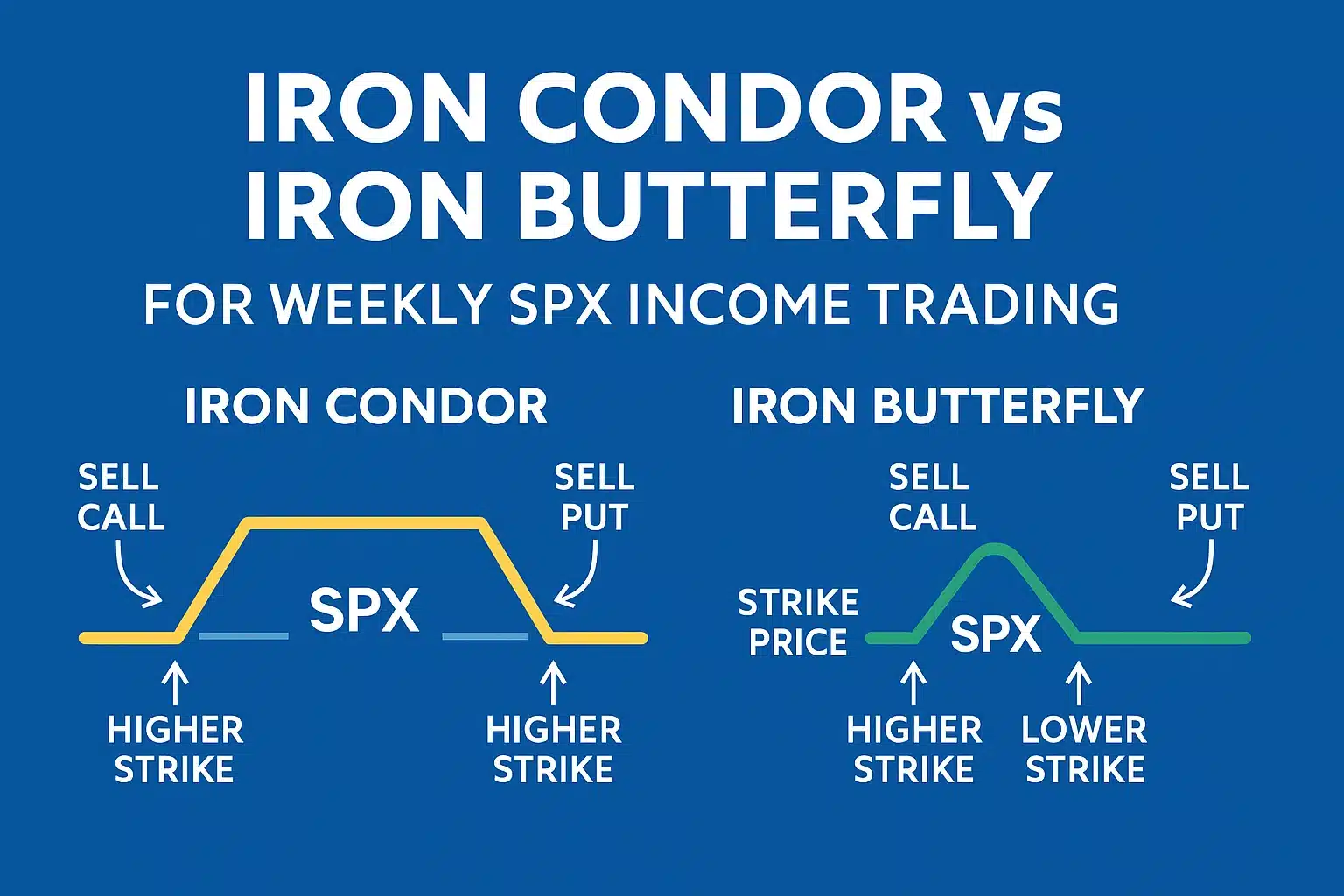

If you’ve been exploring options trading, you’ve likely come across two strategies that seem nearly identical: the iron condor vs the iron butterfly. Both are defined-risk, four-leg option spreads. Both can generate income from time decay. And both work best in low-volatility markets. But while they may look similar on the surface, they behave very differently in real-world trading.

Over the past 15 years, I’ve traded both on SPX, manually and through full automation.

What Is an Iron Condor?

An iron condor is a neutral, defined-risk spread built by combining a short put spread and a short call spread with the same expiration date. The goal is simple: profit when the underlying stays within a specific range. Want a deeper dive into how this strategy works? Check out our detailed guide on the Iron Condor Strategyto understand how we optimize trade setups week after week.Structure

- Sell 1 out-of-the-money (OTM) put

- Buy 1 lower-strike OTM put

- Sell 1 OTM call

- Buy 1 higher-strike OTM call

Key Benefits

- Defined risk and reward

- Wider profit zone than iron butterflies

- Ideal for sideways markets

- Perfect for automation due to rules-based setup

Example

With SPX at 5,300:- Sell 5,220 Put / Buy 5,210 Put

- Sell 5,380 Call / Buy 5,390 Call

- Net Credit: $2.00

- Max Risk: $8.00

- Breakevens: 5,218 and 5,382

- POP: Over 90%

What Is an Iron Butterfly?

The iron butterfly is built using the same legs as the condor – but here, the short call and short put are placed at the same strike price, typically at-the-money. That gives you a narrower profit range, but a larger potential payout if the underlying finishes exactly at that strike.Structure

- Sell 1 ATM put

- Buy 1 lower-strike put

- Sell 1 ATM call

- Buy 1 higher-strike call

Key Characteristics

- Higher reward if pinned at short strike

- Narrow profit zone

- Lower probability of profit

- Requires precise movement

Example

SPX at 5,300:- Sell 5,300 Put / Buy 5,290 Put

- Sell 5,300 Call / Buy 5,310 Call

- Net Credit: ~$10.00

- Breakevens: 5,290 and 5,310

- POP: Around 35–40%

Iron Condor vs Iron Butterfly: Key Differences

| Feature | Iron Condor | Iron Butterfly |

|---|---|---|

| Short Strike Placement | Different (OTM call & put) | Same (ATM call & put) |

| Profit Zone Width | Wide | Narrow |

| Max Credit | Lower | Higher |

| POP | Over 90% | ~35–40% |

| Best Used For | Weekly SPX Income | Event-driven trades |

| Automation-Friendly | Yes | No |

Which Strategy Is Better for Weekly Options?

If you’re trading weekly options – especially on SPX – you want consistency, defined risk, and minimal management. For that, iron condors come out on top every time.- Wider breakeven range

- Better probabilities

- Ideal for automation

- Stress-free position sizing

What Is the Success Rate of the Iron Butterfly Strategy?

The iron butterfly typically has a 35–45% probability of profit, depending on how close the short strike is to the current price and how wide the wings are placed.

Because the short call and short put sit at the money, the position only wins if price finishes in a very tight range at expiration. That narrow profit zone means the reward is high, but the success rate is much lower than an iron condor.

This is why iron butterflies are better suited for event-driven trades where you expect little to no movement—not for weekly income trading or automation.

Reverse Iron Condor vs Reverse Iron Butterfly

| Feature | Reverse Iron Condor | Reverse Iron Butterfly |

|---|---|---|

| Bias | Volatility expansion, large moves | Very large moves or spikes |

| Short/Long structure | Long OTM call + long OTM put | Long ATM straddle + short wings |

| Width of profit zone | Wide | Narrow |

| Max reward | Moderate | High |

| Probability of profit | Higher | Lower |

| Best use case | Pre-event volatility | High-impact catalysts (earnings, FOMC) |

Real-World Example: Weekly SPX Iron Condor vs Iron Butterfly

Setup: SPX at 5,300 | 2 Days to Expiry

Iron Condor

- Sell 5,220 Put / Buy 5,210 Put

- Sell 5,380 Call / Buy 5,390 Call

- Net Credit: $2.00

- Max Risk: $8.00

- POP: Over 90%

- Breakeven Range: 5,218 to 5,382

Iron Butterfly

- Sell 5,300 Put / Buy 5,290 Put

- Sell 5,300 Call / Buy 5,310 Call

- Net Credit: ~$10.00

- Breakeven Range: 5,290 to 5,310

- POP: ~35–40%

Is an Iron Condor Always Profitable?

No — an iron condor is not always profitable, but it does offer one of the highest probabilities of profit among defined-risk strategies.

A far-OTM iron condor on SPX typically has:

-

80–95% probability of profit

-

Defined max loss

-

Wide breakeven range

But an iron condor can still lose money when:

-

A large directional move breaches one of the spreads

-

Implied volatility spikes unexpectedly

-

Traders skip stop-loss or adjustment rules

When used with disciplined sizing and systematic exits (as in your Weekly Premium model), the iron condor becomes a consistent income strategy—not a guaranteed win every week.

Should You Trade Both?

You can – but not for the same reasons. Iron condors are your steady income play. They’re ideal for SPX, automation, and relaxed management. Iron butterflies are more surgical – best used when you expect little to no movement and can monitor the position closely. If you’re looking for consistent, rules-based income, you can’t beat the simplicity and success rate of the far-OTM iron condor approach. There are also alternative approaches to iron condors worth exploring, like theReverse Iron Condor – a directional play often used during earnings or major market catalysts.Ready to Trade Iron Condors Automatically?

- 1 SPX iron condor trades per week

- 5–10% ROI in 2 trading days

- 100% automation with supported brokers

Frequently Asked Questions

What is the main difference between an iron condor and an iron butterfly?

Iron condors use two different short strikes, creating a wider profit range. Iron butterflies use the same short strike, offering a higher reward but a narrower breakeven range.Which strategy is safer for beginners?

Iron condors are generally safer because of their wider range and higher probability of success.Can I automate iron condor trades?

Yes – our Weekly Premium service does exactly that. You can set it and forget it. We also offer trade setups for variations like the Short Iron Condor– perfect for traders looking for fast, rules-based entries.Why use $10-wide condors placed 80 points away?

This setup gives you a high POP (90%+), defined risk, and a reliable return between 5–10% with limited exposure.Can this work with a small account?

Absolutely. You can start with as little as $1,000 account balance, thanks to the defined-risk nature of the spreads.What Is the Difference Between an Iron Fly and an Iron Butterfly?

There is no difference between an iron fly and an iron butterfly — they are the same strategy.

“Iron fly” is just shorthand used by traders to describe the iron butterfly setup:

-

Sell ATM call

-

Sell ATM put

-

Buy long wings for protection

The payoff shape resembles a “butterfly,” which is where the full name comes from.

What Is the Difference Between a Reverse Iron Condor and a Reverse Iron Butterfly?

Both reverse structures are debit spreads designed to profit from big moves, not stability — the opposite of traditional condors/butterflies.

But they differ in structure and price behavior:

Reverse Iron Condor

-

Built with OTM debit call spread + OTM debit put spread

-

Profits from large moves in either direction

-

Wider profitable zone than reverse iron butterfly

-

Lower potential reward, higher probability

Reverse Iron Butterfly

-

Built with long ATM straddle plus OTM wings

-

Profits from very large moves or volatility spikes

-

Narrower profitable zone, larger potential reward

-

More sensitive to volatility and timing

Quick summary:

-

Reverse iron condor → wider range, lower payoff

-

Reverse iron butterfly → narrower range, higher payoff

Master the Iron Condor: Complete Learning Path

- Step 1: The Foundation – What is an Iron Condor?: Understanding the 4-leg structure and the market-neutral objective.

- Step 2: Core Definitions – What is an Iron Condor?: A simplified breakdown of the 4-leg structure for beginners.

- Step 3: Strategy Mechanics – Iron Condor Strategy Explained: A deep dive into how time decay and volatility work in your favor.

- Step 4: Visualizing the Trade – The Iron Condor Payoff Diagram: A visual guide to your profit zones, breakeven points, and max risk.

- Step 5 Strategy Variations – Short vs. Reverse Iron Condors: When to sell volatility vs. when to buy it (including the Reverse Iron Condor).

- Step 6: Comparative Analysis – Iron Condor vs. Iron Butterfly: Which neutral strategy fits your risk profile.

- Step 7: Defensive Management – How to Adjust an Iron Condor: Advanced tactics for managing the position when tested.