A credit spread means very different things depending on whether you’re looking at bonds or options — and mixing them up is a common source of confusion for new traders. In fixed income, a credit spread measures how much extra yield investors demand to hold risky corporate debt instead of risk-free government bonds. In options trading, a credit spread is a defined-risk strategy that collects premium when price stays within a range.

Understanding the difference matters more than terminology. Bond credit spreads reflect fear, confidence, and default risk across the economy. Option credit spreads translate that same risk pricing into tradable probability and income. In this guide, we’ll clearly separate the two, show how each works in practice, and explain why professional traders track bothwhen trading SPX and SPY. By the end, you’ll know exactly what a credit spread means in each market — and how they connect.

🎧 Listen: Credit Spread in Bonds vs Options

Prefer listening? In this short podcast episode, we explain how the term credit spread means two very different things — in bonds and in options — and why both revolve around how markets price risk.

If you’re not yet familiar with how credit spreads work in trading, start with this guide:

What Is a Credit Spread?

Key takeaway: In bonds, a credit spread reflects perceived default risk. In options, it defines your profit and loss range. One measures creditworthiness; the other defines strategy structure.

Credit Spread in Bonds Explained

In the bond market, a credit spread is the difference in yield between two bonds with similar maturity but different credit quality. It’s usually expressed in basis points (bps) — where 100 basis points equals 1%.

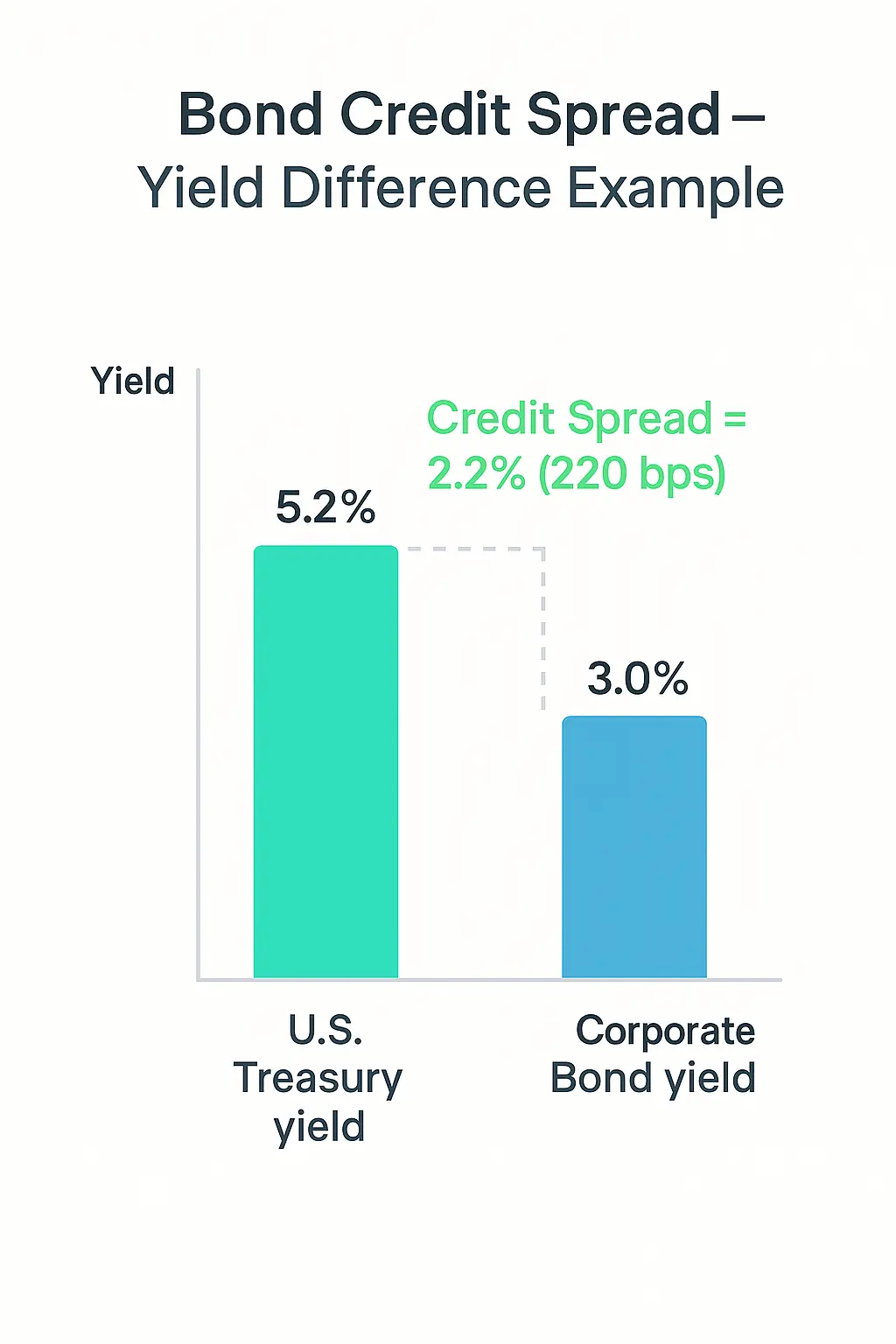

Example: Corporate vs Treasury Bond

If a 10-year U.S. Treasury yields 3.0% and a 10-year corporate bond yields 5.2%, the credit spread is:

5.2% − 3.0% = 2.2% (or 220 basis points)This 2.2% yield difference compensates investors for the extra default risk associated with corporate debt. The wider the spread, the riskier markets perceive the bond issuer to be. When investors grow more confident, credit spreads tend to narrow; when fear rises, they widen.

Bond traders watch credit spreads as a real-time barometer of economic health. A sudden widening often signals that credit conditions are tightening — a warning sign that can ripple into the stock and options markets.

Credit Spread in Options Explained

In options trading, a credit spread refers to a defined-risk position that collects premium upfront. It involves selling one option and buying another at a different strike price within the same expiration cycle. Your profit and loss are capped — but fully known before you place the trade.

The most common types are:

- Bull Put Spread — a mildly bullish position that profits if price stays above the short put strike.

- Bear Call Spread — a mildly bearish position that profits if price stays below the short call strike.

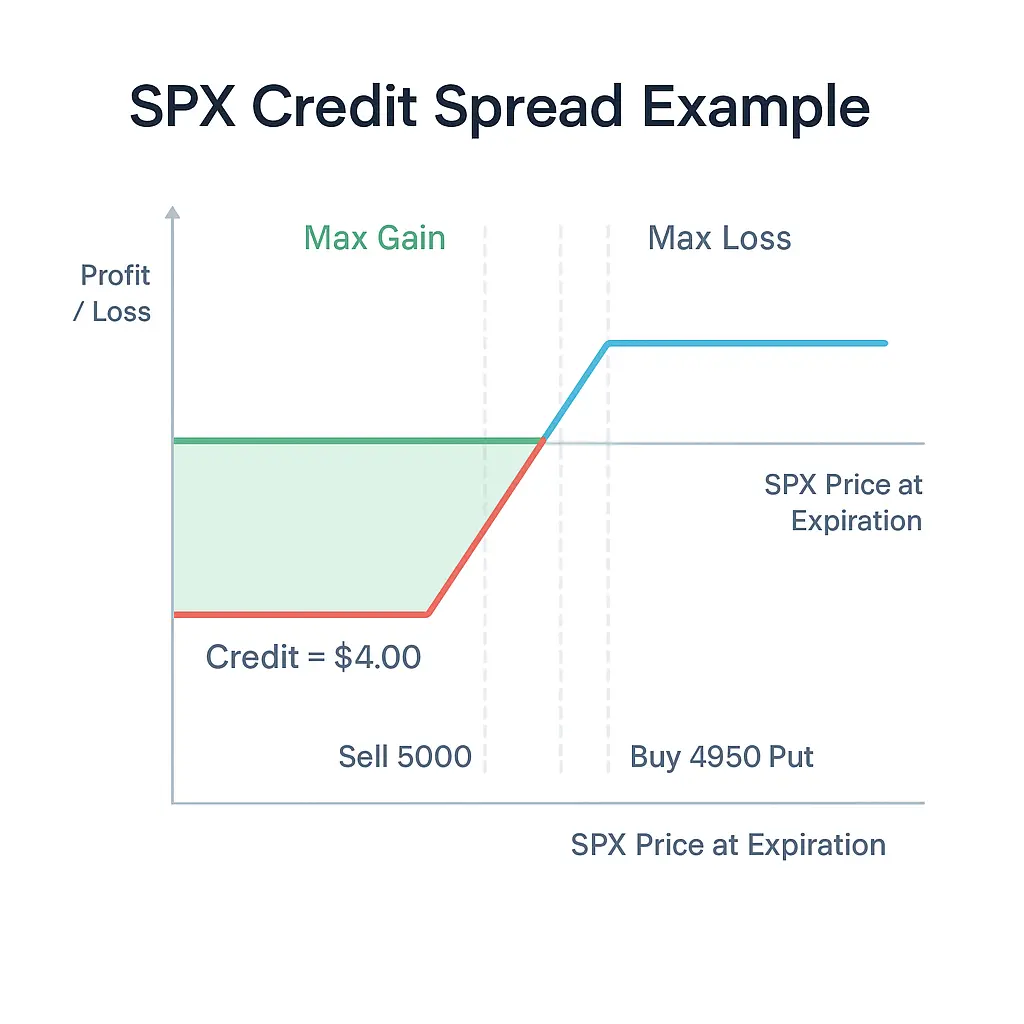

Example: SPX Bull Put Spread

- Sell: 5000 put

- Buy: 4950 put

- Net Credit: $4.00

- Max Profit: $400 (credit received)

- Max Loss: (50 − 4) × 100 = $4,600

- Breakeven: 5000 − 4 = 4996

This setup earns money if SPX stays above 5000. It’s the options-market version of selling insurance — you’re taking on limited risk in exchange for consistent premium income.

Tip: Credit spreads in options are about managing probability, not prediction. The goal is to define risk, automate the process, and let time decay (theta) do the heavy lifting.

For a full breakdown of how these spreads are structured and managed, see

Credit Spread Strategy: When and How to Use It.

Bond vs Option Credit Spread: Key Differences

Although the term “credit spread” appears in both markets, it describes very different mechanics.

Here’s a quick comparison between how credit spreads work in bonds versus options:

| Aspect | Credit Spread in Bonds | Credit Spread in Options |

|---|---|---|

| Definition | Yield difference between two bonds with different credit quality. | Options strategy that sells one option and buys another for a net credit. |

| Purpose | Measures credit risk in fixed income markets. | Generates premium income with defined risk in trading. |

| Key Risk | Default or downgrade risk from the bond issuer. | Market direction and volatility risk in option pricing. |

| Market Indicator | Reflects confidence in the credit market and economy. | Reflects expectations for volatility and price range. |

| Outcome | Wider spreads mean higher perceived risk. | Wider spreads mean higher potential credit and higher risk/reward. |

So while bond traders watch yield spreads to assess credit conditions, option traders use credit spreads to define risk and reward. The same phrase — two entirely different applications.

How Bond and Option Credit Spreads Are Connected

Even though they function differently, bond and option credit spreads often move in tandem. When bond credit spreads widen — meaning corporate yields rise relative to Treasuries — fear increases across financial markets. That fear typically raises implied volatility (IV) in options.

Higher IV leads to richer option premiums, which directly benefits credit spread traders. When investors demand higher yields in bonds, they’re also paying more for protection in the options market. Both reflect the same theme: risk has a price.

At Advanced AutoTrades, we monitor these correlations constantly.

A jump in bond spreads or the VIX index often signals better opportunities to sell SPX or SPY credit spreads at higher premium levels.

When fear rises in the credit market, options sellers get paid more. Understanding that relationship gives traders an institutional edge.

For risk management details and margin control techniques, read

Risks of Credit Spreads: What You Can Lose and How to Manage It.

FAQs About Credit Spreads in Bonds vs Options

1. Why do both bonds and options use the term “credit spread”?

They share the same term but serve different purposes. In bonds, it measures default risk. In options, it describes a defined-risk premium strategy.

2. Which is riskier — a bond credit spread or an option credit spread?

Bond spreads reflect market fear and can signal deep economic risk. Option spreads, on the other hand, have limited risk because each trade’s maximum loss is known upfront.

3. Can bond spreads affect option prices?

Yes. When bond spreads widen, volatility typically rises, and option premiums increase.

That’s why many SPX traders watch both credit markets and implied volatility.

4. Do professionals trade both?

Institutional traders monitor both closely. Credit analysts use bond spreads to gauge systemic risk, while options traders use credit spreads to capture premium from that same fear premium.

5. What is a credit spread in bonds?

In bonds, a credit spread is the yield difference between a corporate bond and a risk-free government bond of similar maturity. It compensates investors for default risk.

6. What is a credit spread for options?

In options, a credit spread is a defined-risk strategy where you sell one option and buy another, collecting premium upfront and capping potential losses.

7. What is the difference between bonds and options credit spreads?

Bond credit spreads measure economic and credit risk, while option credit spreads are trading structures designed to generate income from volatility and time decay.