decay, and clearly defined risk to produce consistent results over time.

At a basic level, a credit spread means selling premium and limiting downside with a protective option. But understanding why they work — when to use bullish vs bearish spreads, how volatility affects pricing, and how to size positions correctly — is what separates professionals from frustrated beginners.

In this guide, you’ll learn exactly how credit spreads work in real trading, how traders calculate profit and loss before entering a trade, and why credit spreads are widely used for SPX and SPY income strategies. Whether you’re new to options or refining an existing approach, this article gives you a complete, practical framework, not theory.

Master Credit Spreads: Complete Learning Path

- Step 1: The Foundation Credit Spreads Explained: The core mechanics and how credit spreads generate income.

- Step 2: How It Works Mechanics of a Credit Spread: Understanding premium collection, margin, and the math of the trade.

- Step 3: Strategy Selection Credit vs. Debit Spreads: Which strategy fits your market outlook?

- Step 4: Tactical Setup Bull Put Credit Spread Guide: A step-by-step framework for placing your first high-probability trade.

- Step 5: Risk & Risk Management The Risks of Credit Spreads: How to identify Max Pain and protect your capital from market shocks.

- Step 6: Real-World Application Examples & Strategy: Case studies and advanced strategy rules for consistent returns.

What Is a Credit Spread in Options Trading?

A credit spread is an options strategy where you sell one option and buy another with the same expiration date but a different strike price. Because the option you sell is worth more than the one you buy, you receive a net credit when entering the trade.- Bull Put Spread – a bullish strategy using puts

- Bear Call Spread – a bearish strategy using calls

How Does a Credit Spread Work?

When you open a credit spread, you’re taking in premium upfront and hoping the price stays on the favorable side of your short strike. If it does, both options expire worthless—and you keep the full credit.- Defined risk: You know your worst-case scenario upfront.

- Time decay advantage: Theta works in your favor.

- Flexibility: You can be bullish or bearish depending on the setup.

Key takeaway: How credit spreads work

- You collect premium upfront by selling a higher-value option and buying protection at another strike.

- If price stays on the favourable side of your short strike, the spread expires worthless and you keep the full credit.

- Because losses are capped, credit spreads are safer than naked options.

Credit Spread Strategy: When and How to Use It

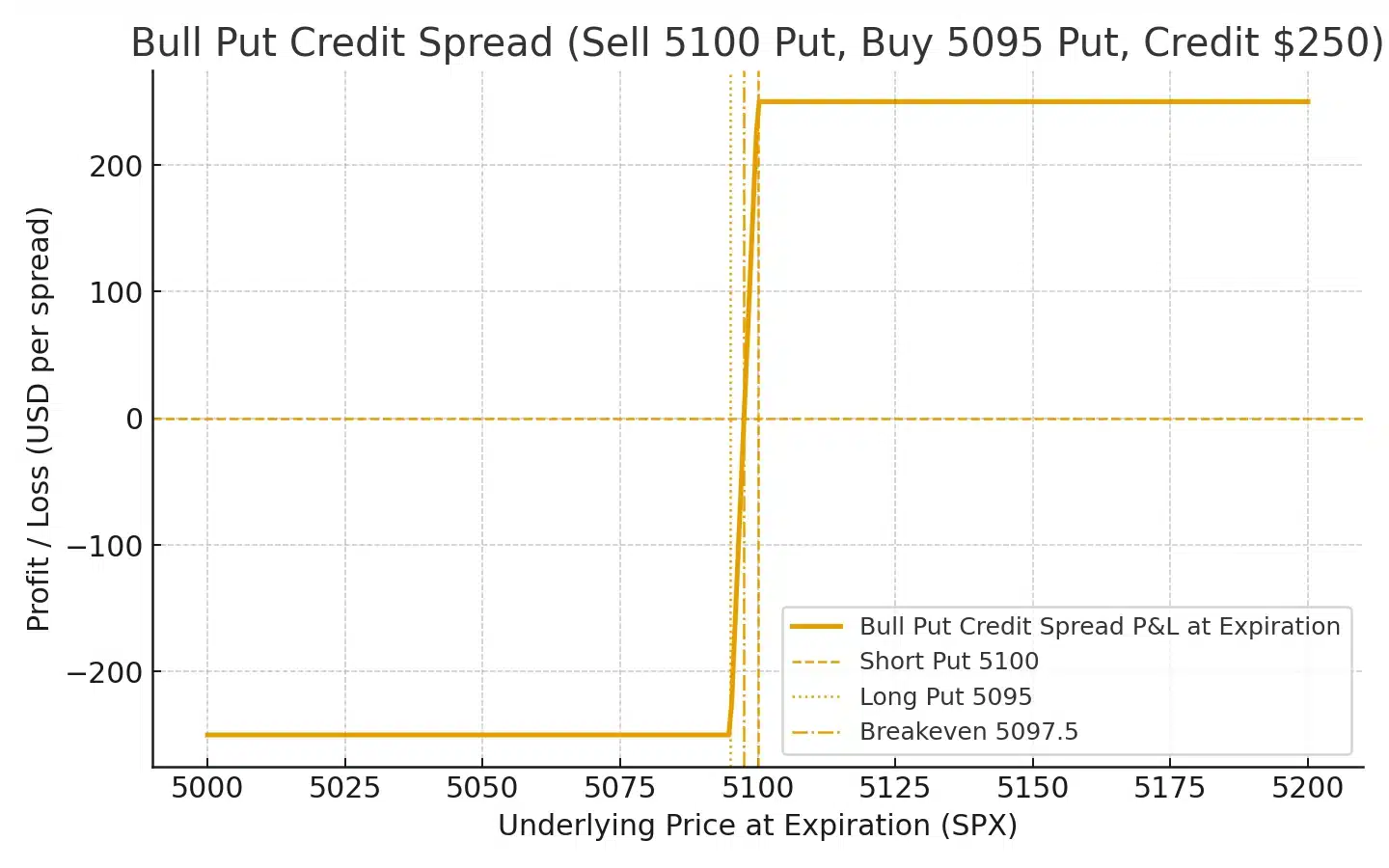

Here’s one of my favorite setups. We run a version of this almost every week on SPX in our Weekly Trend strategy:Real Example: SPX Bull Put Spread with 1:1 Risk-to-Reward

- Underlying: SPX (S&P 500 Index)

- Outlook: Slightly bullish or neutral

- Strategy: Bull Put Spread

- Strike Width: $5

- Expiration: 7 DTE

- Trade Setup: Sell 5100 Put, Buy 5095 Put

- Net Credit: $2.50

Trade Stats:

- Max Profit: $2.50 (if SPX stays above 5100)

- Max Loss: $2.50 (if SPX falls below 5095)

- Breakeven Point: 5097.50

- Risk-Reward: 1:1

Credit Spread Formula: How to Calculate Profit, Loss, and Breakeven

- Net Credit = Premium received – Premium paid

- Max Profit = Net Credit

- Max Loss = Spread Width – Net Credit

- Breakeven = Short Strike – Net Credit (for puts)

When to Use a Credit Spread

I typically deploy put credit spreads:- During earnings season, when there’s a bullish bias

- At large events (FOMC, CPI) that suggest upside

- When technicals show a bottom or strong support level

How to Manage Risk and Adjust a Credit Spread Position

Common Risks:

- Assignment risk (especially near expiration)

- Gap risk (overnight moves through strike)

- Margin pressure (when over-allocated)

How I Manage It:

Assignment: Trade on SPX (cash-settled, no assignment). For SPY, attach a $0.02 target order at entry and close all positions 2 hours before expiration.- Gap risk & margin pressure: Risk only 2.5% or 5% per trade with a 1:1 risk/reward ratio. This limits drawdown and avoids leverage stress.

Credit Spread vs Debit Spread

| Feature | Credit Spread | Debit Spread |

|---|---|---|

| Entry Cost | Receive premium | Pay premium |

| Time Decay | Helps | Hurts |

| Max Profit | Net credit | Spread width – debit |

| Market Bias | Neutral-to-directional | Directional |

| Risk/Reward | 1:1 or better win rate | Higher reward potential |

Common Questions About Credit Spreads

Can I lose more than my initial credit? Yes, but only up to the defined spread width minus the credit. Losses are capped. Is a credit spread bullish or bearish? Bull put spreads are bullish; bear call spreads are bearish. Should I hold until expiration or close early? For SPX, you can hold to expiration. For SPY, close at your $0.02 target or 2 hours before expiration. In Weekly Trend, this is handled automatically. Can beginners trade credit spreads? Yes. With automation and small sizing, it’s an ideal strategy for learning defined-risk income trading.Bond Credit Spreads (Yield Spreads): What They Are & Why They Matter

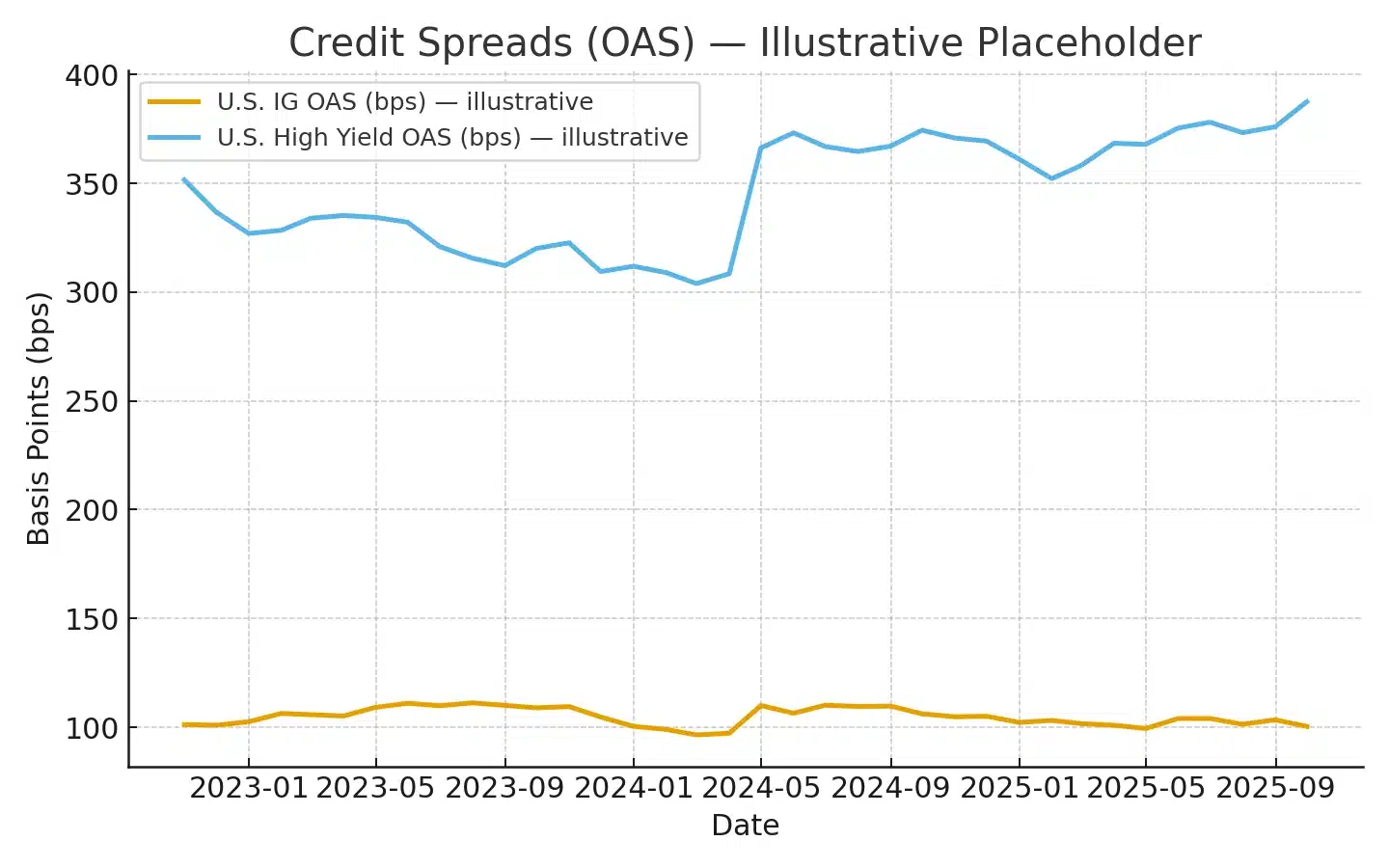

Outside of options, “credit spread” also refers to the yield difference between a risk-free government bond (e.g., a U.S. Treasury) and a riskier bond of the same maturity (e.g., a corporate bond). This spread is a real-time barometer of default risk and overall market sentiment.Quick Definition

Bond credit spread (a.k.a. yield spread) = the extra yield investors demand to hold a risky bond instead of a comparable-maturity Treasury.Formula

Credit Spread = Corporate Bond Yield − Treasury Yield (in %, or basis points)

Example (10-Year Bonds)

| Instrument | Yield |

|---|---|

| U.S. Treasury (10Y) | 4.00% |

| Corporate Bond (10Y) | 6.00% |

| Credit Spread | 2.00% (200 bps) |

Investors are demanding an additional 200 bps to hold the corporate bond over Treasurys to compensate for default and liquidity risk.

How to Read Bond Credit Spreads

- Widening spreads → Rising perceived credit risk, tighter financial conditions, risk-off sentiment.

- Narrowing spreads → Improving credit outlook, easier conditions, risk-on sentiment.

What to Track

- Investment-Grade OAS (option-adjusted spread)

- High-Yield OAS

- Sector spreads (e.g., financials vs. industrials)

Why Options Traders Should Care

Credit cycles influence volatility, liquidity, and directional risk. Wider bond spreads often coincide with elevated equity volatility—an environment where defined-risk credit spreads in options (bull put / bear call) can be sized conservatively while targeting attractive premiums.Next up: Bull Put Spreads · Iron Condors · Automated Credit Spread Signals

Bond Credit Spread: Quick FAQ

Is a bigger credit spread always bad?

No. Bigger spreads indicate higher perceived risk, but they can also reflect normal risk-off periods. Persistent, fast widening—especially in high-yield—usually signals stress.What’s a “normal” spread?

It varies by rating and cycle. Investment-grade often sits near low hundreds of basis points, while high-yield is structurally wider. During crises, both can spike materially.Do I use bond spreads to time options trades?

Use them as a context gauge. Widening regimes imply higher volatility and fatter options premiums; narrow regimes suggest calmer conditions and smaller credits.Best Tools to Trade Credit Spreads

- Platforms: Thinkorswim, Tastytrade, Interactive Brokers

- Tools: OptionStrat, POP calculators, trade probability models

- Automation: Advanced AutoTrades integrates with IB and Tradier to auto-execute Weekly Trend signals