Credit spreads are often described as “defined-risk” trades — but that label can be dangerously misleading. Defined risk limits a single trade’s loss, not the damage that poor sizing, volatility spikes, or assignment can do to your account.

Most credit spread losses don’t come from one bad idea. They come from compounding risk: too many positions open, too close to expiration, in the wrong products, during the wrong market conditions. Add margin pressure or early assignment into the mix, and losses can escalate fast.

In this guide, I’ll break down what credit spread risk really means, how max loss and assignment actually happen, and the exact rules I use to keep losses small and survivable. You’ll see real examples, clear formulas, and a practical checklist you can apply immediately — whether you trade SPY, SPX, or both.

🎧 Listen: Credit Spread Risks, Loss, Assignment & Risk Management

In this episode, we break down real examples of credit spread losses, early assignment traps, and how we manage risk step by step.What Credit Spread Risk Really Means

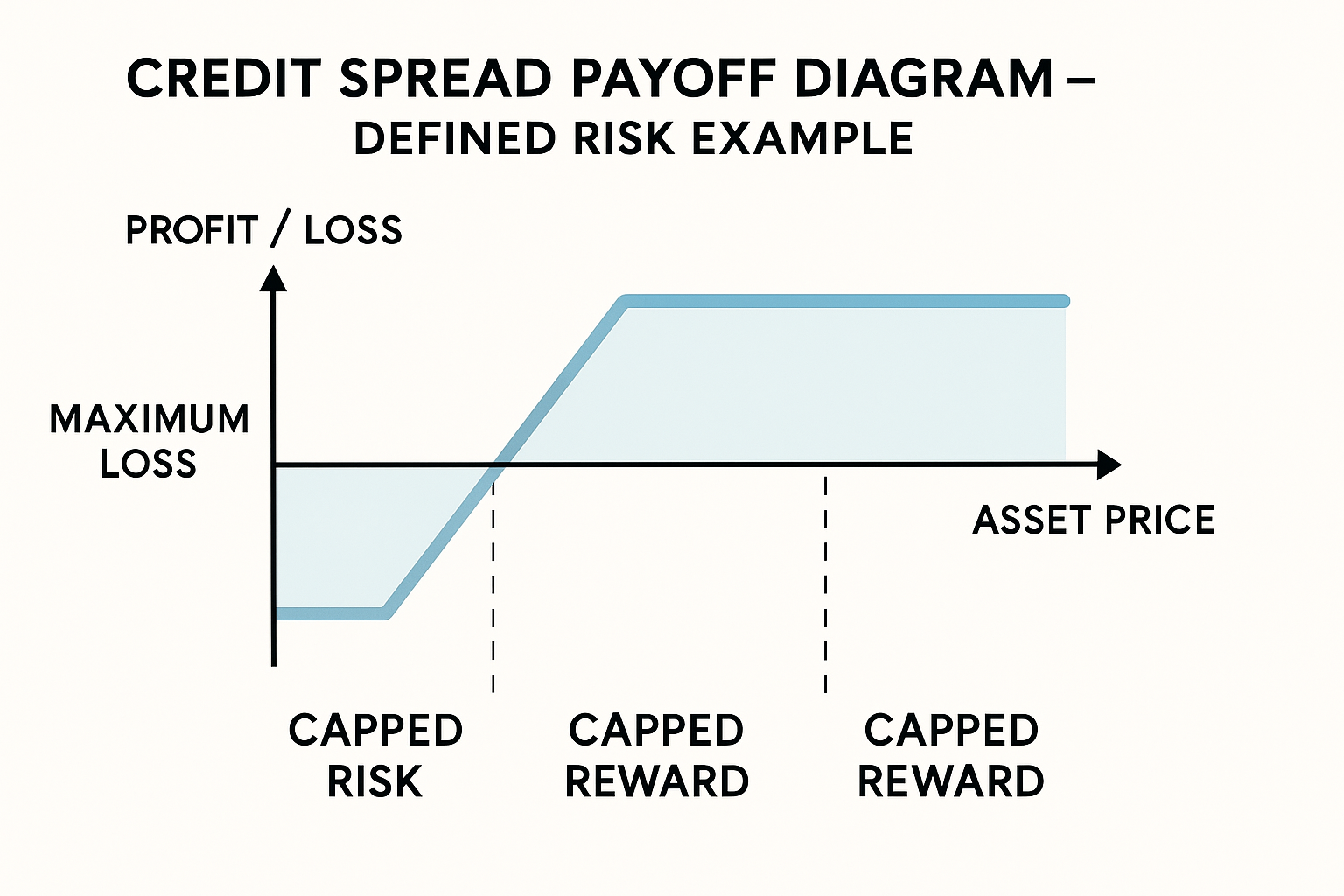

A credit spread is a defined-risk options strategy—you know your maximum loss before entry. Many traders confuse “defined” with “safe.” The cap on loss still demands discipline: you sell one option, buy another for protection, and collect a premium. That premium is your potential profit; fast moves, IV spikes, or bad execution can quickly turn that small credit into a painful loss.What Are the Risks of Credit Spreads?

These are the core risks you must plan for before you place a trade:- Max loss: when price blows through your strikes and the spread realizes full width minus credit.

- Assignment risk: especially on SPY (American-style), where early exercise can happen—contrast with SPX (European-style) cash-settled options.

- Margin calls: brokers may increase margin as short strikes move ITM; forced liquidation can lock in losses.

- Volatility & liquidity shocks: IV expansion and wide bid-ask spreads could make adjusting or exiting costly.

- Over-allocation: stacking “defined-risk” positions so losses compound across multiple trades.

| Risk type | What causes it | Why it matters |

|---|---|---|

| Max loss | Price moves through strikes | Full spread width realised |

| Assignment | American-style options (SPY) | Stock exposure, margin shock |

| Margin calls | ITM short legs | Forced liquidation risk |

| Volatility spikes | IV expansion | Harder, costlier exits |

| Over-allocation | Too many positions | Losses compound quickly |

Credit Spread Max Loss (and How to Keep It Small)

Formula: Max Loss = (Spread Width − Credit Received) × 100- Sell the SPY 440 put for $3.00

- Buy the SPY 439 put for $2.50

- Spread width = 1 points

- Net credit = $0.50

- Risk 1–5% of account equity per spread.

- Prefer a risk/reward 1:1–1:2 to keep payoff sane.

Assignment Risk: SPY vs. SPX (Early Exercise vs. Cash Settlement)

SPY options are American-style—they can be exercised any time before expiration. Early assignment most often happens when the short option’s extrinsic value is near zero (e.g., around ex-dividend dates for calls). You can wake up long/short 100 shares per contract and your long leg may not offset immediately. SPX options are European-style—they’re cash-settled and cannot be exercised early, so there’s no assignment risk before expiration (price and volatility risk still apply).How I Reduce Assignment Risk

- Know your product: Treat SPY and SPX differently.

- Watch out for dividend payouts: Every three months, your ITM short call could be assigned.

- Avoid holding SPY later than 1.30 pm ET on expiration day.

- Defined risk limits one trade, not total account damage

- Max loss compounds quickly when position sizing is ignored

- SPY carries assignment and margin risks that SPX avoids

- Volatility spikes make exits harder and losses larger

- Risk control matters more than strike selection

Margin Calls and Broker Behavior (Even with “Defined Risk”)

Defined risk doesn’t eliminate operational risk. As your short strike moves in the money, brokers can raise margin requirements. If equity is too low, you may face a margin call or forced liquidation—often at the worst possible time.Prevent Margin Surprises

- Maintain a 25–30% buying-power buffer at all times.

- Don’t over-leverage small accounts—reduce contract count as IV rises.

- Know your broker’s spread margin formula and auto-liquidation rules.

- Use alerts on the short strike and account margin%.

Volatility, Execution & Liquidity Risk

Markets don’t move in straight lines. When implied volatility (IV) spikes, option premiums expand, your open spreads show larger unrealized losses, and bid–ask spreads widen—making exits or adjustments more expensive.What Happens When IV Jumps?

- Premium expansion: short options gain value against you; mark-to-market P&L worsens.

- Wider spreads: slippage increases; mid-price fills are harder to get.

- Gamma risk near expiry: price changes hit harder; small moves can flip your P&L fast.

Execution Rules I Follow

- Let spreads expire on SPX without any adjustments or early exits.

- Prefer liquid underlyings like SPY or SPX and expirations with tight markets (< $0.10 bid–ask on each leg if possible).

- Use limit orders and work the mid; don’t chase fills in thin markets.

- If IV is extreme, stay patient—sometimes the best trade is no trade.

Over-Allocation & Position Sizing (The Silent Account Killer)

“Defined risk” tempts traders to open too many positions. Losses then stack across spreads during stress events. Sizing discipline keeps you in the game.My Sizing Guardrails

- Risk 1–5% of account equity per trade.

- Cap total exposure: avoid allocating more than 25% of account buying power to open spreads.

- Prefer setups with clean technical context (support/resistance, breadth) to avoid stacking correlated bets.

Defined Risk ≠ No Risk

Defined risk caps the per-trade loss, not your account-level risk. Overtrading or ignoring volatility can still produce large drawdowns.Keep the Math on Your Side

- Favor a ratio that targets 1:1–1:2 risk/reward.

- Avoid major news (Fed, CPI, earnings) unless it’s part of the plan.

Rule of thumb: Credit spreads reward consistency, not courage. Manage downside first—the upside takes care of itself.Are credit spreads safe for beginners? Safer than naked options, yes—but only with strict sizing, 1:1 or 1:2 risk-to-reward, and disciplined execution.

Real-World Credit Spread Example Under Pressure

Suppose the index is at SPX 5000, and I sell a bull put spread:- Sell the 5020 put @ $6.50

- Buy the 5015 put @ $3.00

- Net credit = $2.50 (=$250)

My Decision Flow

- Check context: Did price lose key support? Is breadth confirming weakness?

- If support failed: Exit quickly to protect capital (avoid hoping for a bounce).

- If support holds: Consider a roll down/out to regain distance from the short strike.

- Avoid “averaging down.” Adjust only if it reduces risk and improves the position’s probability of profit.

Credit Spread Risk-Management Checklist

These are the guardrails I use so one bad day doesn’t become a bad month:- Risk 1–5% max per trade; cap total spread exposure near ≤ 25% of account.

- Sometimes take profits early at 50–60% capture to cut gamma/event risk.

- Avoid major news (Fed, CPI, earnings clusters) unless explicitly planned.

- Maintain 25–30% BP buffer to reduce margin-call risk.

- Trade liquid products and expirations with tight markets; use limit orders.

- If you do not want to hold until expiration day, close 3–5 DTE—don’t donate to late-cycle gamma or assignment games.

- Size down when IV rises; widen strikes or move further OTM instead of forcing fills.

- Diversify timing/symbols to avoid stacking correlated losses.

Adjustments & Recovery (When Things Go Wrong)

Adjustments are tools—not magic. Use them only if they lower risk and improve your odds.Adjustment Playbook

- Roll down/out: Move the spread further OTM or add time to regain distance from the short strike.

- Convert to iron condor: If both sides are threatened in a range, sell the opposite wing (defined risk).

- Partial hedge: Add a small opposing vertical to neutralize delta while you manage the main position.

- Reduce size: Scaling out into strength/weakness often beats “being right.”

Common Beginner Mistakes (And How to Avoid Them)

You’ve seen the headlines: “Option credit spreads destroyed my life.” It’s almost always the same pattern—oversizing, bad risk-to-reward, and ignoring volatility.Frequent Errors

- Bad risk-to-reward at entry, hoping for a miracle instead of taking a controlled risk.

- Selling too far out of the money for a too small credit (and a much bigger possible loss).

- Ignoring IV spikes and trading through major news events.

- Over-allocating across multiple correlated “defined-risk” trades that compound losses together.

- Chasing fills in thin markets and donating P&L to slippage.

Automation & Discipline: Execute the Plan, Not the Emotion

Even good traders struggle with hesitation and second-guessing. The edge in credit spreads isn’t prediction—it’s consistent execution. That’s where automation shines.What Automation Enforces

- Pre-defined sizing (1–5% risk per trade) and a buying-power buffer.

- Strict entries only in liquid markets and clean technical context.

- Rule-based exits (50–60% profit-taking or holding till expiration).

- News filters to avoid Fed/CPI/earnings landmines.

FAQs: Risks of Credit Spreads

What are the main risks of credit spreads?

Max loss (width minus credit), early assignment on American-style options like SPY, margin calls during stress, and volatility/liquidity shocks that make exits expensive.Can you lose more than you invest in a credit spread?

Per trade, the loss is capped by the long leg. But forced liquidation during a margin call or extreme slippage can make the realized loss worse than you expect.How do you manage credit spread risk?

Risk 1–5% per trade, maintain a 25–30% buying-power buffer, take profits early (50–60%) or hold till expiration, avoid major news, and close before possible assignment on SPY.Can credit spreads be assigned early?

Yes on SPY (American-style). SPX (European-style) is cash-settled and cannot be exercised early, so there’s no assignment risk before expiration.Are credit spreads safe for beginners?

They’re safer than naked options because risk is defined—but only with strict sizing, disciplined exits, and attention to risk-to-reward and liquidity.Conclusion

In the end, every trade is credit spread risk vs. reward. You collect steady income in exchange for controlled exposure—but only if you respect the downside. Keep position sizes small, select a good risk-to-reward, avoid event risk, and close before possible assignments on SPY. If you want a refresher on setup and strike selection, read: Credit Spread Strategy: When and How to Use It. When you’re ready to see disciplined risk rules executed with consistency, explore: Credit Spread Signals – Advanced AutoTrades.Master Credit Spreads: Complete Learning Path

- Step 1: The Foundation Credit Spreads Explained: The core mechanics and how credit spreads generate income.

- Step 2: How It Works Mechanics of a Credit Spread: Understanding premium collection, margin, and the math of the trade.

- Step 3: Strategy Selection Credit vs. Debit Spreads: Which strategy fits your market outlook?

- Step 4: Tactical Setup Bull Put Credit Spread Guide: A step-by-step framework for placing your first high-probability trade.

- Step 5: Risk & Risk Management The Risks of Credit Spreads: How to identify Max Pain and protect your capital from market shocks.

- Step 6: Real-World Application Examples & Strategy: Case studies and advanced strategy rules for consistent returns.