Understanding credit spreads in theory is one thing. Seeing how they work in real trades — with real numbers, real risk, and real outcomes — is what actually builds confidence.

In this guide, I’ll walk through two practical SPX credit spread examples: a bull put spread for mildly bullish conditions and a bear call spread for mildly bearish setups. You’ll see exactly how I calculate max profit, max loss, breakevens, and probability before placing a trade — and why structure matters more than prediction.

These examples show how different types of credit spreads behave in live markets, how risk stays defined, and where beginners often go wrong with sizing or timing. If you want to understand how credit spreads really work — not just what they are — these examples will give you a clear, repeatable framework you can apply to your own trading.

If you’re brand new to spreads, start with the basics: What Is a Credit Spread? or check my step-by-step guide Credit Spread Strategy: When and How to Use It.Example 1: SPX Bull Put Credit Spread (Mildly Bullish)

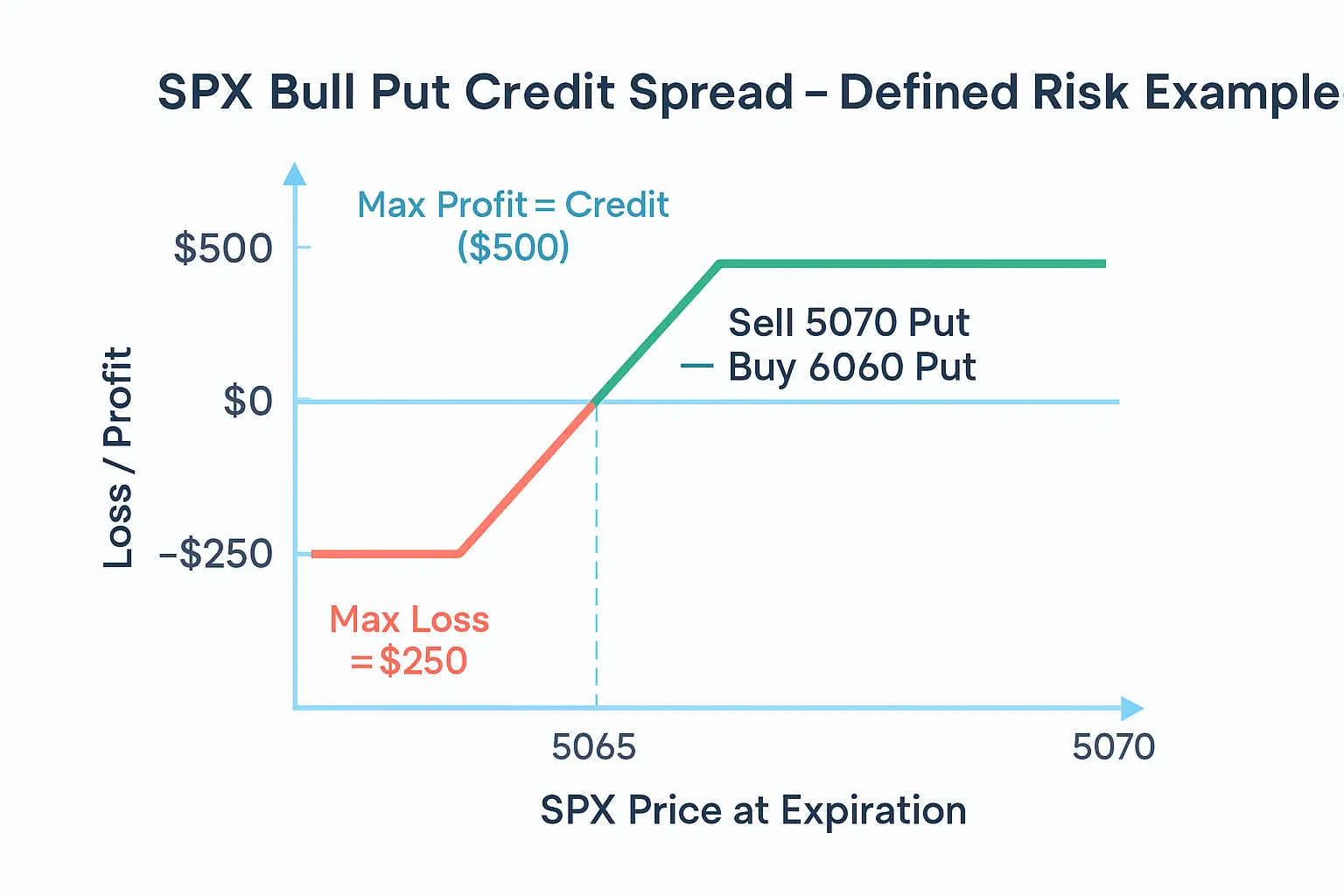

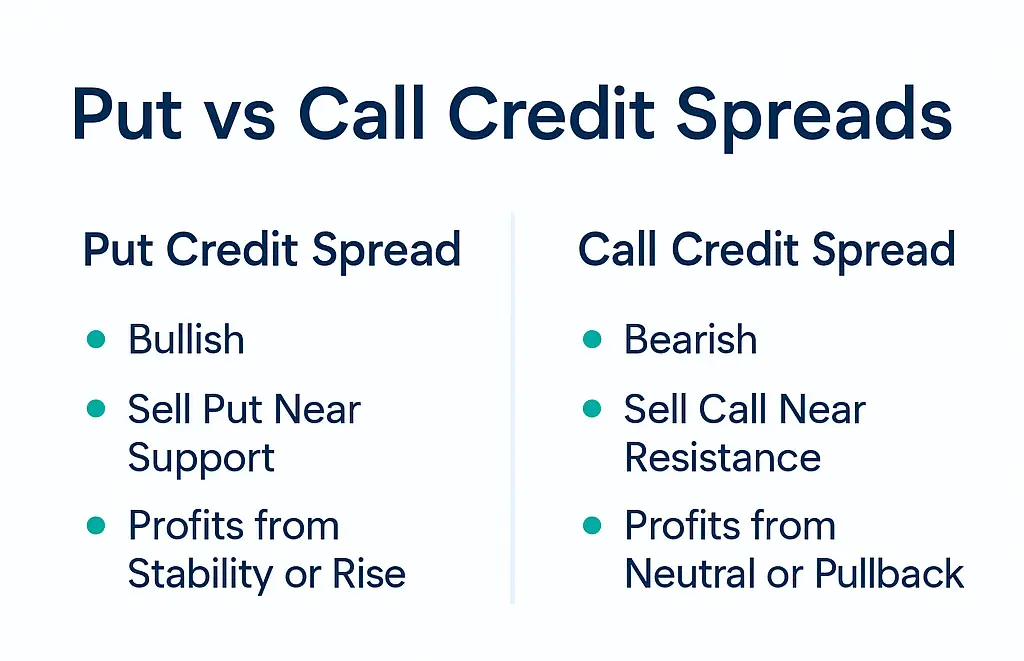

A bull put spread is a bullish credit spread where you sell a put option closer to the current price and buy another put further out of the money for protection. You earn a credit upfront and profit if SPX stays above your short strike at expiration.Trade Setup

- Underlying: SPX

- Current Price: 5000

- Sell: 5070 put

- Buy: 5060 put

- Width: 10 points

- Credit Received: $5.00

- Days to Expiration: 30 (typical for Monthly Trend setups)

Trade Metrics

- Max Profit: $5.00 × 100 = $500 (credit received)

- Max Loss: (10 − 5) × 100 = $500

- Breakeven: 5070 − 5 = 5065

- Probability of Profit: around 60–70%

Example 2: SPX Bear Call Credit Spread (Mildly Bearish)

A bear call spread is the mirror image of a bull put spread. It’s a bearish credit spread where you sell a call near resistance and buy another call further out of the money to define risk. You profit if SPX stays below your short call by expiration.Trade Setup

- Underlying: SPX

- Current Price: 5000

- Sell: 4960 call

- Buy: 4970 call

- Width: 10 points

- Credit Received: $5.00

- Days to Expiration: 30

Trade Metrics

- Max Profit: $5.00 × 100 = $500 (credit received)

- Max Loss: (10 − 5.00) × 100 = $500

- Breakeven: 4960 + 5.00 = 4965

- Probability of Profit: about 60–70%

Credit Spread Calculator: Understanding Risk and Reward

Every credit spread can be broken down into three key components: credit received, spread width, and breakeven point. Understanding how these elements interact helps you estimate risk and profit potential before placing a trade.Formulas:

- Max Profit: Credit received × 100

- Max Loss: (Spread width − credit) × 100

- Breakeven: Short strike ± credit (minus for puts, plus for calls)

- Sell: 5070 put

- Buy: 5060 put

- Credit: $5.00

Common Mistakes Traders Make With Credit Spreads

Even though credit spreads are safer than naked options, traders still make predictable mistakes that hurt results. These errors usually come from misunderstanding volatility, sizing, or timing.- 1. Selling too far out of the money: lower credit means higher risk if being wrong.

- 2. Ignoring volatility shifts: selling spreads during low IV can offer little reward for the risk taken.

- 3. Holding to expiration: trying to squeeze out the last few dollars increases gamma risk dramatically in the last 7 days before expiration.

- 4. Oversizing trades: even defined risk can hurt if you over-leverage your account.

- 5. Trading during major news events: CPI, FOMC, or NFP can move SPX 50+ points overnight — beyond your strikes.

Rule of thumb: trade smaller, close earlier, and avoid entering spreads through volatility events. The goal is consistency — not perfection.

FAQs About Credit Spread Examples

1. How much can you make with a credit spread?

Your profit is limited to the credit received. For example, a $5.00 credit on a 10-point spread means your max gain is $500. The goal is not to hit home runs, but to collect repeatable profits over time.2. What happens if the stock moves against your credit spread?

Your maximum loss is capped. If SPX closes below your short put (or above your short call), both legs are exercised, and you take the full defined loss. Proper sizing keeps this from damaging your account.3. Are credit spreads safe for beginners?

They’re one of the safest strategies for beginners because you know exactly how much you can lose or make. Just keep risk small and avoid holding through major volatility events.4. When is the best time to trade credit spreads?

Sell them when implied volatility is elevated and the market looks stable. Avoid periods right before earnings or high-impact news, when spreads widen and prices move unpredictably.5. Can credit spreads be automated?

Yes. Many traders, including me, automate SPX credit spreads for consistency. Systems can place and manage trades based on predefined rules, removing emotion and execution errors.Conclusion: Turning Credit Spread Theory Into Practice

Credit spreads are one of the most efficient ways to trade defined risk. They allow you to generate consistent income without guessing direction, as long as you respect volatility and position sizing. Whether you use a bull put spread or a bear call spread, the key is matching your setup to the market. Sell puts when the market looks stable or bullish, and sell calls when price stalls or reverses near resistance. Each trade has a purpose — it’s never random.Master Credit Spreads: Complete Learning Path

- Step 1: The Foundation Credit Spreads Explained: The core mechanics and how credit spreads generate income.

- Step 2: How It Works Mechanics of a Credit Spread: Understanding premium collection, margin, and the math of the trade.

- Step 3: Strategy Selection Credit vs. Debit Spreads: Which strategy fits your market outlook?

- Step 4: Tactical Setup Bull Put Credit Spread Guide: A step-by-step framework for placing your first high-probability trade.

- Step 5: Risk & Risk Management The Risks of Credit Spreads: How to identify Max Pain and protect your capital from market shocks.

- Step 6: Real-World Application Examples & Strategy: Case studies and advanced strategy rules for consistent returns.