Automated options trading comes with its own language, and misunderstanding just one term can lead to costly mistakes. This glossary is designed to give you clear, plain-English definitions of the most important concepts used in automated options trading, from credit spreads and execution algorithms to broker APIs and risk controls.

Whether you’re new to automation or already following live signals, this page is your reference point for understanding how automated strategies actually work, how risk is defined and managed, and how execution happens behind the scenes. Every term here reflects how automation is used in real trading, not academic theory.

Use this glossary to decode our strategy guides, interpret performance data correctly, and build confidence as you move from manual trading to rule-based automation.

Automation & technology

Algorithmic trading

The use of computer programs to execute trades based on predefined rules. Algorithms remove emotional bias, increase execution speed, and ensure consistent decision-making, which is essential for options traders running structured, rules-based systems.

Autotrading

Trading that runs automatically once rules or signals are set. The system monitors the market, sends orders, and manages exits without manual input, giving traders consistency and freeing them from screen-watching.

Automated options trading

Automated options trading uses software to execute predefined options strategies like credit spreads, bull put spreads, or iron condors, without manual clicks. The trader selects the strategy and defines the risk allocation, while automation ensures consistent entry, exit, and risk control.

Automated copy trading

Automated copy trading is a trading method that lets you automatically mirror the trades of experienced investors using automation tools or bots. It combines copy trading and algorithmic execution, so your account replicates a professional’s strategy instantly and without manual effort.

Automated trading legality

Automated trading is legal in most major markets, including the U.S., UK, and EU, as long as you use regulated brokers and compliant platforms. Oversight is provided by bodies like the SEC, CFTC, and FCA.

Low-latency automated trading

A setup designed to minimise delay between receiving market data and executing trades. Low latency improves fill quality and reduces slippage, especially in high-volume or fast-moving markets.

Automation platform

Software or infrastructure that connects a trader’s strategy to a broker for hands-free execution. These trading platforms handle order placement and risk management automatically, with varying levels of control and transparency.

AutoShares

A U.S.-regulated broker that supports automated options trading through Advanced AutoTrades. Traders can open an account, connect automation services, and start hands-free trading in minutes.

Broker API

An interface provided by brokers (such as Interactive Brokers or Tradier) that allows external platforms or bots to connect directly for order placement and data access. API trading enables precision, scalability, and faster execution

Global AutoTrading (GAT)

A third-party service that connects trade signal providers to supported brokers. It allows subscribers to mirror trades automatically while maintaining full account control.

SignalStack

Middleware software that converts trading alerts from signal providers into executable broker orders. It bridges the gap between data, automation, and execution.

No-code automation

Tools that allow traders to automate strategies without programming. They typically use drag-and-drop interfaces or simple rule builders. Ideal for beginners seeking automation without technical setup.

Execution algorithm

A program that determines how trades are placed in the market. It controls timing, order type, and routing logic to balance speed, slippage, and price improvement for each transaction.

Execution speed

Execution speed refers to how quickly your broker receives, processes, and fills an order. For automated options traders, stable and predictable execution matters far more than microsecond timing.

Order routing

The process of sending an order to the best exchange or venue for optimal execution. Good routing improves fills and reduces cost; poor routing leads to higher slippage or missed trades.

Limit order

An order type that executes only at a specified price or better. Used by professional and automated traders to maintain price discipline and prevent unfavourable fills.

Liquidity

The ease of buying or selling a contract without significantly affecting its price. Highly liquid markets, such as SPX and SPY, ensure faster fills and tighter bid-ask spreads, key to consistent automation results.

Options trading bots

An options trading bot is software that automatically places and manages options trades based on predefined rules or signals. It removes emotion from trading, ensures consistent execution, and can monitor multiple markets simultaneously, allowing traders to follow a disciplined, data-driven approach without manual order entry.

Automated execution

Automated execution refers to trades that are placed and filled automatically by a computer program once certain market conditions are met. Instead of clicking manually, the system handles order timing, sizing, and routing, ensuring consistent entries and exits according to a pre-set strategy.

Spread execution

Spread execution is the coordinated filling of all legs in a multi-leg options trade. Clean spread execution depends on liquidity, routing quality, and consistent automation.

Multi-leg spread

A multi-leg spread is an options trade involving two or more linked contracts that must be executed together. Because each leg affects the strategy’s risk, stable and synchronised execution is essential.

Fill rate

Fill rate measures how often your orders execute successfully at or near your target price. High fill rates come from strong liquidity, proper limit prices, and reliable routing.

Options trading basics

Call option

A contract giving the buyer the right, but not the obligation, to purchase an underlying asset at a specified strike price before expiration. Calls are used for bullish positions or covered strategies that collect premium.

Backtesting auto trading

Backtesting is the process of testing an automated trading strategy on historical market data to measure its past performance and reliability. Backtesting helps traders verify claims, assess risk, and refine strategies before going live.

Backtesting vs. forward testing

Backtesting uses historical data to test how a trading strategy would have performed in the past, while forward testing validates it in live or simulated conditions. Together, they help traders confirm whether a strategy works consistently before risking real money or automating it.

Put option

A contract granting the buyer the right, but not the obligation, to sell an asset at a specific strike before expiration. Puts are used for bearish trades or as protection within defined-risk strategies.

Strike price

The agreed price at which an option can be exercised. It determines profitability and risk levels and is central to setting up spreads and condors.

Expiration date

The final day on which an option can be exercised. After expiration, all rights to buy or sell expire and the contract becomes worthless if not in-the-money.

Premium

The cost of an option contract. Buyers pay the premium for rights; sellers receive it as income. Premium levels reflect volatility, time to expiry, and distance from the strike price.

Implied volatility (IV)

A market-based measure of expected future volatility embedded in option prices. Higher IV typically means more expensive premiums, influencing strategy selection and timing.

IV crush

A rapid drop in implied volatility after major events such as earnings or Fed announcements. An IV crush causes option premiums to collapse, often reducing profits for long-volatility trades.

Greeks

A group of metrics (delta, gamma, theta, vega, rho) that describe how an option’s value responds to market variables such as price, volatility, and time decay. Understanding these ‘Greeks’ is vital for managing options risk

Delta

Measures how much an option’s price is expected to change for each $1 move in the underlying asset. High-delta options move closely with the underlying, while low-delta options move less.

Theta

Represents time decay, which is how much an option’s price decreases each day as it approaches expiration. Time decay accelerates in the final weeks before expiry.

Gamma

Shows how delta changes relative to the underlying’s price. High gamma near expiry means small price moves can shift delta sharply.

Vega

Indicates how sensitive an option is to changes in implied volatility. Long options benefit when volatility rises; short options benefit when it falls.

Rho

Measures how option value changes with interest rate movements. Typically minor but relevant for longer-dated contracts.

DTE (days to expiration)

The number of days remaining before an option expires. Shorter DTE trades decay faster but require precise management.

0DTE (Zero-day-to-expiration) options

Options that expire the same day they’re opened. These contracts move fast and can generate large gains or losses within hours, making them unsuitable for most retail automation.

Defined-risk strategies & structures

Credit spread

A credit spread is a defined-risk options strategy involving selling one option and buying another with the same expiry but a further-out strike. It collects a net credit upfront and profits if the underlying stays within a target range.

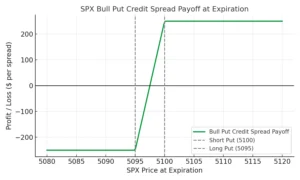

Bull put spread

A bull put spread is a bullish-to-neutral strategy selling a higher-strike put and buying a lower-strike put. It earns premium income with limited downside risk and benefits from stable or rising markets.

Iron condor

An iron condor is a combination of a call credit spread and a put credit spread that profits when the market trades in a range. It offers defined risk and steady income potential for neutral market conditions.

Iron butterfly

A strategy built by selling a call and put at the same strike and buying wings above and below. It profits from minimal price movement and time decay around a central price level.

Max pain

Max pain is the theoretical price at which the largest number of options (both calls and puts) will expire worthless, inflicting the most loss on option buyers. Traders watch max pain near expiration because prices often gravitate toward this level due to hedging flows.

Spy max pain

Spy max pain is a specific application of max pain for SPY options, tracking where the most contracts will expire worthless to anticipate potential expiry “pinning.”

Probability-based trading

An approach focused on trading setups with mathematically high win probabilities, such as selling options outside the expected move. It favours consistency and risk control over speculative bets.

Hedging

Using offsetting positions, like long puts or spreads, to reduce potential losses in an existing trade or portfolio. Automation ensures hedge execution is timely and rule-based.

Adjustment

A proactive modification to an open position (rolling, closing one side, or shifting strikes) to reduce risk or extend potential profit.

Roll

Closing one options leg and reopening at a different strike or expiry to manage risk, reduce assignment exposure, or maintain strategy consistency.

Instruments, products & settlement

SPX

Cash-settled options on the S&P 500 index, favoured by institutions for liquidity, tax efficiency, and avoidance of share assignment.

SPY

An ETF tracking the S&P 500, offering smaller contract sizes suitable for retail traders. SPY options are physically settled, so positions can convert into shares.

Cash-settled

Settlement type where the difference between strike and market price is paid or received in cash with no shares changing hands.

Physically settled

Settlement that results in ownership or delivery of the underlying asset when an option is exercised or assigned.

Assignment risk

The risk that a short option is exercised before expiration, obligating the trader to buy or sell the underlying. Proper risk control and rolling can minimise exposure.

Covered vs. naked options

Covered options are protected by an offsetting position (e.g., owning the underlying or another option). Naked options lack protection and expose traders to potentially unlimited losses.

Brokers, costs & accounts

Interactive Brokers (IBKR)

A leading broker for advanced traders offering low commissions, deep liquidity, and full API access. Ideal for large SPX accounts and high-frequency automation setups.

Tradier

A tradier is an API-enabled broker with subscription pricing and fast execution, well suited to smaller accounts trading SPY spreads or short-term credit strategies.

AutoShares

A beginner-friendly broker offering simple onboarding and integrated automation for hands-off trading. Ideal for low-frequency strategies such as Monthly Trend.

Commissions

Brokerage fees charged per options contract or via monthly subscriptions. Understanding commission structures is essential for evaluating real strategy performance.

Slippage

The gap between an expected and actual execution price. It can erode returns if not managed with limit orders, liquidity filters, and fast execution systems.

Margin requirements

The minimum capital brokers require to open and maintain leveraged or spread positions. Margin rules differ by strategy and broker.

Cash account vs. margin account

A cash account trades only with available funds, suitable for defined-risk spreads. A margin account allows leverage, required for multi-leg strategies like condors.

Robinhood alternatives

Brokerages that offer more advanced tools, automation, and risk-defined options strategies than Robinhood. Popular 2025 alternatives include Interactive Brokers, Tradier, Tastytrade, and Fidelity.

Testing, performance & risk

Backtesting

Testing a strategy on historical data to evaluate its consistency, drawdown, and performance. Reliable backtests use realistic assumptions for commissions, slippage, and fills.

Forward testing

Running a strategy in live or simulated conditions (paper trading) to verify performance before scaling with real capital.

Curve fitting (over-optimisation)

Adjusting strategy parameters so tightly to past data that results look perfect historically but fail in real markets. Avoid by testing across diverse conditions.

Position sizing

Allocating a fixed percentage of account equity per trade, often 1–5%, to control losses and maintain consistent growth.

Risk-defined strategy

Any options strategy where the maximum loss is known from the outset, such as vertical spreads or iron condors. Preferred for automation due to predictable outcomes.

Drawdown

The percentage drop from a portfolio’s peak to its lowest point before recovery. Drawdowns help measure risk tolerance and the sustainability of a system.

Risk-to-reward ratio

Compares potential loss to potential gain. Balanced ratios help traders evaluate whether a setup justifies the risk taken.

Latency (Trading Latency)

Latency is the time it takes for your order to travel from your trading system to the market and back again. For retail traders, the goal isn’t microsecond speed but reliable, consistent execution that avoids slippage and rejected fills.

Win rate

The percentage of profitable trades over time. High win rates don’t guarantee success unless aligned with proper risk-to-reward management.

Liquidity

Liquidity describes how easily an options contract can be bought or sold without causing major price movement. High-liquidity markets like SPX and SPY deliver faster fills, tighter spreads, and more stable execution for automated systems.

Compounding

Reinvesting profits to increase future position sizes and accelerate long-term growth. Automation helps apply compounding consistently and without emotion.

Slippage

Slippage is the difference between the price you expect and the price you actually receive when your order fills. It usually occurs in fast-moving or low-liquidity markets and can be minimised through limit orders and stable execution.

Paper trading

Simulated trading with virtual funds used for testing, training, or forward validation before live deployment.

Live-tracked performance

Verified, real-time results showing actual fills and execution, far more reliable than static backtests or marketing claims.

SEC compliance

Following all U.S. securities regulations and fair-trading standards. Automated strategies must operate legally and transparently, avoid manipulation, and use registered brokers.

Execution discipline

Entry rules

Objective conditions (price, volatility, timing) that trigger trade entries. Consistent entry rules reduce emotional bias and improve backtest reliability.

Exit rules

Defined criteria for closing trades, such as profit targets, stop levels, or time-based exits. Automated systems enforce these rules precisely, preventing hesitation.

Risk cap per trade

The maximum percentage of account capital allocated to one position, typically 1–5%. It limits losses and prevents emotional overexposure.

If you found this glossary useful, you’ll love our Ultimate Guide to Automated Options Trading, a comprehensive overview of how automation works, which strategies to use, and how to trade with the precision of a professional desk.

Automated Options Trading: Complete Learning Path

- Step 1: The Foundation. The Ultimate Guide to Automated Options Trading: Understanding how algorithms remove emotion and why professional traders use automated systems.

- Step 2: The Basics. Is It Possible to Automate Options Trading?: Breaking down the technology that allows retail traders to execute complex strategies automatically.

- Step 3: Platform Selection. Best Platforms for Automated Options Trading: A review of the software and brokerages required to run institutional-grade signals.

- Step 4: Tactical Setup. How to Trade Automatically: A step-by-step framework for connecting your account and activating your first automated strategy.

- Step 5: Reality & Risk. Is Automated Trading Risky?: A transparent look at the risks of algorithmic trading and how to implement proper safety controls.

- Step 6: Data & Profitability. Is Automated Options Trading Profitable?: Examining the performance data and why “zero-emotion” execution leads to more consistent returns.

- Step 7: Reference Guide. Glossary of Automated Options Trading Terms: A quick-reference library for the technical jargon used in the automated space.