If you’re searching for iron condor payoff, iron condor max loss, or trying to understand exactly how risk works on SPX iron condors, this guide is for you. Too many explanations stay vague or theoretical, which is dangerous when you’re trading defined-risk strategies close to expiration.

In this article, I’ll break down the iron condor payoff step by step using a real SPX example I actually trade. You’ll see how maximum profit, maximum loss, and breakeven levels are calculated, how the payoff diagram really behaves as expiration approaches, and where most traders misunderstand risk.

By the end, you’ll know precisely how much you can make, how much you can lose, and how to plan iron condor trades with confidence — without guessing direction or relying on hope.

How the Iron Condor Works

An Iron Condor is built from two credit spreads—one on each side of the current price range. Think of it like setting invisible goalposts. As long as the market (the ball) stays between those posts, you score.- Sell one put option (higher strike) and buy one lower-strike put for downside protection → bull put spread.

- Sell one call option (lower strike on the top side) and buy a higher-strike call to cap the risk → bear call spread.

Iron Condor Max Profit and Max Loss Explained

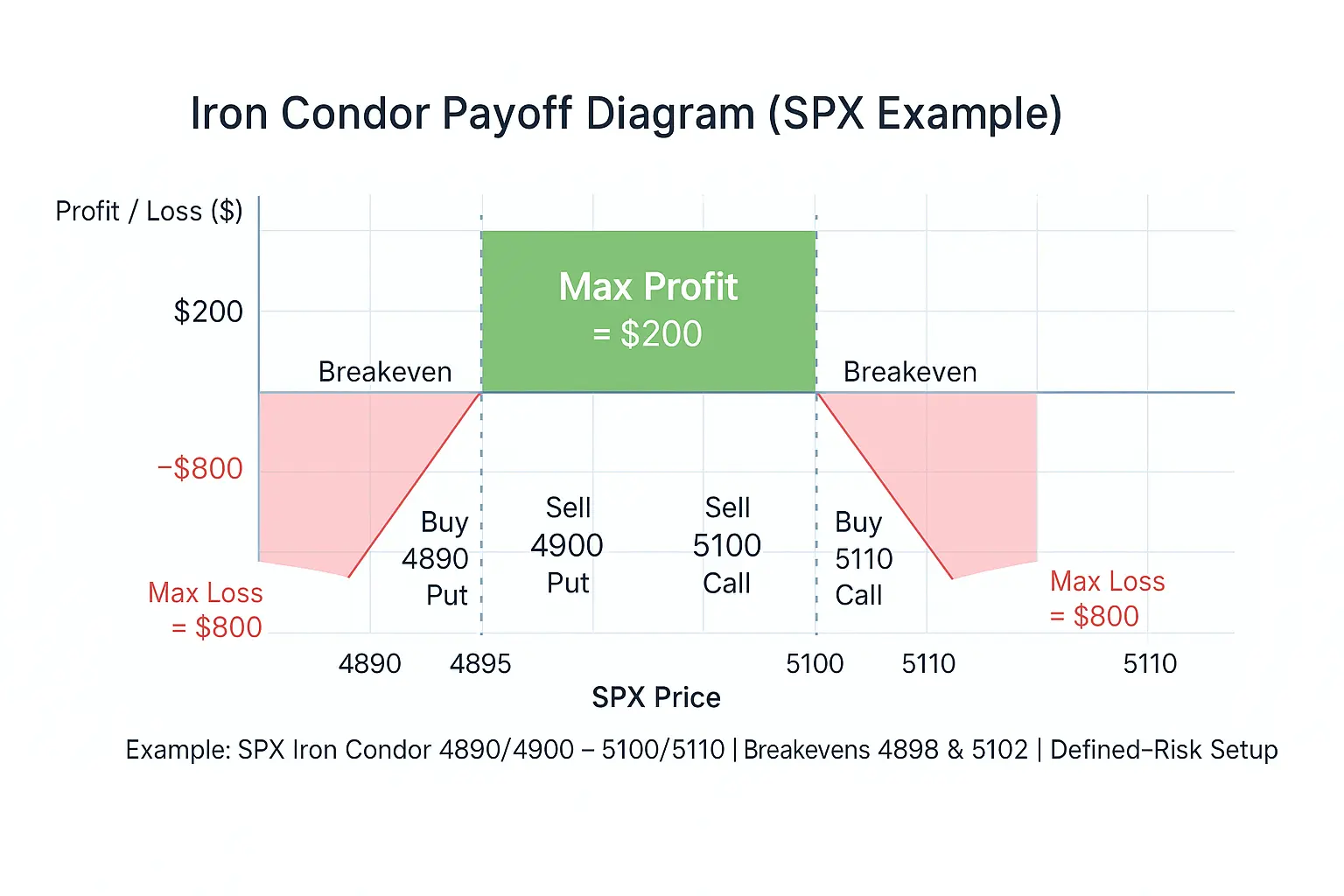

Here’s the golden question every trader asks: “How much can I make and how much can I lose?” Let’s break it down. Maximum Profit: Your max profit is the total net credit received when opening the trade. You earn that full amount if the underlying stays between your short strikes at expiration. Example setup:- Sell 1 5100 Call and buy 1 5110 Call.

- Sell 1 4900 Put and buy 1 4890 Put.

- Total net credit received: $2.00 (i.e., $200 per Iron Condor).

Max Loss = Spread Width − Net Credit

With each spread 10 points wide and a $2.00 credit, max loss = $10 − $2.00 = $8.00 (i.e., $800 per Condor). The key advantage: risk is defined upfront.

Breakeven Points:

- Upper Breakeven =

Short Call Strike + Credit→ 5100 + 2 = 5102 - Lower Breakeven =

Short Put Strike − Credit→ 4900 − 2 = 4898

Iron Condor Payoff Diagram Example

The classic iron condor payoff diagram looks like a flat-topped hill: profit in the middle, limited losses on both sides.- Max profit sits in the center (between the short strikes).

- Loss begins once price crosses a breakeven line.

- Loss is capped by the long options you bought (defined risk).

SPX Iron Condor Example

Let’s walk through a real-world SPX Iron Condor example — the kind of setup I actually trade.- SPX at 5050

- Days to expiration: 3

- Volatility: Moderate (VIX around 16)

- Sell 1 5140 Call @ 6.00

- Buy 1 5150 Call @ 5.00

- Sell 1 4950 Put @ 6.50

- Buy 1 4940 Put @ 5.50

- Max profit: $200 if SPX stays between 4950–5140.

- Max loss: $800 if SPX breaks below 4940 or above 5150.

- Breakevens: 4948 and 5142.

Risk Management and Trade Planning

Now, let’s talk about what separates hobbyists from pros: Iron Condor risk management. When I trade, I don’t rely on hope — I plan exits and size positions with discipline. Here are my simple rules:- Define Profit Targets: Aim to close when you’ve captured 50–70% of max profit. Don’t try to squeeze every dollar; risk accelerates near expiration.

- Avoid Holding Too Long: Time decay speeds up in the final days, but so does gamma risk. If SPX touches your short strikes close to expiration, a small move can flip a winner into a loser.

- Use Volatility to Your Advantage: Enter Condors when implied volatility is slightly above average but stable. When volatility drops, your position gains value — that’s “vol crush,” and it’s your friend.

- Track and Review Every Trade: Log your entries, exits, duration, and market conditions. Patterns emerge — maybe you hold too long or open too close to expiration. Tracking improved my own consistency more than any indicator ever did.

- Maximum profit equals the total credit received

- Maximum loss equals spread width minus credit

- Profit occurs when price stays between short strikes

- Risk is defined before entering the trade

- Gamma risk increases sharply near expiration

Final Thoughts

The Iron Condor strategy is one of my all-time favorites because it rewards patience, discipline, and understanding over adrenaline. Once you master the iron condor payoff diagram, you’ll realize every trade is a probability game — you know your reward, your max loss, and your risk before entering. That’s the kind of clarity most traders never achieve. Whether you trade SPX, QQQ, or RUT, remember: the Iron Condor isn’t about predicting direction — it’s about managing time, volatility, and confidence. When you’re ready to trade like a professional, automation can take it to the next level. Automate your Iron Condor trading with our Weekly Premium Signals for SPX. Get real trade alerts to target 5% weekly ROI, risk management insights, and see how defined-risk trading can build consistent income.Iron Condor FAQs

What is the maximum profit in an Iron Condor?

The maximum profit is the total credit received when you open the trade. You earn that full amount if the underlying stays between your short call and short put strikes at expiration.How is the max loss calculated?

Your max loss is the spread width minus the credit received. It happens only if price moves completely past one of your long strikes. The key benefit of the Iron Condor is that this risk is clearly defined before you enter.When does an Iron Condor work best?

An Iron Condor performs best in low-to-moderate volatility markets when prices stay within a predictable range. Traders often use it when implied volatility is slightly elevated, so that time decay (theta) works in their favor as volatility drops.Can I trade Iron Condors on SPX or SPY?

Yes. Many professional traders use SPX and SPY options for Iron Condors because of their tight spreads, high liquidity, and cash-settled nature. SPX is especially popular for defined-risk income strategies.How can I reduce risk with Iron Condors?

Keep position size reasonable, close trades once you’ve captured 50–70% of potential profit, and avoid holding through major news or earnings. Those steps help control risk and improve consistency.What is the formula for iron condor max profit?

Iron condor max profit equals the total net credit received when opening the position. This occurs if the underlying price finishes between the two short strikes at expiration.

What is the formula for iron condor max loss?

Iron condor max loss is calculated as:

Spread width − net credit received.

This loss occurs only if price moves completely beyond one side of the condor and through the long strike.

What are common iron condor mistakes?

The most common mistakes include oversizing positions, holding too close to expiration, selling strikes too close to price, and trading through major news events when volatility can spike unexpectedly.

Is an iron condor risky?

An iron condor has defined risk, meaning maximum loss is capped. However, poor sizing, late exits, or trading during volatile conditions can still lead to large drawdowns.

Master the Iron Condor: Complete Learning Path

- Step 1: The Foundation – What is an Iron Condor?: Understanding the 4-leg structure and the market-neutral objective.

- Step 2: Core Definitions – What is an Iron Condor?: A simplified breakdown of the 4-leg structure for beginners.

- Step 3: Strategy Mechanics – Iron Condor Strategy Explained: A deep dive into how time decay and volatility work in your favor.

- Step 4: Visualizing the Trade – The Iron Condor Payoff Diagram: A visual guide to your profit zones, breakeven points, and max risk.

- Step 5 Strategy Variations – Short vs. Reverse Iron Condors: When to sell volatility vs. when to buy it (including the Reverse Iron Condor).

- Step 6: Comparative Analysis – Iron Condor vs. Iron Butterfly: Which neutral strategy fits your risk profile.

- Step 7: Defensive Management – How to Adjust an Iron Condor: Advanced tactics for managing the position when tested.