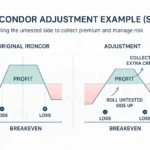

How I Adjust or Manage an Iron Condor Position

Iron condors don’t fail because the strategy is broken, they fail because traders wait too long, adjust too often, or react emotionally when price starts to test a short strike. Knowing when to adjust an iron condor (and when not to) is what separates consistent traders from those constantly repairing damage. Adjustments aren’t about predicting direction.…