If you’re wondering how a credit spread works, the core idea is simple: you collect money upfront by selling an option, buy a second option for protection, and profit if the market doesn’t move against you. This creates a defined-risk, defined-reward setup that traders use to generate steady income on SPX, SPY, QQQ and other liquid markets.

Credit spreads don’t require big price moves, they thrive in stable or slow markets where time decay works in your favour.

Credit spreads are one of the simplest ways to generate consistent returns in options trading, without taking unlimited risk.

In this guide, I’ll break down exactly how a credit spread works, how the profit/loss formula is calculated, and walk through real SPX examples so you can see how this strategy performs in practice. By the end, you’ll understand the mechanics clearly enough to start trading (or automating) spreads with confidence.

🎧 Listen: How Does a Credit Spread Work?

Prefer listening instead of reading? Tune in to this 19-minute episode of

The Automated Trading Podcast by Advanced AutoTrades, where we break down the

mechanics, formulas, and live SPX examples.

How Does a Credit Spread Work?

A credit spread is an options strategy that involves selling one option and buying another with the same expiration date but a different strike price. The trade collects a net premium (credit) when opened — that’s why it’s called a credit spread. Your goal is for both options to expire worthless, letting you keep that credit as profit.

The position can be either bullish or bearish, depending on which side of the market you choose:

- Bull Put Spread: Sell a higher-strike put and buy a lower-strike put. Profits if the price stays above the short strike.

- Bear Call Spread: Sell a lower-strike call and buy a higher-strike call. Profits if the price stays below the short strike.

In both cases, the risk and reward are defined: you know the maximum profit (the credit) and the maximum loss (the strike width minus the credit) the moment you open the trade. That makes it ideal for traders who want consistent income with clear boundaries.

Example: On SPX, you might sell a 5100 put and buy a 5090 put for a $2.00 net credit. If the index stays above 5100 through expiration, you keep $200 per spread.

See real SPX examples of bull put and bear call credit spreads to understand how each setup performs in practice.

- You sell an option closer to the current price (higher premium).

- You buy another option farther away (lower premium).

- The net difference = your credit received.

That credit is your maximum profit if the trade expires out of the money. Your maximum loss occurs only if the underlying closes beyond the long option’s strike. Because both legs offset each other, your risk is capped — making this one of the most reliable income setups in options trading.

In simple terms: You’re selling insurance against extreme price moves and getting paid upfront for taking that calculated risk.

Unlike naked options, you can’t lose more than your predefined spread width minus the credit received. That’s what makes credit spreads such a practical strategy for both retail and institutional traders who focus on probabilities rather than predictions.

Credit Spread Formula (Options)

Understanding the credit spread formula helps you calculate potential profit, loss, and breakeven before entering a trade. The math is simple — and once you know it, you can size positions confidently and manage risk like a pro.

Basic Credit Spread Formula

Max Profit = Net Credit Received

Max Loss = Strike Width − Net Credit

Breakeven (Bull Put) = Short Put Strike − Net Credit

Breakeven (Bear Call) = Short Call Strike + Net Credit

In a credit spread, the short option generates more premium than the long option costs. The difference between those two premiums is your net credit — your maximum potential gain if both options expire worthless.

This formula works identically whether you’re trading SPX, SPY, QQQ, or single-stock options — the only difference is contract multiplier (usually 100 per option).

How Do You Make Money on Credit Spreads?

You make money on credit spreads when the short option loses value faster than the long option. This happens when:

price stays above your bull put short strike or below your bear call short strike

time decay erodes the spread value

implied volatility contracts after you open the trade

Because spreads profit from not moving into danger, they thrive in neutral or slow markets. Most traders take 50–60% of the credit early to reduce gamma and event risk.

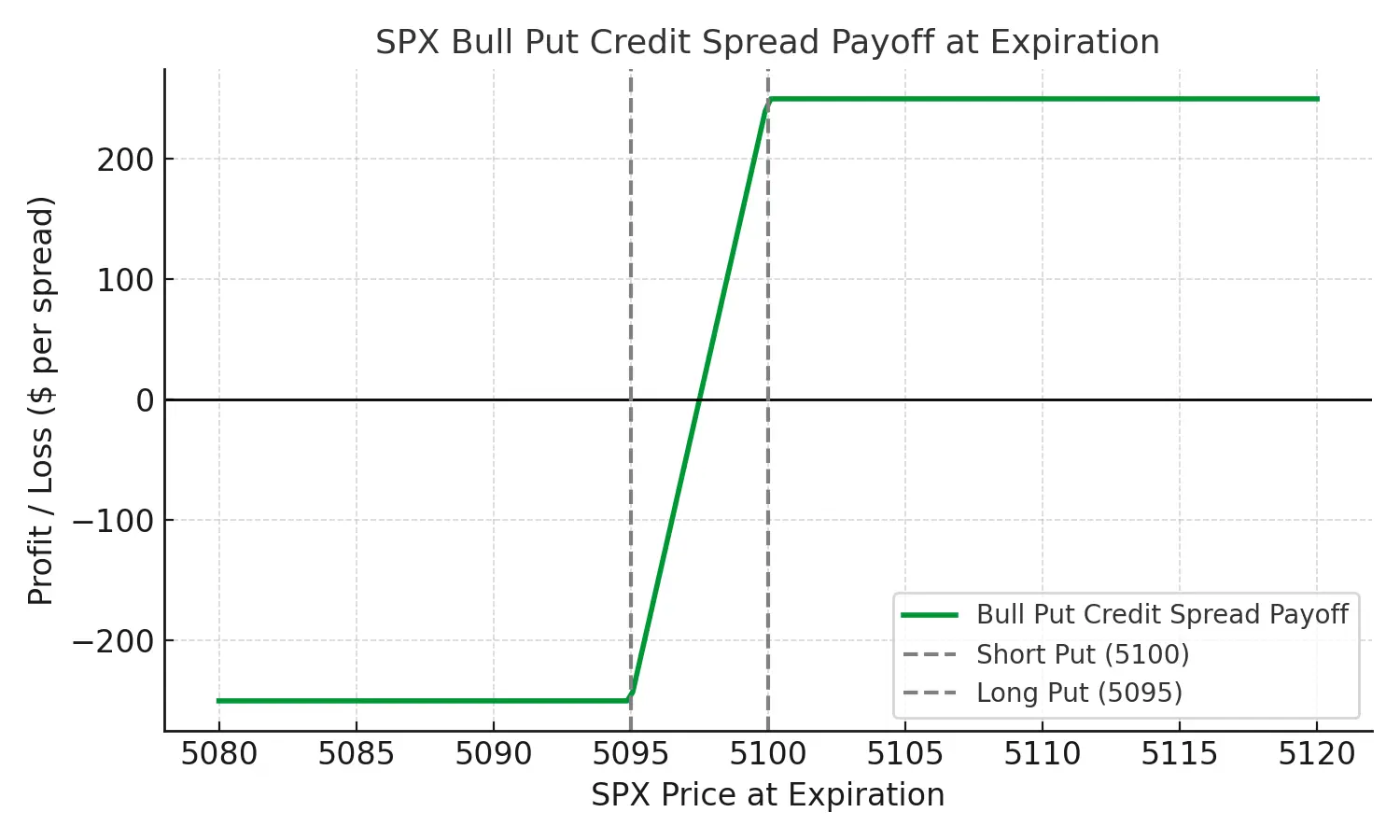

Example 1: SPX Bull Put Credit Spread

Let’s look at a practical example to see how the numbers play out in real time.

Setup:

- Sell 1 SPX 5100 Put @ $5.00

- Buy 1 SPX 5095 Put @ $2.50

Net Credit Received: $2.50 (or $250 per spread)

Strike Width: 5 points

Outcome Scenarios

- If SPX stays above 5100: Both puts expire worthless → Keep full $250 profit.

- If SPX drops to 5095: Max loss = (5 − 2.50) × 100 = $250.

- Breakeven: 5100 − 2.5= 5097.50.

That’s a 1:1 risk-to-reward ratio, or a 50% potential return on risk per trade if your thesis holds. In practice, traders can close early when 50-60% of the credit is captured to reduce tail risk or hold it till expiration.

To fully understand how credit spreads generate defined risk and reward, check out our main guide —

What Is a Credit Spread?

It covers both bond and options credit spreads with examples and risk formulas.

Credit Spread Profit and Loss Breakdown

Here’s how to interpret your potential outcomes for any credit spread trade:

| Condition | Result |

|---|---|

| Underlying stays above short strike (bull put) or below short strike (bear call) | Both options expire worthless → Keep full credit (Max Profit) |

| Underlying crosses breakeven | Partial loss or gain → depends on distance to strike at expiration |

| Underlying closes beyond long strike | Max Loss reached → Strike Width − Credit |

Because both legs offset each other, credit spreads cap your downside while preserving upside potential through time decay. The key is to position trades where price is unlikely to challenge your short strike before expiration.

Credit spreads don’t require large moves — they simply need the market to not move against you. That’s why professional traders use them to generate consistent income even in sideways markets.

Can You Lose More Than the Max Loss on a Credit Spread?

No, you cannot lose more than the defined maximum loss on a credit spread. The long leg caps your downside, so even in a market gap or flash crash, your loss is limited to:

Max Loss = Spread Width − Net Credit Received

This is why credit spreads are considered one of the safest option-selling strategies. Unlike naked positions, there is no unlimited risk.

Example 2: Bond Credit Spread (Yield Spread)

In the bond market, the term credit spread has a slightly different meaning. Instead of option premiums, it refers to the difference in yield between a corporate bond and a risk-free government bond of the same maturity. This “spread” reflects how much extra return investors demand for taking on credit risk.

Example:

- 10-Year U.S. Treasury Yield: 4.25%

- 10-Year Corporate Bond (BBB rating): 5.15%

The credit spread here is 0.90% (90 basis points).

A widening spread means investors are demanding higher returns because they perceive greater default risk.

A narrowing spread means improving confidence and stronger credit conditions.

Traders and analysts monitor these spreads to gauge overall market sentiment.

Widening credit spreads often precede risk-off periods in equities, while tightening spreads support risk-on environments.

That’s why understanding both bond and options credit spreads provides a more complete picture of market risk.

Curious how the same term applies in fixed income? Here’s the difference between bond and options credit spreads explained clearly.

Risk Management for Credit Spreads

Even though credit spreads are defined-risk strategies, proper risk management determines long-term success.

The best traders think in probabilities, not predictions — focusing on position sizing, strike selection, and exit discipline.

1. Keep Position Size Consistent

Risk no more than 2–5% of your total account per spread. This ensures one losing trade doesn’t impact overall capital.

Many traders at Advanced AutoTrades follow a % on account allocation to manage exposure automatically.

2. Choose High-Probability Strikes

For bullish bull put spreads, choose strikes 2–3 standard deviations below the current price.

For bearish bear call spreads, select strikes well above resistance levels.

The goal is to sell where the market is unlikely to go — not where you hope it won’t.

3. Manage Before Expiration

You can close early when you’ve captured 50-60% of the credit or if volatility spikes sharply.

Exiting before expiration minimizes emotional decision-making.

Automation tools such as AutoShares or Gobal AutoTrading can help enforce these rules consistently.

When Credit Spreads Work Best

Credit spreads perform best in neutral or moderately trending markets where implied volatility is elevated.

That combination allows you to collect higher premiums while maintaining a wide margin of safety.

Ideal Conditions:

- Volatility Index (VIX) between 15 and 25 — premiums are rich, but not panic-driven.

- Markets trading inside a stable range with clear support/resistance zones.

- Weekly or monthly expirations with sufficient liquidity (SPX, SPY, QQQ, RUT).

Periods following earnings season or major economic releases often provide excellent opportunities, as option premiums remain inflated while directional momentum fades.

Pro tip: The best time to sell credit spreads is when fear is still high — not when the market already feels safe.

To see how this looks in practice, check out our Credit Spread Signals.

They apply the same principles using SPX options with automated entry, management, and defined-risk exits.

Credit Spread vs. Debit Spread

Credit spreads and debit spreads are mirror images of each other — both use two option legs, but the cash flow and risk profile differ completely.

| Feature | Credit Spread | Debit Spread |

|---|---|---|

| Cash Flow | You receive a net credit at entry. | You pay a net debit at entry. |

| Max Profit | The net credit received. | Spread width minus debit paid. |

| Max Loss | Spread width − credit. | The debit paid upfront. |

| Market Bias | Neutral to moderately directional. | Directional (needs movement). |

| Time Decay (Theta) | Works for you. | Works against you. |

Both strategies can be profitable, but credit spreads are typically preferred for generating income, while debit spreads are better for directional momentum plays.

In practice, experienced traders often use both — collecting credits when volatility is high and paying small debits when volatility is low.

If you’re new to defined-risk spreads, start with credit spreads. They naturally teach patience, risk control, and probability thinking — the foundation of every professional options trader’s mindset.

Learn how credit spreads differ from debit spreads in terms of cash flow, capital efficiency, and risk profile.

What Should You do When a Credit Spread Goes Against You?

When a credit spread moves against you, act quickly and mechanically — not emotionally. Professional traders typically use one of these responses:

Close the spread if price decisively breaches the short strike.

Roll out in time (same strikes, later expiration) to regain theta advantage.

Roll out and widen to reduce risk per trade.

Exit early if IV spikes sharply — spreads inflate even without a price move.

The worst action is to “hope” it recovers. Defined-risk spreads only work long term with disciplined exits.

Common Mistakes When Trading Credit Spreads

Even though credit spreads are simple in theory, traders often make avoidable mistakes that turn good setups into bad outcomes.

Here are the biggest ones I’ve seen over two decades in the markets:

1. Selling Too Close to the Money

Many beginners sell strikes too close to the current price to collect a slightly higher credit. That extra $0.50 isn’t worth the added assignment and drawdown risk.

Stick to higher-probability zones (delta 0.10–0.25 range).

2. Ignoring Volatility Shifts

Implied volatility changes can distort spread pricing. Selling credit spreads when volatility is at yearly lows leaves no margin for expansion.

Use indicators like the VIX and historical percentiles to choose better timing windows.

3. Not Managing Early

Professionals can hold until expiration to maximize profits – but this also maximizes tail risk.

Beginners might like to close when 70–80% of the credit is earned.

4. Oversizing Positions

Defined-risk doesn’t mean risk-free. Using too many spreads at once amplifies volatility exposure.

Always size based on total capital — not conviction.

Remember: Surviving the next trade is more important than winning the current one.

Why Many Traders Prefer SPX Credit Spreads

The SPX index has become the benchmark for professional credit spread trading for several good reasons:

- Cash-Settled: SPX options settle in cash, so there’s no stock assignment or delivery risk.

- European-Style: They can’t be exercised early — ideal for spread sellers.

- High Liquidity: Tight bid–ask spreads make entry and exit smoother, even for multi-lot trades.

- Tax Efficiency (U.S.): SPX index options often qualify for Section 1256 60/40 tax treatment.

That’s why most defined-risk automated strategies, including those at Advanced AutoTrades, rely on SPX spreads for weekly and monthly cycles.

Final Thoughts

Credit spreads combine structure, control, and probability — making them one of the most practical strategies for consistent returns in the options market.

They define risk the moment you enter, and reward traders who think in probabilities instead of predictions.

By mastering the credit spread formula, strike selection, and disciplined risk management, you can turn small, consistent wins into long-term performance — whether you’re trading manually or through automation.

Ready to Trade Credit Spreads the Smart Way?

Try our Credit Spread Signals — fully automated SPX setups with defined risk, verified performance, and hands-free execution.

Start with confidence and let our system manage the details.

Credit Spread — Quick FAQ (Formulas & Calculation)

What is the basic credit spread formula?

Max Profit = Net Credit Received

Max Loss = Strike Width − Net Credit

Breakeven (Bull Put) = Short Put Strike − Net Credit

Breakeven (Bear Call) = Short Call Strike + Net Credit

How do I calculate the net credit?

Subtract the premium paid for the long option from the premium received for the short option. Example: sell for $5.00, buy for $3.00 → net credit = $2.00 ($200 per spread with 100× multiplier).

Where do I place the strikes for a high-probability trade?

Many traders choose short strikes with a 10–25 delta (well outside the current price). For bull puts, place strikes below support; for bear calls, above resistance.

Should I hold a credit spread to expiration or close early?

Common practice is to close after capturing 60–80% of the credit or before major events to reduce gap/assignment risk. Holding to expiry can maximize credit but increases tail risk near your strikes.

Can I get assigned on a credit spread?

American-style options can be assigned any time. Using cash-settled index options and managing positions before expiration reduces assignment events.

How much capital should I risk per spread?

Keep risk small and consistent (often 2–5% of account per position). Your dollar risk per spread is (Strike Width − Credit) × 100.

What is a bond credit spread and how is it different from an options credit spread?

In bonds, a credit spread measures the yield difference between a corporate bond and a risk-free government bond of the same maturity. It reflects the market’s view of default risk — wider spreads mean higher perceived risk.

In options trading, a credit spread refers to a defined-risk strategy that collects premium by selling one option and buying another. Both use “spread” to express risk versus reward, but one measures yield, the other manages price exposure.

Master Credit Spreads: Complete Learning Path

- Step 1: The Foundation Credit Spreads Explained: The core mechanics and how credit spreads generate income.

- Step 2: How It Works Mechanics of a Credit Spread: Understanding premium collection, margin, and the math of the trade.

- Step 3: Strategy Selection Credit vs. Debit Spreads: Which strategy fits your market outlook?

- Step 4: Tactical Setup Bull Put Credit Spread Guide: A step-by-step framework for placing your first high-probability trade.

- Step 5: Risk & Risk Management The Risks of Credit Spreads: How to identify Max Pain and protect your capital from market shocks.

- Step 6: Real-World Application Examples & Strategy: Case studies and advanced strategy rules for consistent returns.