🎧 Listen: How Does a Credit Spread Work?

Prefer listening instead of reading? Tune in to this 19-minute episode of The Automated Trading Podcast by Advanced AutoTrades, where we break down the mechanics, formulas, and live SPX examples.

What Is a Credit Spread?

A credit spread is an options strategy that involves selling one option and buying another with the same expiration date but a different strike price. The trade collects a net premium (credit) when opened — that’s why it’s called a credit spread. Your goal is for both options to expire worthless, letting you keep that credit as profit. The position can be either bullish or bearish, depending on which side of the market you choose:- Bull Put Spread: Sell a higher-strike put and buy a lower-strike put. Profits if the price stays above the short strike.

- Bear Call Spread: Sell a lower-strike call and buy a higher-strike call. Profits if the price stays below the short strike.

How Does a Credit Spread Work?

When you open a credit spread, you’re entering a defined-risk trade that profits from time decay and stable prices. The short option (the one you sell) decays faster than the long option you buy — meaning the spread’s value decreases over time in your favor. Here’s the basic concept:- You sell an option closer to the current price (higher premium).

- You buy another option farther away (lower premium).

- The net difference = your credit received.

In simple terms: You’re selling insurance against extreme price moves and getting paid upfront for taking that calculated risk.Unlike naked options, you can’t lose more than your predefined spread width minus the credit received. That’s what makes credit spreads such a practical strategy for both retail and institutional traders who focus on probabilities rather than predictions.

Credit Spread Formula (Options)

Understanding the credit spread formula helps you calculate potential profit, loss, and breakeven before entering a trade. The math is simple — and once you know it, you can size positions confidently and manage risk like a pro.Basic Credit Spread Formula

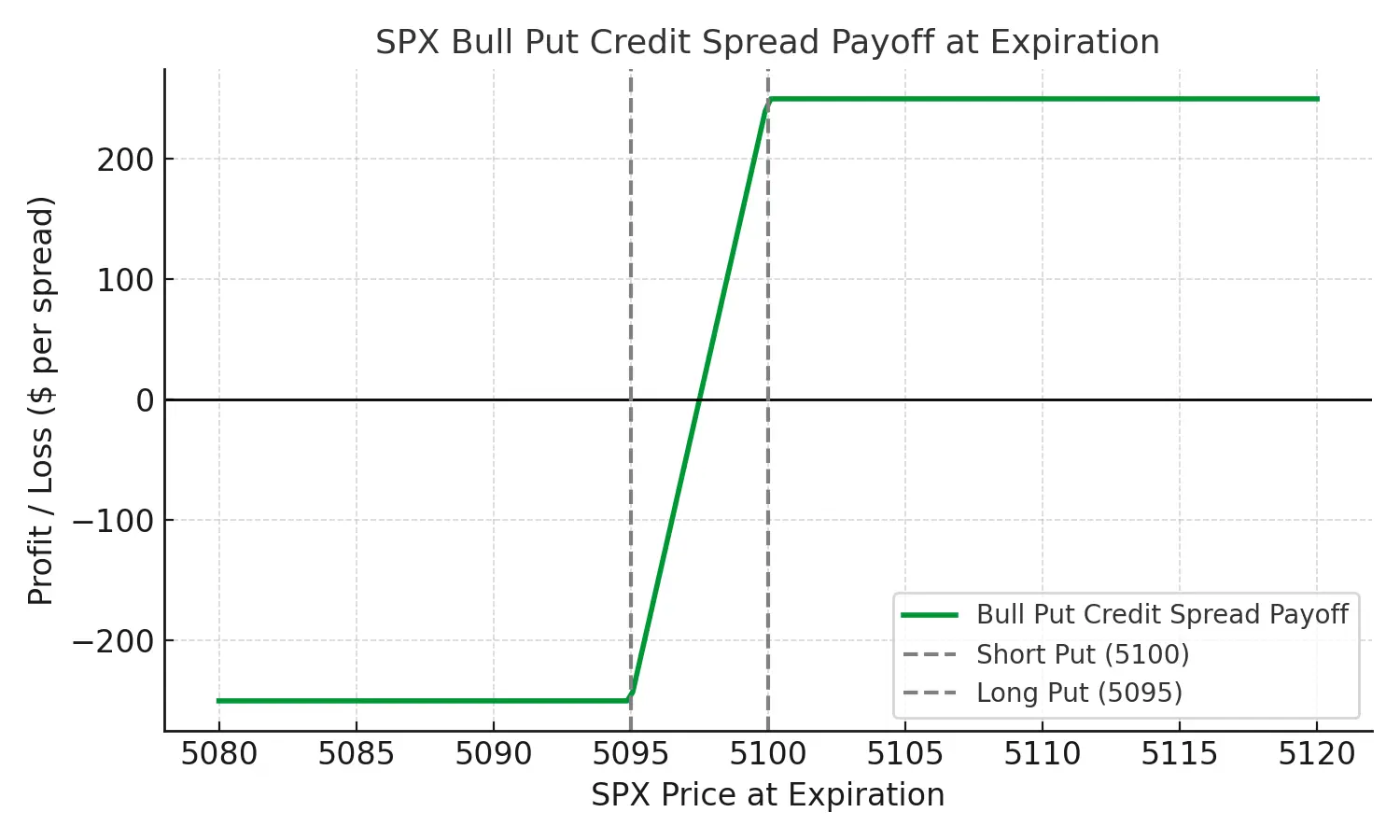

Max Profit = Net Credit Received Max Loss = Strike Width − Net Credit Breakeven (Bull Put) = Short Put Strike − Net Credit Breakeven (Bear Call) = Short Call Strike + Net Credit In a credit spread, the short option generates more premium than the long option costs. The difference between those two premiums is your net credit — your maximum potential gain if both options expire worthless. This formula works identically whether you’re trading SPX, SPY, QQQ, or single-stock options — the only difference is contract multiplier (usually 100 per option).Example 1: SPX Bull Put Credit Spread

Let’s look at a practical example to see how the numbers play out in real time. Setup:- Sell 1 SPX 5100 Put @ $5.00

- Buy 1 SPX 5095 Put @ $2.50

Outcome Scenarios

- If SPX stays above 5100: Both puts expire worthless → Keep full $250 profit.

- If SPX drops to 5095: Max loss = (5 − 2.50) × 100 = $250.

- Breakeven: 5100 − 2.5= 5097.50.

Credit Spread Profit and Loss Breakdown

Here’s how to interpret your potential outcomes for any credit spread trade:| Condition | Result |

|---|---|

| Underlying stays above short strike (bull put) or below short strike (bear call) | Both options expire worthless → Keep full credit (Max Profit) |

| Underlying crosses breakeven | Partial loss or gain → depends on distance to strike at expiration |

| Underlying closes beyond long strike | Max Loss reached → Strike Width − Credit |

Example 2: Bond Credit Spread (Yield Spread)

In the bond market, the term credit spread has a slightly different meaning. Instead of option premiums, it refers to the difference in yield between a corporate bond and a risk-free government bond of the same maturity. This “spread” reflects how much extra return investors demand for taking on credit risk. Example:- 10-Year U.S. Treasury Yield: 4.25%

- 10-Year Corporate Bond (BBB rating): 5.15%

Risk Management for Credit Spreads

Even though credit spreads are defined-risk strategies, proper risk management determines long-term success. The best traders think in probabilities, not predictions — focusing on position sizing, strike selection, and exit discipline.1. Keep Position Size Consistent

Risk no more than 2–5% of your total account per spread. This ensures one losing trade doesn’t impact overall capital. Many traders at Advanced AutoTrades follow a % on account allocation to manage exposure automatically.2. Choose High-Probability Strikes

For bullish bull put spreads, choose strikes 2–3 standard deviations below the current price. For bearish bear call spreads, select strikes well above resistance levels. The goal is to sell where the market is unlikely to go — not where you hope it won’t.3. Manage Before Expiration

You can close early when you’ve captured 50-60% of the credit or if volatility spikes sharply. Exiting before expiration minimizes emotional decision-making. Automation tools such as AutoShares or Gobal AutoTrading can help enforce these rules consistently.When Credit Spreads Work Best

Credit spreads perform best in neutral or moderately trending markets where implied volatility is elevated. That combination allows you to collect higher premiums while maintaining a wide margin of safety.Ideal Conditions:

- Volatility Index (VIX) between 15 and 25 — premiums are rich, but not panic-driven.

- Markets trading inside a stable range with clear support/resistance zones.

- Weekly or monthly expirations with sufficient liquidity (SPX, SPY, QQQ, RUT).

Pro tip: The best time to sell credit spreads is when fear is still high — not when the market already feels safe.To see how this looks in practice, check out our Credit Spread Signals. They apply the same principles using SPX options with automated entry, management, and defined-risk exits.

Credit Spread vs. Debit Spread

Credit spreads and debit spreads are mirror images of each other — both use two option legs, but the cash flow and risk profile differ completely.| Feature | Credit Spread | Debit Spread |

|---|---|---|

| Cash Flow | You receive a net credit at entry. | You pay a net debit at entry. |

| Max Profit | The net credit received. | Spread width minus debit paid. |

| Max Loss | Spread width − credit. | The debit paid upfront. |

| Market Bias | Neutral to moderately directional. | Directional (needs movement). |

| Time Decay (Theta) | Works for you. | Works against you. |

Common Mistakes When Trading Credit Spreads

Even though credit spreads are simple in theory, traders often make avoidable mistakes that turn good setups into bad outcomes. Here are the biggest ones I’ve seen over two decades in the markets:1. Selling Too Close to the Money

Many beginners sell strikes too close to the current price to collect a slightly higher credit. That extra $0.50 isn’t worth the added assignment and drawdown risk. Stick to higher-probability zones (delta 0.10–0.25 range).2. Ignoring Volatility Shifts

Implied volatility changes can distort spread pricing. Selling credit spreads when volatility is at yearly lows leaves no margin for expansion. Use indicators like the VIX and historical percentiles to choose better timing windows.3. Not Managing Early

Professionals can hold until expiration to maximize profits – but this also maximizes tail risk. Beginners might like to close when 70–80% of the credit is earned.4. Oversizing Positions

Defined-risk doesn’t mean risk-free. Using too many spreads at once amplifies volatility exposure. Always size based on total capital — not conviction.Remember: Surviving the next trade is more important than winning the current one.

Why Many Traders Prefer SPX Credit Spreads

The SPX index has become the benchmark for professional credit spread trading for several good reasons:- Cash-Settled: SPX options settle in cash, so there’s no stock assignment or delivery risk.

- European-Style: They can’t be exercised early — ideal for spread sellers.

- High Liquidity: Tight bid–ask spreads make entry and exit smoother, even for multi-lot trades.

- Tax Efficiency (U.S.): SPX index options often qualify for Section 1256 60/40 tax treatment.

Final Thoughts

Credit spreads combine structure, control, and probability — making them one of the most practical strategies for consistent returns in the options market. They define risk the moment you enter, and reward traders who think in probabilities instead of predictions. By mastering the credit spread formula, strike selection, and disciplined risk management, you can turn small, consistent wins into long-term performance — whether you’re trading manually or through automation.Ready to Trade Credit Spreads the Smart Way?

Try our Credit Spread Signals — fully automated SPX setups with defined risk, verified performance, and hands-free execution. Start with confidence and let our system manage the details.Credit Spread — Quick FAQ (Formulas & Calculation)

What is the basic credit spread formula?

Max Profit = Net Credit Received

Max Loss = Strike Width − Net Credit

Breakeven (Bull Put) = Short Put Strike − Net Credit

Breakeven (Bear Call) = Short Call Strike + Net Credit

How do I calculate the net credit?

Subtract the premium paid for the long option from the premium received for the short option. Example: sell for $5.00, buy for $3.00 → net credit = $2.00 ($200 per spread with 100× multiplier).

Where do I place the strikes for a high-probability trade?

Many traders choose short strikes with a 10–25 delta (well outside the current price). For bull puts, place strikes below support; for bear calls, above resistance.

Should I hold a credit spread to expiration or close early?

Common practice is to close after capturing 60–80% of the credit or before major events to reduce gap/assignment risk. Holding to expiry can maximize credit but increases tail risk near your strikes.

Can I get assigned on a credit spread?

American-style options can be assigned any time. Using cash-settled index options and managing positions before expiration reduces assignment events.

How much capital should I risk per spread?

Keep risk small and consistent (often 2–5% of account per position). Your dollar risk per spread is (Strike Width − Credit) × 100.

What is a bond credit spread and how is it different from an options credit spread?

In bonds, a credit spread measures the yield difference between a corporate bond and a risk-free government bond of the same maturity. It reflects the market’s view of default risk — wider spreads mean higher perceived risk.

In options trading, a credit spread refers to a defined-risk strategy that collects premium by selling one option and buying another. Both use “spread” to express risk versus reward, but one measures yield, the other manages price exposure.